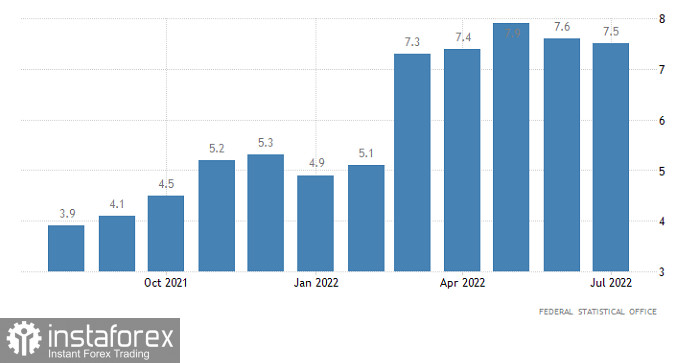

Quite strange statements by Federal Reserve Chairman Jerome Powell, especially about a recession, of course, contributed to the weakening of the dollar, and, accordingly, to the strengthening of the single European currency, but yesterday, during the European trading session, the market essentially returned to the values it was at before Powell's press conference. And it's all about indirect data on inflation and business activity. European sentiment indices in the economy as a whole and industry fell much more than expected. Inflationary expectations, instead of falling, on the contrary rose. So inflation in Europe is unlikely to decline. In confirmation of this thesis, preliminary data on inflation in Germany showed a decrease from 7.6% to 7.5%, with a forecast of 7.2%. This is what caused the euro's decline.

Inflation (Germany):

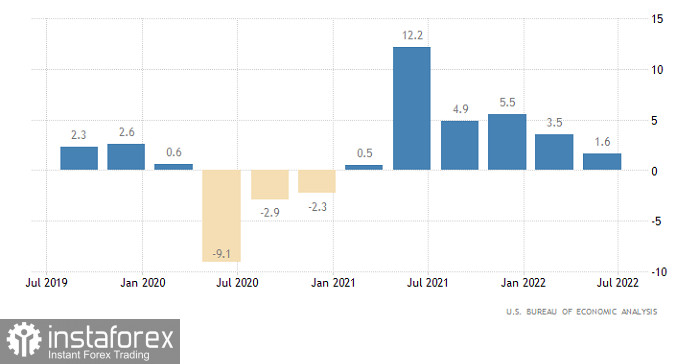

But immediately after that, the dollar began to actively fall in price. And in this case, the reason was the preliminary data on the GDP of the United States for the second quarter. It is worth noting that both Powell and US Treasury Secretary Janet Yellen tirelessly say that there is no recession. So, quarterly data showed a decline of -0.9%. The economy contracted by -1.6% in the first quarter of this year. So the US economy is declining for the second consecutive quarter. On an annualized basis, the economic growth slowed down from 3.5% to 1.6%. So formally, there is no recession. Moreover, in terms of the dominant approach to economic analysis in the United States, a recession is considered a decline in GDP for three consecutive quarters. Both Powell and Yellen are representatives of the academic environment. That is why they say there is no recession. However, quarterly data points to its beginning. But officials deny this fact. And it gives the impression that they have no idea what to do in the current situation. Which is also not surprising, since the United States has not experienced a combination of economic recession and high inflation for almost half a century. Simply put, the people who run the American economy do not have the necessary competencies. Not surprisingly, this scares investors a lot.

Change in GDP (United States):

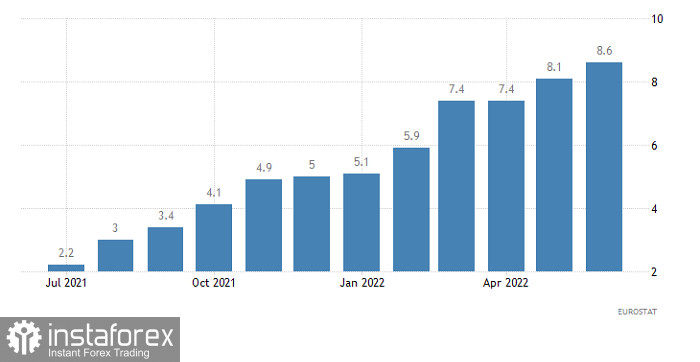

However, today the single currency is likely to return to the lowest values of yesterday. The reason will be preliminary data on inflation in the euro area. The growth rate of consumer prices should accelerate from 8.6% to 9.0%. So inflationary pressures in Europe are clearly on the rise. And the situation is very similar to that in the United States. This is high inflation combined with a recession. Another thing is that at least individual European countries relatively recently faced a similar problem. But not the main countries, such as Germany or France, which determine the economic policy of the entire European Union. So here, too, there are doubts about the ability of people in charge of the economy to cope with the current situation.

Inflation (Europe):

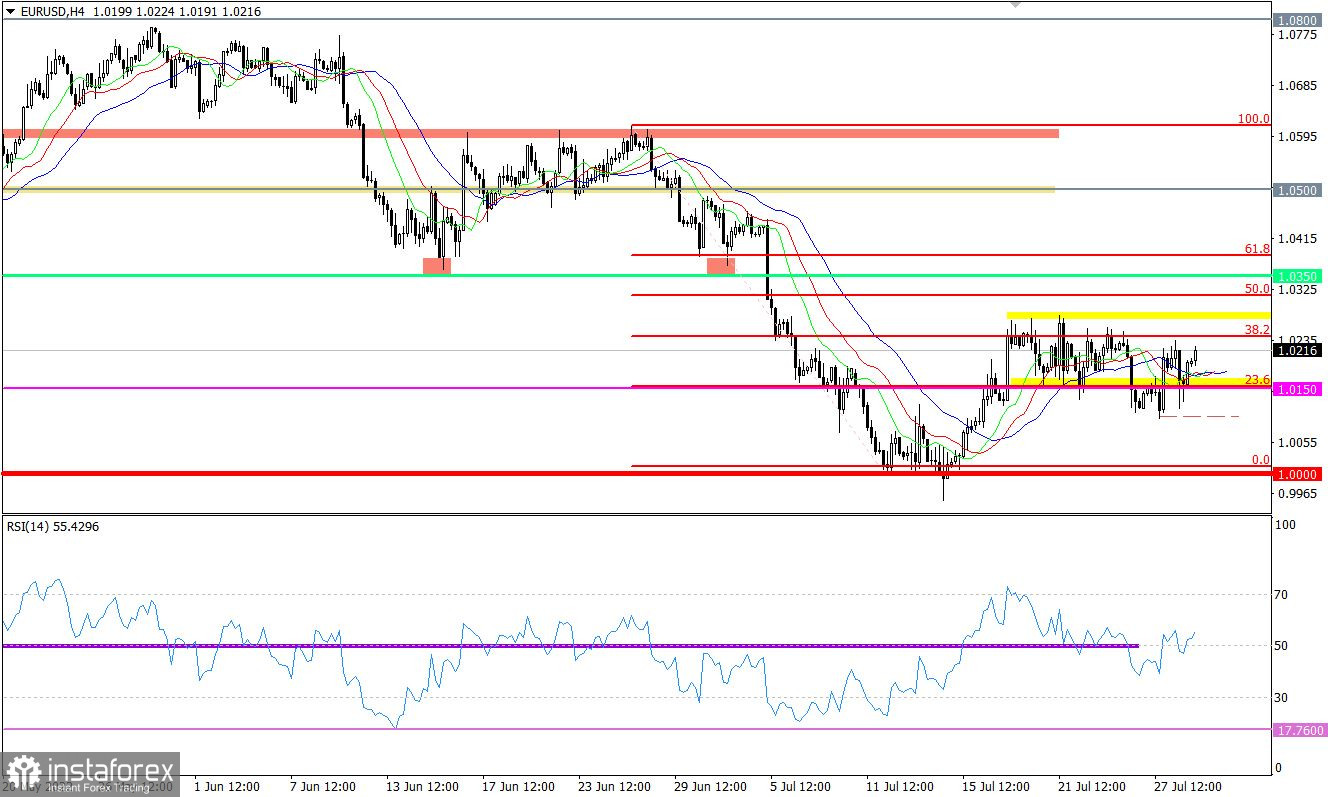

The EURUSD currency pair is again moving within the boundaries of the previously broken flat of 1.0150/1.0270. This indicates a stage of uncertainty among traders.

The RSI H4 technical instrument returned to the 50 line, which corresponds to the stage of stagnation. RSI D1 ignores the signal about the slowdown of the downward cycle, the indicator is still moving in the lower area of 30/50.

The MA moving lines on the Alligator H4 indicator have many intersections with each other, which indicates a flat. The MA lines on the Alligator D1 are down, there is no entanglement.

Expectations and prospects

In this situation, you can work according to two strategies: a rebound from the given flat boundaries, or a breakdown of one of the control levels.

In case of a breakout, special attention is paid to the values of 1.0280 in case of an upward scenario and 1.0100, when considering a downward cycle. It is worth noting that the signal must be confirmed in the form of keeping the quote outside the control value for at least a four-hour period.

Complex indicator analysis has a buy signal in the short-term and intraday periods due to the price rebound from the 1.0150 border. Technical instruments in the medium term are still focused on a downward trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română