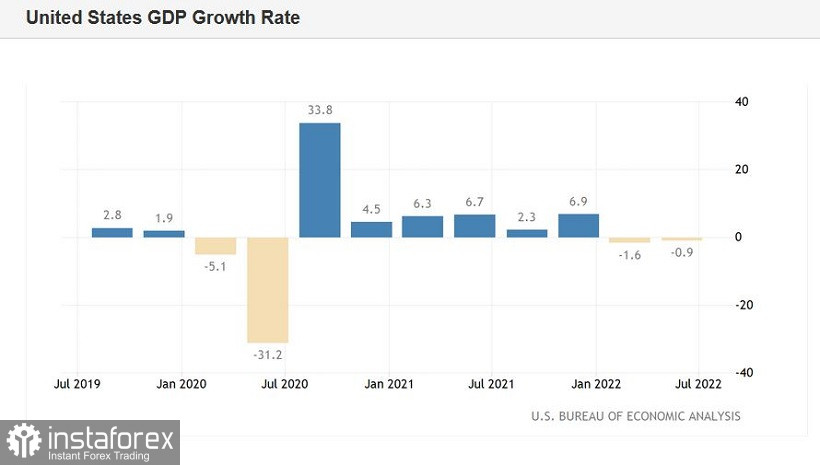

The US is in a technical recession. The latest data reflected the slowdown in the US economy in the second quarter of this year. Let me remind you that the first quarter was also closed in the red, so at the moment there is every reason to talk about the onset of a recession.

However, US Treasury Secretary Janet Yellen, even before the release of the latest data, stated that the current situation should not be viewed as a recession, but as a "necessary slowdown" in the economy. According to her, the high level of employment and consumer spending of the population indicate that we are not talking about an economic downturn. One of the key components of GDP - consumer spending - although it slowed down its growth rate, it maintained a positive trend (at the level of 1%). Exports also rose by 18% at once, after falling in the first quarter.

And yet, from a formal point of view, it is considered that a recession is declared when the country's economy declines for two or more consecutive quarters. In the first quarter of 2022, the volume of US GDP decreased by 1.6%, in the second quarter - by 0.9%, although most experts expected to see an increase of up to 0.4%.The euro-dollar pair reacted quite calmly to the release: the price retreated from intraday lows, but at the same time it did not leave the range of 1.0130-1.0270, within which it has been fluctuating for the second consecutive week.

During the US session on Thursday, the bears of the EUR/USD pair more than made up for the previous day's losses. The results of the Federal Reserve's July meeting were not in favor of the greenback, despite the 75-point increase in interest rates. While Fed Chairman Jerome Powell assured the markets that the tightening cycle is not yet over, he also signaled that the rate is approaching neutral. In general, following the results of the July meeting, it became clear that the central bank would resort to an aggressive pace of rate hike only as a last resort, if inflation continued to show jumpy growth. EUR/USD traders interpreted Powell's rhetoric in their own way, after which the dollar came under background pressure. After all, even the day before yesterday, some experts did not rule out the option of a 100-point rate hike and a more aggressive attitude towards future prospects. The reality turned out to be different, so the market reacted accordingly.

In some currency pairs of the major group, the dollar is still under significant pressure (for example, USD/JPY, USD/CHF). However, in pair with the euro, the bears seized the initiative. And even the disappointing data on the growth of the US economy did not turn the tide for the pair. The safe dollar is still in high demand - and especially when paired with the euro, which is going through far from the best of times.

Let me remind you that the latest reports from many institutions (IFO, ZEW, GfK, PMI indices) reflected the growing pessimism of representatives of the European business environment - both about the current situation and about future prospects. The energy crisis, which is getting worse every day, paints a grim picture of the near and distant future. As part of the autumn-winter period, Europeans may face not only a reduction in industrial production, but also power outages. This week, aluminum producers sounded the alarm. In particular, representatives of the Norwegian metallurgical company Norsk Hydro ASA reported that the energy crisis in Europe threatens to significantly reduce aluminum production. Similar signals were sounded from manufacturers from Slovakia. In general, according to European media, the largest industrial energy consumers in the EU have already warned that with the advent of cold weather, some plants may stop due to an acute shortage of fuel, as well as due to emergency measures introduced to limit its use. Amid such prospects, experts from large financial conglomerates continue to voice pessimistic estimates, predicting a recession in the eurozone economy as early as the 4th quarter of this year.

Meanwhile, the cost of gas in Europe is above $2,000 per 1,000 cubic meters, and yesterday exceeded $2,500. Blue fuel has risen sharply in price after Russia announced a reduction in gas exports via Nord Stream to 20% of the design capacity. Gazprom justifies this decision by the technical condition of the gas pumping units at the Portovaya compressor station.

Thus, the escalating energy crisis did not allow EUR/USD bulls to take advantage of the temporary weakness of the US currency. And do not forget that the safe dollar is in high demand not only due to European problems, but also due to the escalation of the "Taiwan issue", as well as another wave of COVID-testing in 25 million Chinese Shanghai. All these factors allow the greenback to stay afloat, and even more so when paired with the single currency.

Therefore, despite the controversial results of the Fed's July meeting and despite the slowdown in the US economy, short positions in the EUR/USD pair are still a priority. It is advisable to open short positions on corrective upward price rollbacks to the area of the 2nd figure. Downward targets in the medium term remain the same: 1.0150, 1.0100.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română