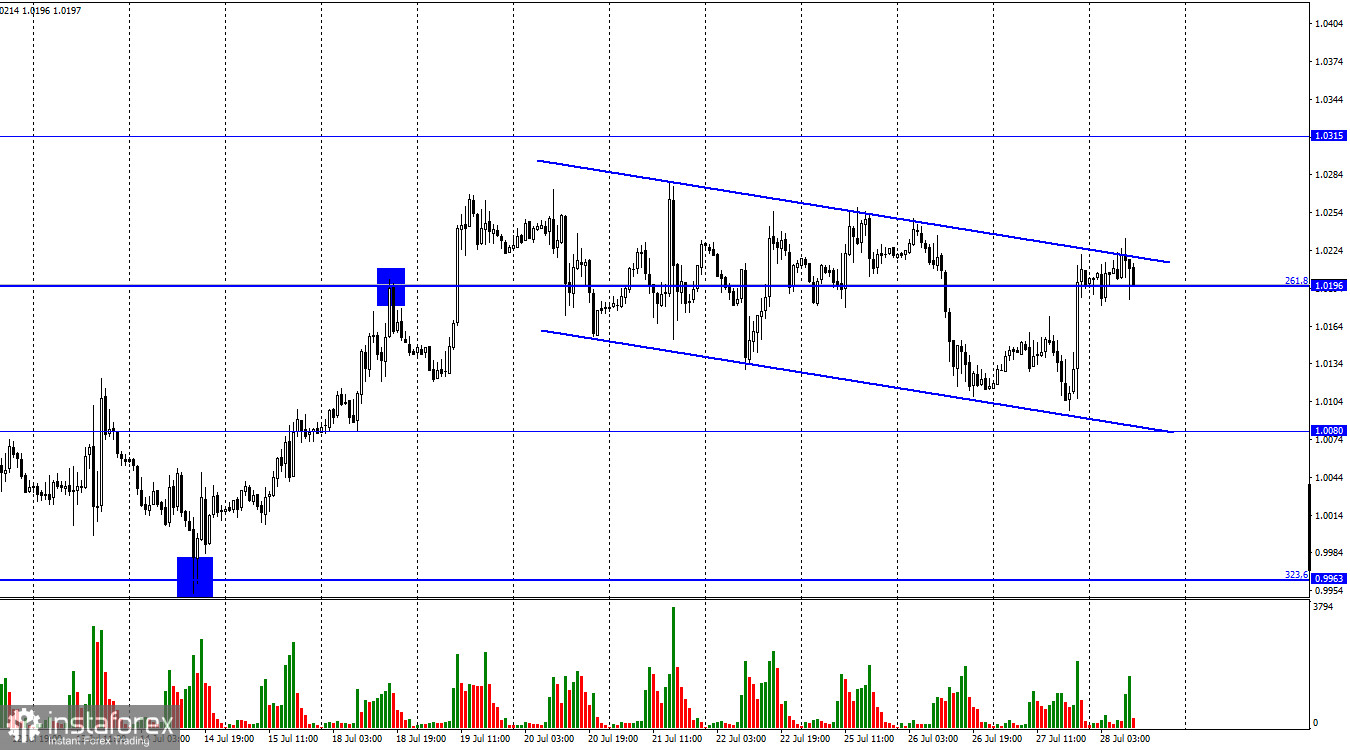

The EUR/USD pair on Wednesday performed an increase to the upper line of the descending trend corridor and failed to consolidate above it. Thus, a rebound from this line will favor the US currency and the resumption of the fall in quotes in the direction of the 1.0080 level. If the consolidation does occur, the chances of further growth of the European currency in the direction of the 1.0315 level will increase sharply. Last night, an event took place that many traders have been waiting for for a long time. The Fed announced the results of the two-day meeting, and it turned out that the interest rate was raised to 2.5% by 0.75%. Thus, we have witnessed a new tightening of monetary policy.

Nevertheless, the US currency dropped 100 points after the results became known. Why did this happen if the results were "hawkish"? From my point of view, this is nonsense. Remember that many traders are on the market, and the information background does not have to cause this or that movement. The pair's movement is caused by the reaction of traders to the event. And traders have every right to react as they want. Let's say most traders do not see a further fall in the European currency and do not want to get rid of it anymore. Then the Fed can raise the rate by at least 5%, and the dollar will not grow. Of course, this explanation is a bit exaggerated, but its essence lies in the fact that there can be any reaction of traders to any event.

In most cases, it coincides with the nature of the event itself, but sometimes it does not. Traders have long been morally ready to raise the rate by 0.75%, so this did not surprise them. And we ended up with a situation where the Fed has been raising the rate at a record pace over the past 40 years, and the dollar is falling simultaneously. But I want to remind you that the dollar has fallen by only 100 points, the downward trend channel remains, and the US currency has been growing for more than a year in the long term. Therefore, I believe that nothing terrible happened last night.

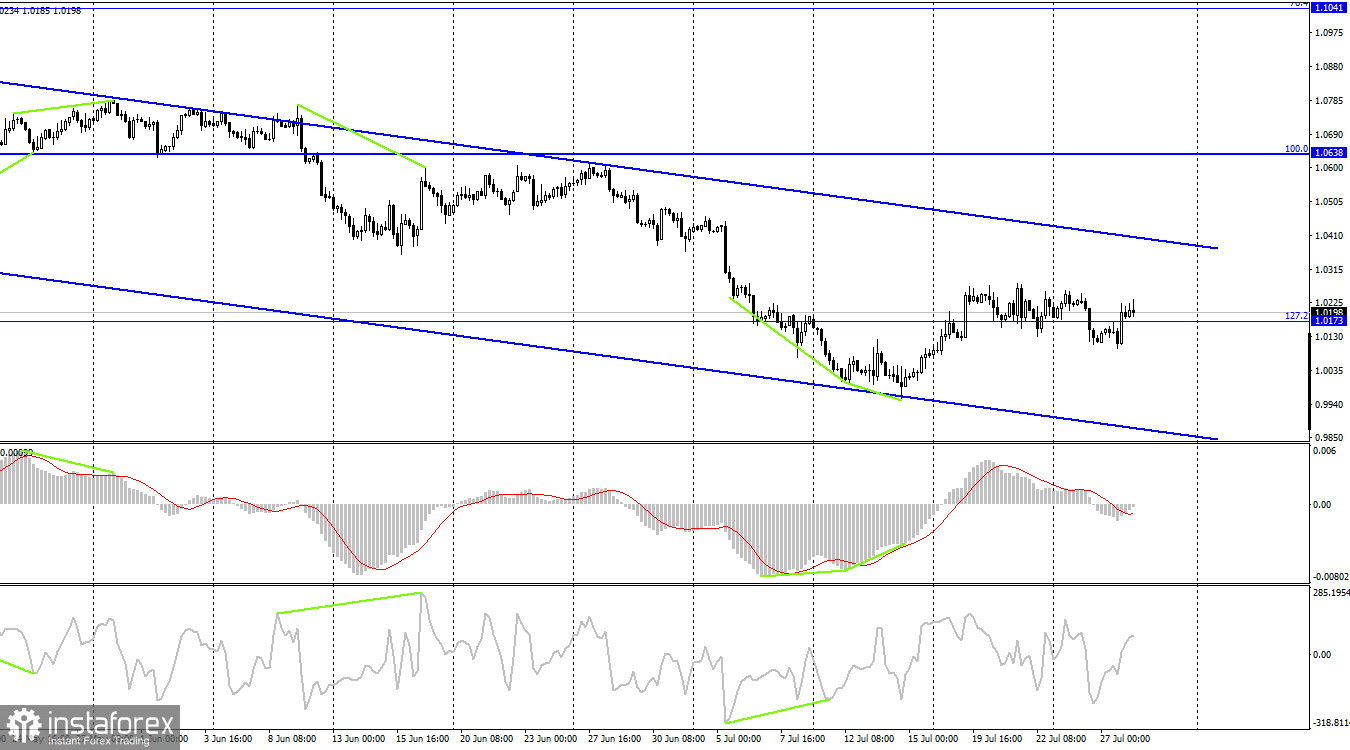

On the 4-hour chart, the pair reversed in favor of the euro currency and consolidated above 127.2% (1.0173). Thus, the growth process can be continued in the direction of the upper line of the descending trend corridor, but I think that the more important now is the descending corridor on the hourly chart, from the upper line of which the pair can perform a rebound in the coming hours. In this case, the drop in quotes can be resumed.

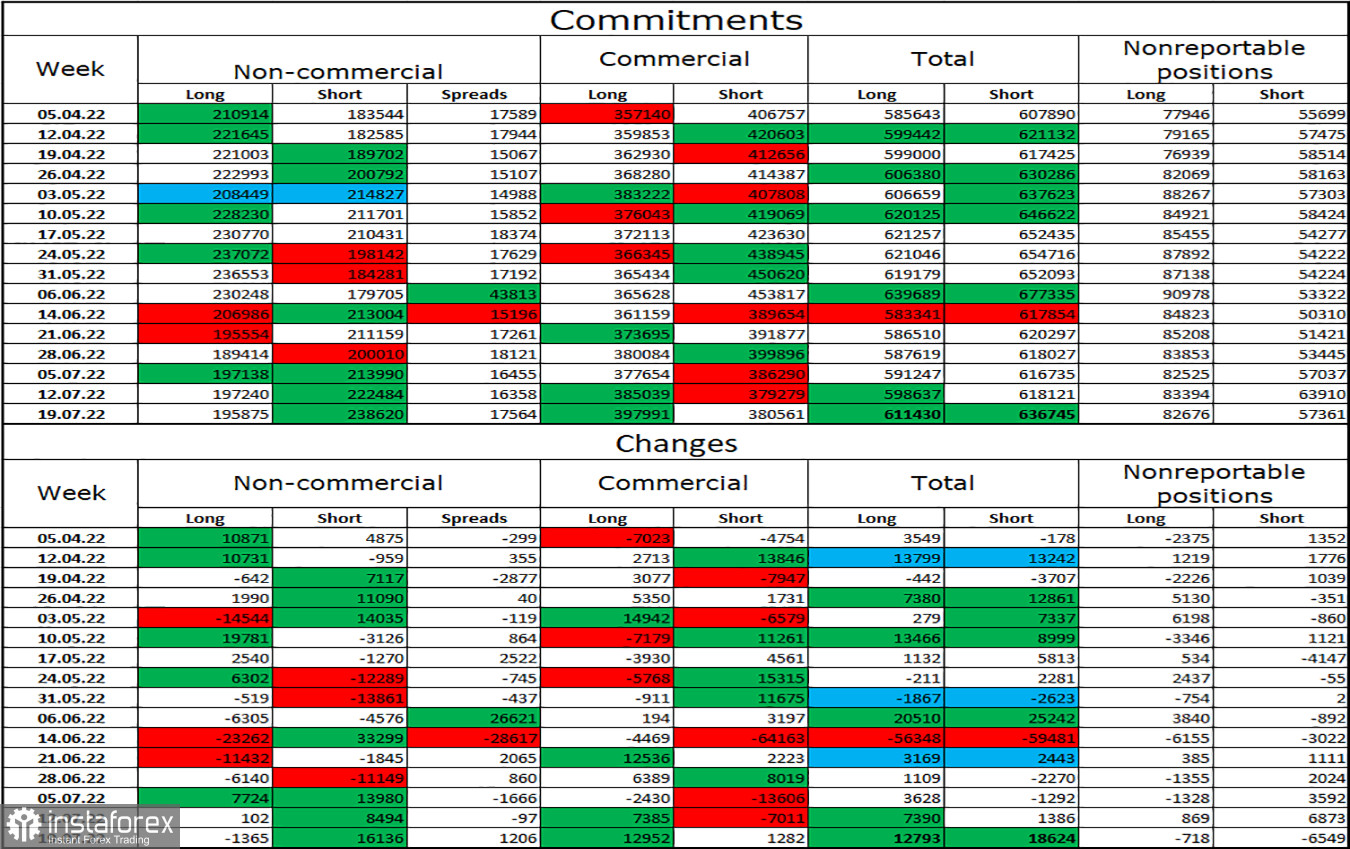

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 1,365 long contracts and opened 16,136 short contracts. It means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators now amounts to 238 thousand, and short contracts – 195 thousand. The difference between these figures is still not too big, but it remains not in favor of the bulls. In the last few weeks, the chances of a rise in the euro currency have been gradually growing, but recent COT reports have shown that new sales may now follow, as the mood of speculators has changed from "bullish" to "bearish," and it is intensifying. Thus, it is still difficult for me to count on strong growth of the euro currency.

News calendar for the USA and the European Union:

US - GDP for the second quarter (12:30 UTC).

US - number of initial applications for unemployment benefits (12:30 UTC).

US - speech by Fed Chair Yellen (12:30 UTC).

On July 28, the calendar of economic events of the European Union is empty, and an important report on GDP for the second quarter will be released in the United States. Traders will be able to see how likely a recession is in the near future. I believe that the influence of the information background on the mood of traders will be average in strength today.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the hourly chart with a target of 1.0080. I recommend buying the euro currency when it is fixed above the corridor on the hourly chart with a target of 1.0315.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română