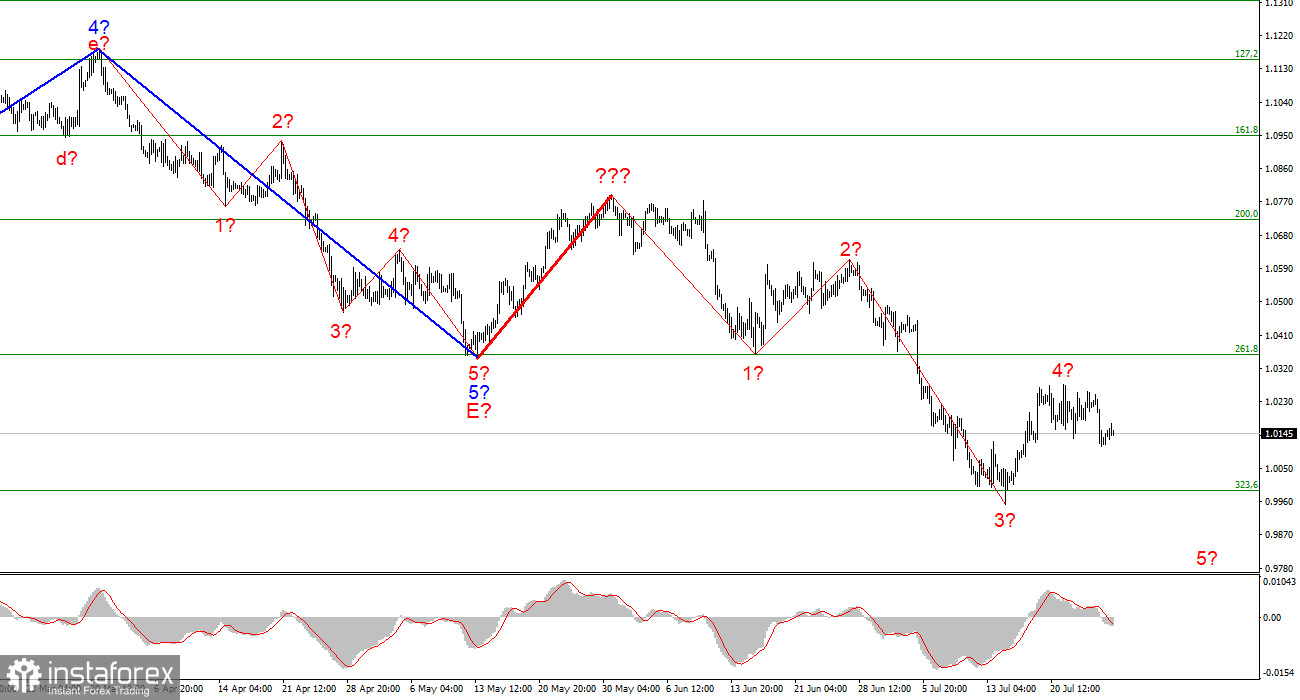

The wave marking of the 4-hour chart for the euro/dollar instrument grew more sophisticated a few weeks ago, but it did not require any adjustments at the time. A successful attempt was made to break over the 261.8 percent Fibonacci level, which was also the low of the waves E and b. Therefore, these waves are hardly E and b anymore. I have developed a new wave markup, which does not yet consider the rising wave marked with a bold red line. I have already indicated that the entire wave structure can be complicated an indefinite number of times. This is the drawback of wave analysis, as any structure can adopt a more complex and extended shape. Therefore, today I propose to concentrate on simpler wave structures that incorporate waves of a lower magnitude.

As you can see, the construction of a descending wave has commenced, which may be wave 5 of a new downward trend section. If this assumption is right, the instrument has begun its drop with targets below 1.0000. So far, I don't see any reason to expect more movements of the instrument.

The findings of the Fed meeting will be announced in a few hours

The euro/dollar instrument climbed by 30 basis points on Wednesday. The amplitude of the day's movements was no more than 20 points; that is, it was quite feeble. In my opinion, this market behavior does not match the news background that will be today. If the instrument plummeted by 100 points yesterday, why is it not moving today? After all, there was no news background yesterday. Today, data on orders for durable goods have already been released in the United States, according to which volumes climbed by 1.9 percent m/m in June. Market forecasts were -0.5 percent mum; that is, the report turned out significantly better than predictions. The demand for the US dollar could expand, which is what we need now so that the wave picture remains complete and does not require new additions. I remark that the five-wave wave structure appears almost flawless now and raises no issues.

But maybe all is not gone yet? In a few hours, the FOMC will publish its decision on the rate, issue a report on monetary policy, and Jerome Powell will speak on the economy's current status and the prospects for inflation. And I don't expect anything that could diminish the desire for American money. Any rate hike is always a tightening of monetary policy, to which the market should respond with purchases of the corresponding currency. Now everything argues in favor of the expansion of the dollar. Wave marking suggests a further reduction of the instrument, an increase in the Fed rate (the issue has already been practically resolved), high inflation (which implies a further increase in the interest rate), and a low threat of recession (no more than 50 percent, which is not so much, given the pace of rate increases). Some FOMC members openly advocated a rate hike even by 100 basis points. Thus, the market may be stunned by the Fed's decision in the evening. Most observers still do not expect a raise of 100 points at once, given that Jerome Powell is not the largest "hawk" on the monetary committee. But inflation continues to climb, and we need to continue to battle it since the Fed has labeled its major goal the return of inflation to 2 percent. And the decision on the rate is not made by Powell personally.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. If this is the case, it is now viable to sell the instrument with goals at the estimated 0.9397 level, which corresponds to 423.6 percent Fibonacci, for each "down" MACD signal generated during the development of wave 5. Wave 4 is currently completeable.

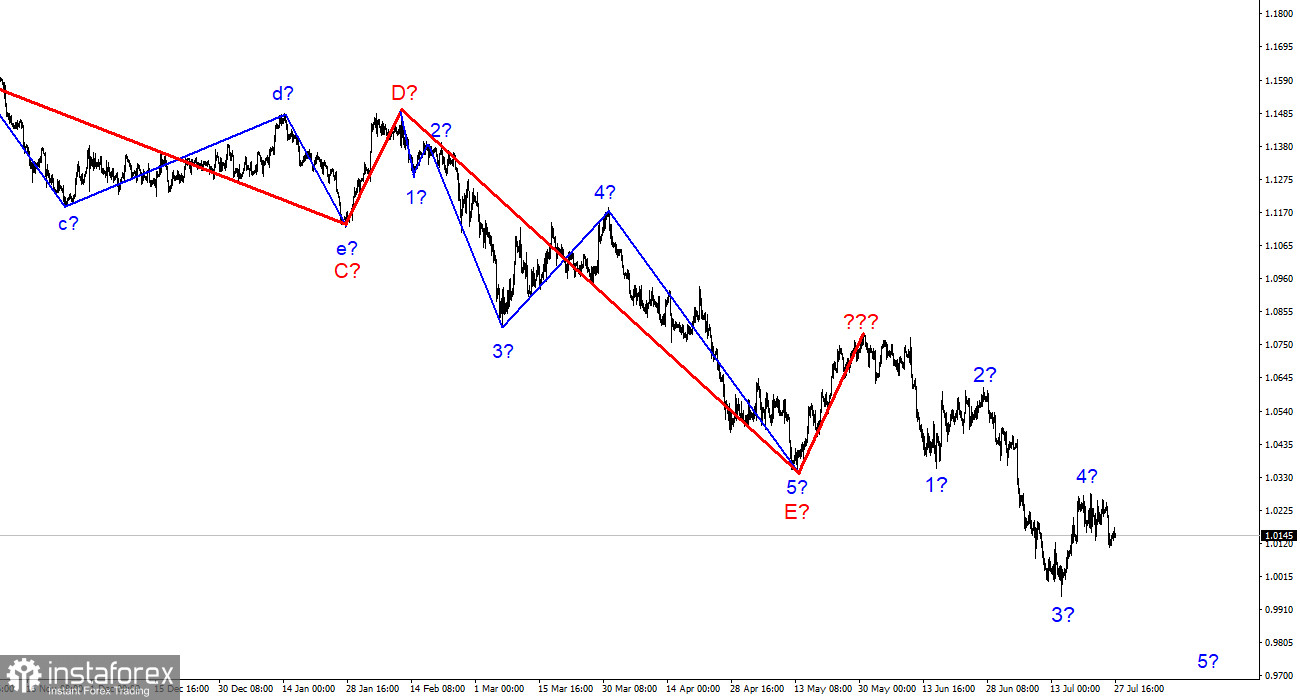

At the larger wave size, the wave marking of the descending trend segment becomes considerably more complex and extends in length. It can assume virtually any length. Thus, I believe it is best to concentrate and focus on three and five-wave conventional wave structures at this time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română