Those who have initiated the development of metaverses suffer tremendous losses. And we are not talking about little businesses that are just entering the market and attempting to find a way to survive. In certain quarters, we are discussing the massive conglomerate Meta, often known as Facebook.

According to the study released by the social media behemoth, its metaverse-focused company lost $2.81 billion in the second quarter alone. Thus, losses since the start of the year total a staggering $5.77 billion.

Facebook Reality Labs (FRL), which is distinct from Facebook, Instagram, Messenger, and Whatsapp and focuses on developing the tech and content required to promote Meta in the metaverse, is experiencing significant difficulties. According to their earnings report for the second quarter of 2022, FRL made $452 million in revenue, which is 35% less than the previous quarter. In 2012, the division reported astonishing yearly losses of $10.2 billion. It is now projected to surpass this mark in 2022.

In this context, Meta's stock plunged 20 percent but eventually recovered its losses. But do not take everything so seriously. Zuckerberg cautioned at the end of the first quarter that the new business was initially unprofitable, and the situation is unlikely to improve until the industry reaches full development.

Mark Zuckerberg, CEO of Meta, conceded, "Clearly, this is an extremely costly endeavor, which in the next years will result in only one loss." "However, when the metaverse grows increasingly significant in our lives, I'm certain we'll be pleased to have played a significant role in its construction."

Allow me to remind you that last November, Zuckerberg changed Facebook's name to Meta. Additionally, he refocused the company's objective on conquering the metaverse.After the report was released, Zuckerberg attempted to persuade shareholders that this is a well-considered long-term strategy. Zuckerberg stated, "By assisting in developing these platforms, we will have flexibility and choice over our competitors, who will be subject to various restrictions." Now, I am more convinced than ever that the growth of these platforms will eventually provide access to hundreds of billions, if not trillions, of wealth.

According to the report, the company's total sales this quarter climbed by slightly over 3 percent to $28.8 billion.

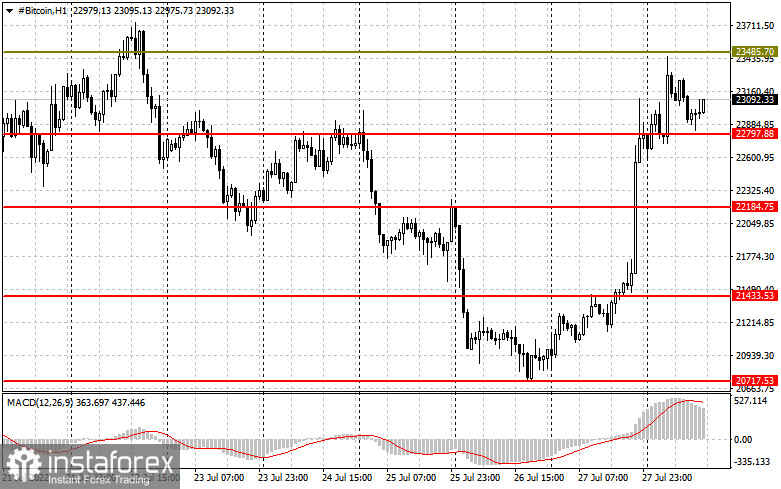

Metaverses play a significant part in the new digital sphere. It is intricately connected with cryptocurrencies and everything associated with encryption. Consequently, a breakthrough in this area will unquestionably result in expanding the cryptocurrency sector. It is already comprised of many organizations working on developing the metaverse.Regarding bitcoin's technical prospects, the balance of power has shifted in favor of purchasers. In the case of a collapse in the trading instrument, speculators will defend the $22,720 support level, which is crucial. Its collapse and consolidation below this range will cause the trading instrument to return to the lows, between $22,180 and $21,430, reaching as low as $20,700. If the demand for bitcoin resumes, it will be necessary to break above $ 23,480 to establish an uptrend. Fixing higher will drive the trading instrument to its highs of $24,280 and $25,700.

In the event of a return of pressure, Ether buyers should demonstrate themselves in the region of $1,575, as a breach below this level would soon send the trading instrument to a low of $1,500. If we are talking about a genuine decline in the ether, then the next stop is only achievable between $1,420 and $1,350. When the $1,650 resistance is broken, it will be possible to discuss the continuance of ether's growth. Only if growth surpasses this level can we anticipate a faster acceleration with the repeat of the highs: $1,740 and $1,830, as well as the possibility of constructing a medium-term upward trend at $1,910.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română