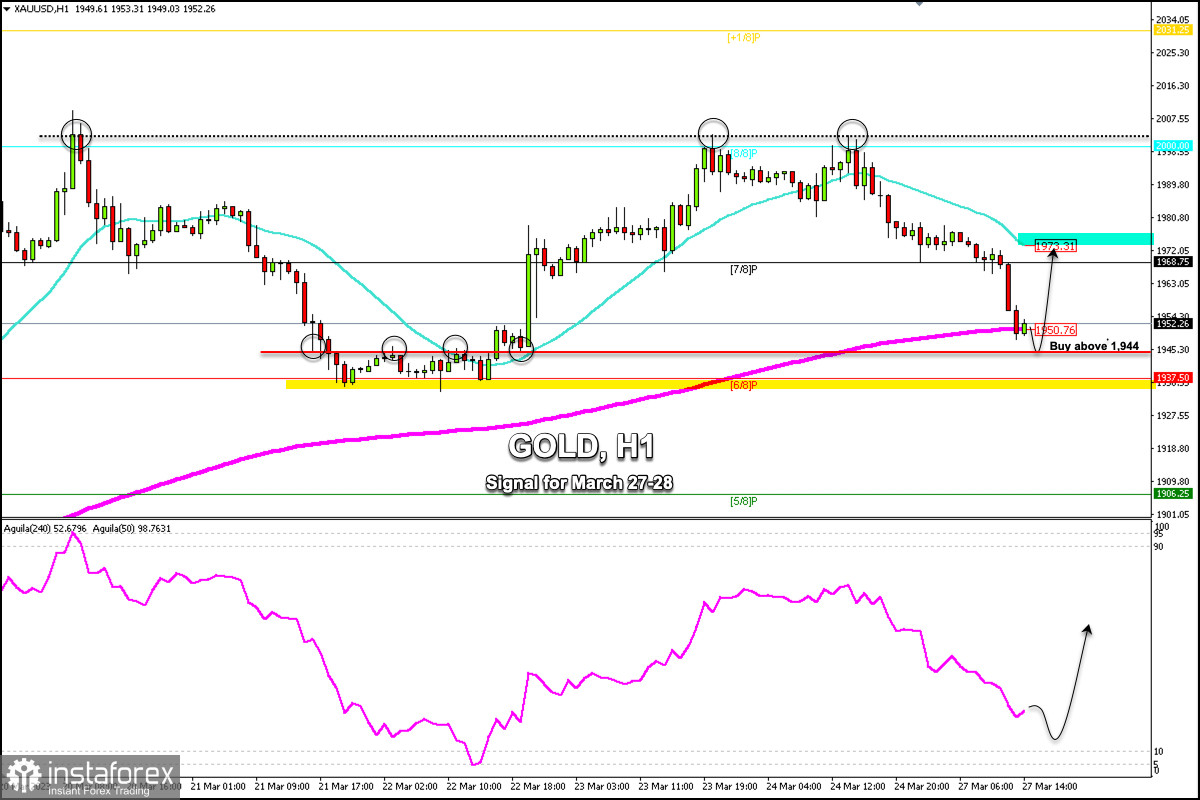

Early in the American session, Gold (XAU/USD) is trading around 1,952.26, above the 200 EMA, and below the 21 SMA located at 1,973. Since the opening of this trading week, gold has made a strong technical correction from the level of 1,979.38 towards 1,950. So, it has depreciated by almost $30.

According to the 1-hour chart, we can see that gold has found strong support around 1,944. In the past week, this level has turned out to be a key area of resistance and could now serve as a bottom, which could give the price a technical bounce and it could reach 1,968 (7/8 Murray) and finally the 21 SMA at 1,973.

Gold's average daily volatility is around 600 pips between rises and falls, which could indicate that the market is still nervous and investors are likely to continue to take refuge in gold.

If gold consolidates above 1,950 (200 EMA) in the next few hours, we could expect a rally and the metal could reach 1,968 and 1,973.

On the contrary, in case gold closes below 1,937, the scenario could change and the metal could resume a bearish trend and could reach 5/8 Murray located at 1,906 and finally reach the psychological level of 1,900.

The key will be to watch the 1,937 (6/8 Murray) and the 1,944 level, an area of strong support which could offer a technical bounce and an opportunity to resume buying. The eagle indicator is reaching the oversold zone and it is likely that any pullback has been seen as a signal to buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română