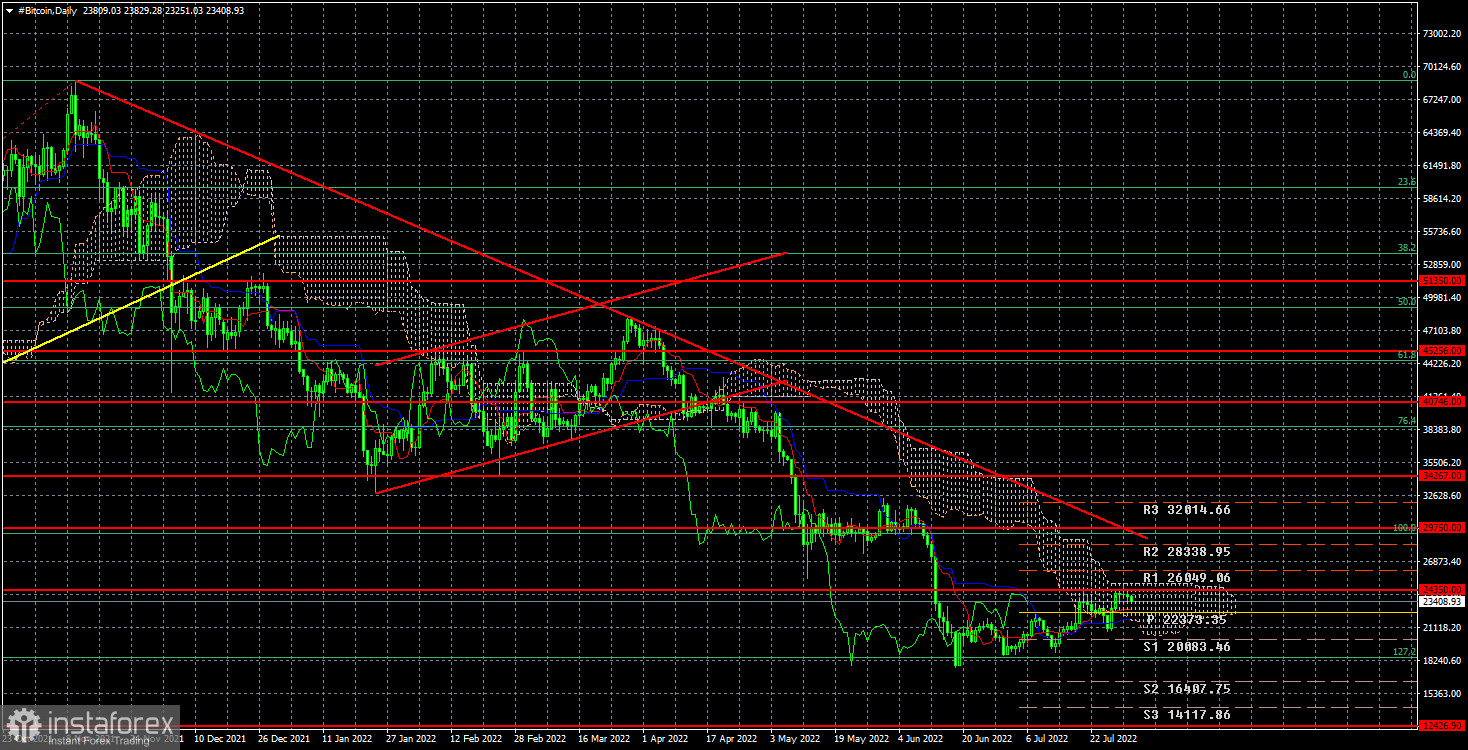

Last week, the flagship cryptocurrency hit $24,350 again. It has been its second-time breaking through this important level. Both times, the price pulled back, thus showing that it was not strong enough to extend growth. As a reminder, after yet another collapse in the crypto market, a correction occurred. As a result, bitcoin was able to gain almost $8,000. However, according to the 24-hour time frame, the ongoing correction is nothing compared with the recent fall. Most trends in the market begin with a sharp countertrend move. Bitcoin has been climbing for almost 2 months now. During this time, the digital asset somehow managed to reach the upper limit of the Ichimoku cloud. Rather, it is the limit that approached the price. The descending trendline is still relevant. It clearly shows where the price will go next. Technically, bitcoin as well as the entire crypto market is seen to be in a downtrend.

Notably, bitcoin's correction is smaller than that of the US stock market. Stock indices are stocks, while stocks are companies, productions, goods, jobs, profits, and assets. Bitcoin is a mere code that has no practical value. Naturally, it can show a bigger fall in price than stocks. As for the fundamental background, it remains negative for the crypto market. Although some crypto news comes in from time to time, demand for virtual assets has plunged in recent months. We used to read about bullish BTC and its potential rise to $100,000. We remember not a day without calls to invest in bitcoin and believe in it. Now the news is only scandalous: new legal battles or Tesla selling its coins. In this light, we see the digital asset in a downtrend.

In the 24-hour time frame, BTC quotes are below the mark of $24,350. The target is now seen at $12,426. Bitcoin has unsuccessfully tried to break through $18,500 (Fibonacci level of 127.2%) three times. Technically, the digital asset may enter the $5,000-10,000 range in 2022. There is a signal to sell the coin amid a pullback from $24,350. The signal will be confirmed should the price consolidate below $18,500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română