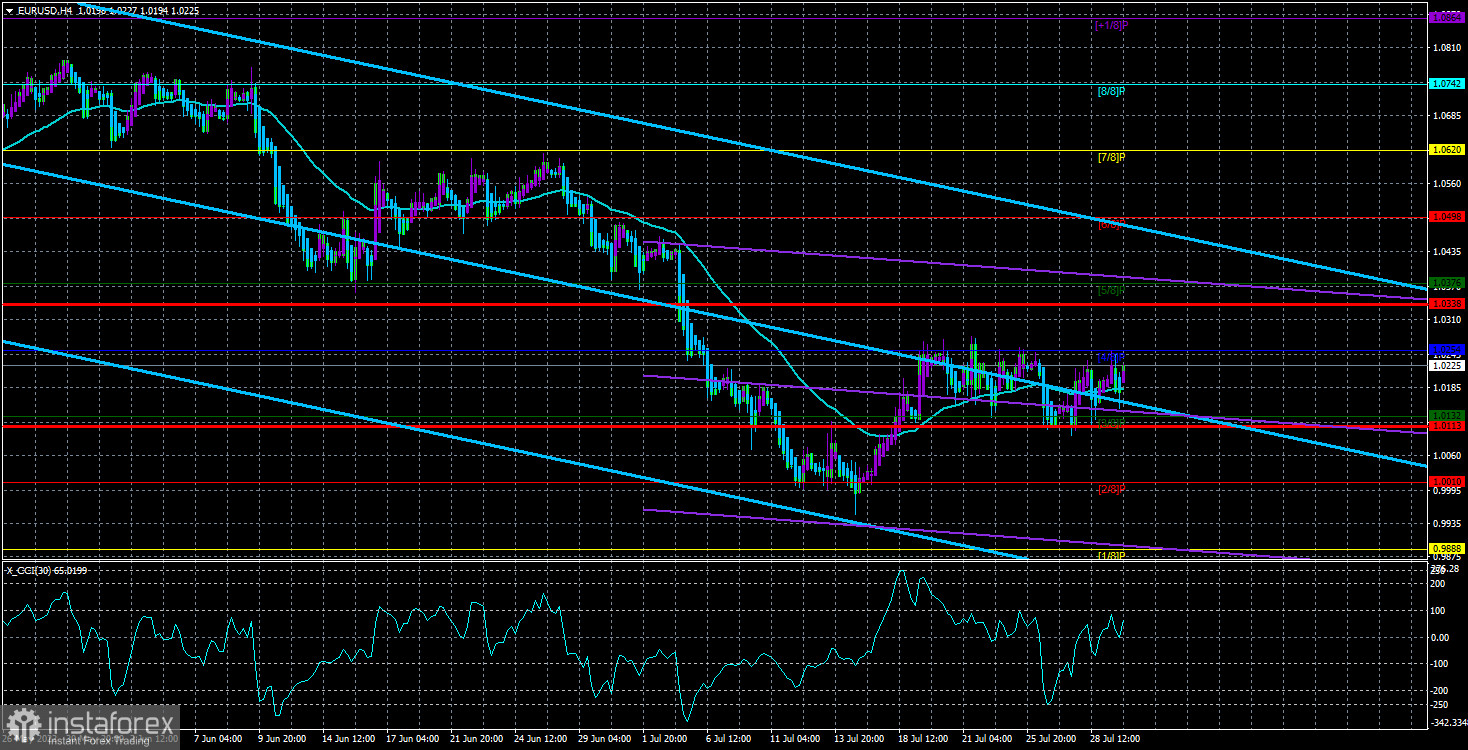

The EUR/USD currency pair continued to stay inside the side channel at 1.0132-1.0254 on Friday. It is evident from the illustration shown above. Consequently, based on the 4-hour TF, we can assume that the pair has been unchanged for several weeks. For lower TF, it appears more like a "swing," whereas for higher TF, it is a flat. Clearly, the meetings of the ECB and the Fed, during which both central banks boosted interest rates, had no positive effect on the euro/dollar pair. The European currency remains at its 20-year lows and is unable to adjust regularly. Currently, the pair has recovered just 300 points from the most recent lows. Consequently, the long-term downturn is not over, and the euro may plunge anew at any moment.

As stated numerous times, the majority of variables continue to favor the US dollar. Moreover, the situation remains unchanged despite the ECB's rate increase of 0.5%. It is the first increase in interest rates in over a decade. Therefore, traders are not hopeful about this event. The Fed continues to actively tighten monetary policy in an effort to combat inflation. Because the consumer price index continues to rise and the country's economy has been contracting for two consecutive quarters, it cannot be argued that it is succeeding. However, market players remain more likely to purchase the dollar than the euro. Almost often, a local reaction is there, but what use is it if the pair remains within the side channel?

In the coming week, the European Union will release a number of key publications. These include the unemployment rate, measures of corporate activity in the service and manufacturing sectors, and retail sales. All of these statistics are now, however, of minor value. They may elicit a response, but it would be more prudent to await the pair's decisive action before taking action. In principle, the future of the pair and all subsequent actions of the Fed depend only on the US inflation rate. Recall that the Fed has already raised the rate to 2.5%, and Jerome Powell has stated that the regulator will be prepared for another significant tightening of monetary policy if inflation does not begin to moderate by the time of the next meeting. In principle, this makes sense. What would be the sense of abandoning an aggressive strategy if inflation has not yet begun to decline? Moreover, it is highly unlikely to slow down by the end of July. First, according to projections, the indicator will remain between 8.9 and 9.2 percent y/y. The present rate is 9.1 percent, but we do not consider a decline to 9.0 percent a "decline." A noticeable, significant slowing is necessary. After that, it will be possible to anticipate a drop in the Fed's key rate's rate of increase.

Second, the Fed meeting occurred just last week, so the inflation index did not have sufficient time to react. Therefore, the August report will be crucial, as it will be important to anticipate a response to the 2.5% rate. If there is no major slowdown in August, the Federal Reserve will be in a very precarious position, as the US economy is already in recession and rates cannot be raised indefinitely. In this situation, it will be increased by 0.75 percent in September, bringing the rate to 3.25 percent. Will this be sufficient to return inflation to 2% over time? From our perspective, no. Consequently, it is certain that the September tightening will not be the last. This information is manna from heaven for the US currency. Remember that the higher the key rate, the greater the likelihood that the dollar will remain in demand. Obviously, its worth cannot increase forever. There will inevitably come a point when market participants refuse to purchase further US money. However, the likelihood of the pair dropping remains extremely high.

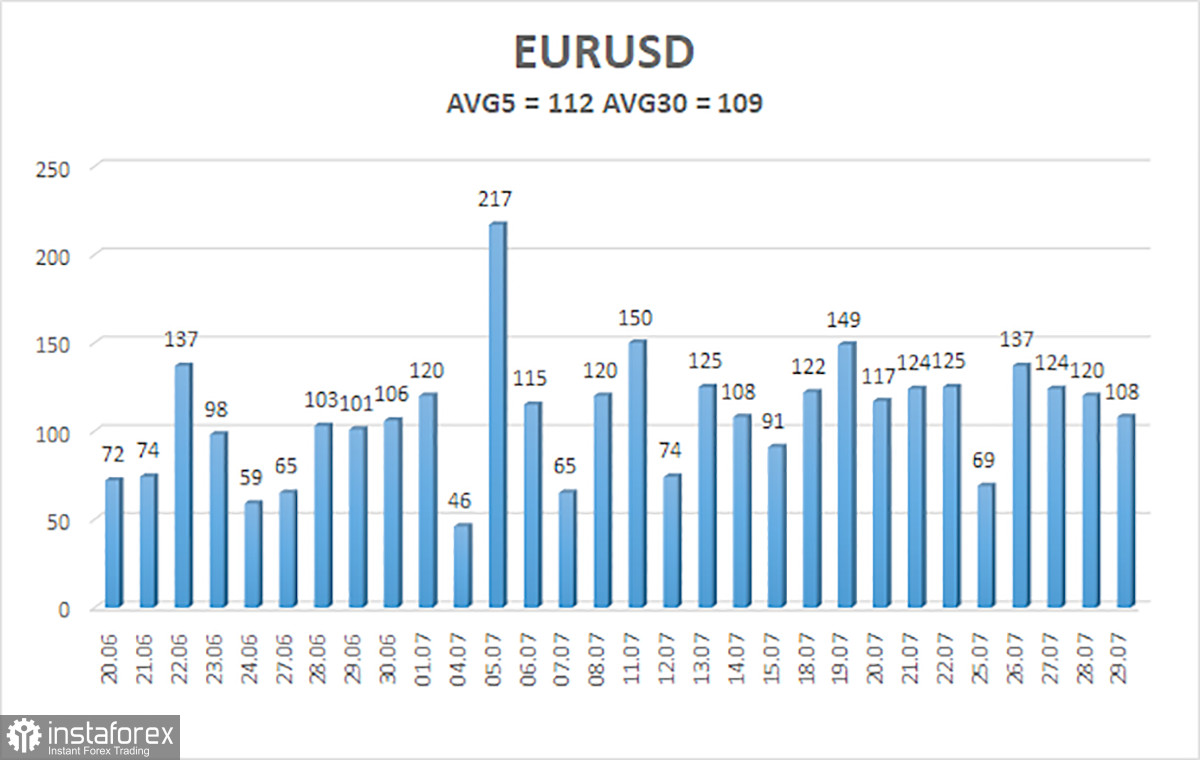

As of July 29, the average volatility of the euro/dollar currency pair for the previous five trading days was 112 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0113 and 1.0338 today. The Heiken Ashi indicator's upward reversal will suggest a new round of upward movement.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

The EUR/USD pair is attempting to continue its long-term downturn, but is drifting sideways instead. Thus, it is now viable to trade on Heiken Ashi reversals between 1.0132 and 1.0254 until the price exits this channel.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română