Markets froze in anticipation of the Fed's verdict following the July 26–27 FOMC meeting, which promises to be a landmark for many assets. If the US economy has one foot in recession, the Fed could loosen the reins a bit and signal a slowdown in monetary restrictions. On the other hand, the continuation of the central bank's previous intention to devote all its efforts to fighting inflation while sacrificing both employment and GDP suggests that a 75 bps increase in the federal funds rate in July will not be the last such broad step. Everything is in the hands of Fed Chairman Jerome Powell, including the fate of EURUSD.

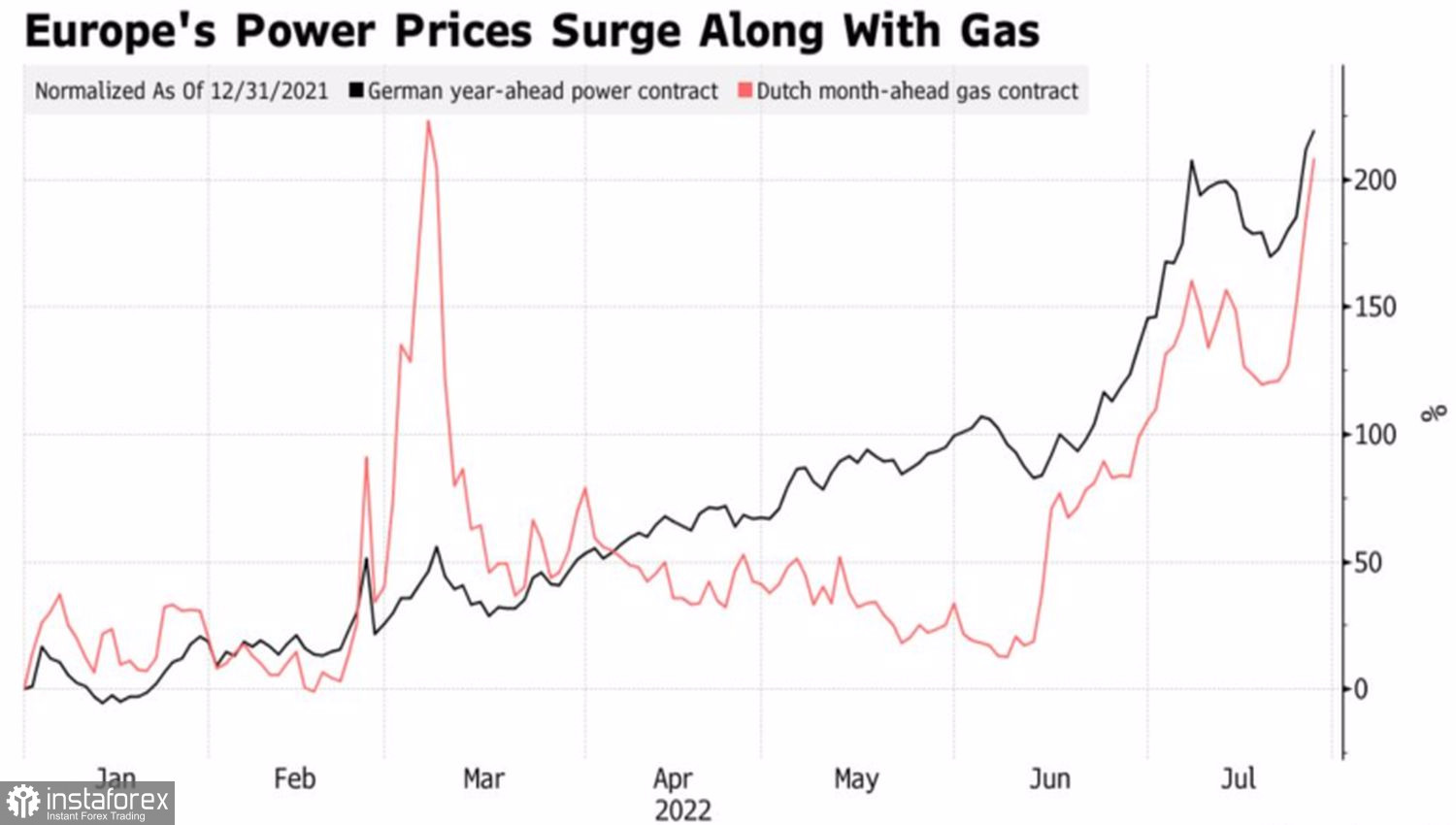

The euro continues to be under pressure amid the ongoing rally in gas prices, which increases the risks of an economic downturn in the eurozone. German futures for blue fuel have reached a new record level. The Dutch are close to it, which creates serious problems for the euro area industry, increases household bills, and contributes to inflation accelerating to historical highs.

Dynamics of gas prices in Europe

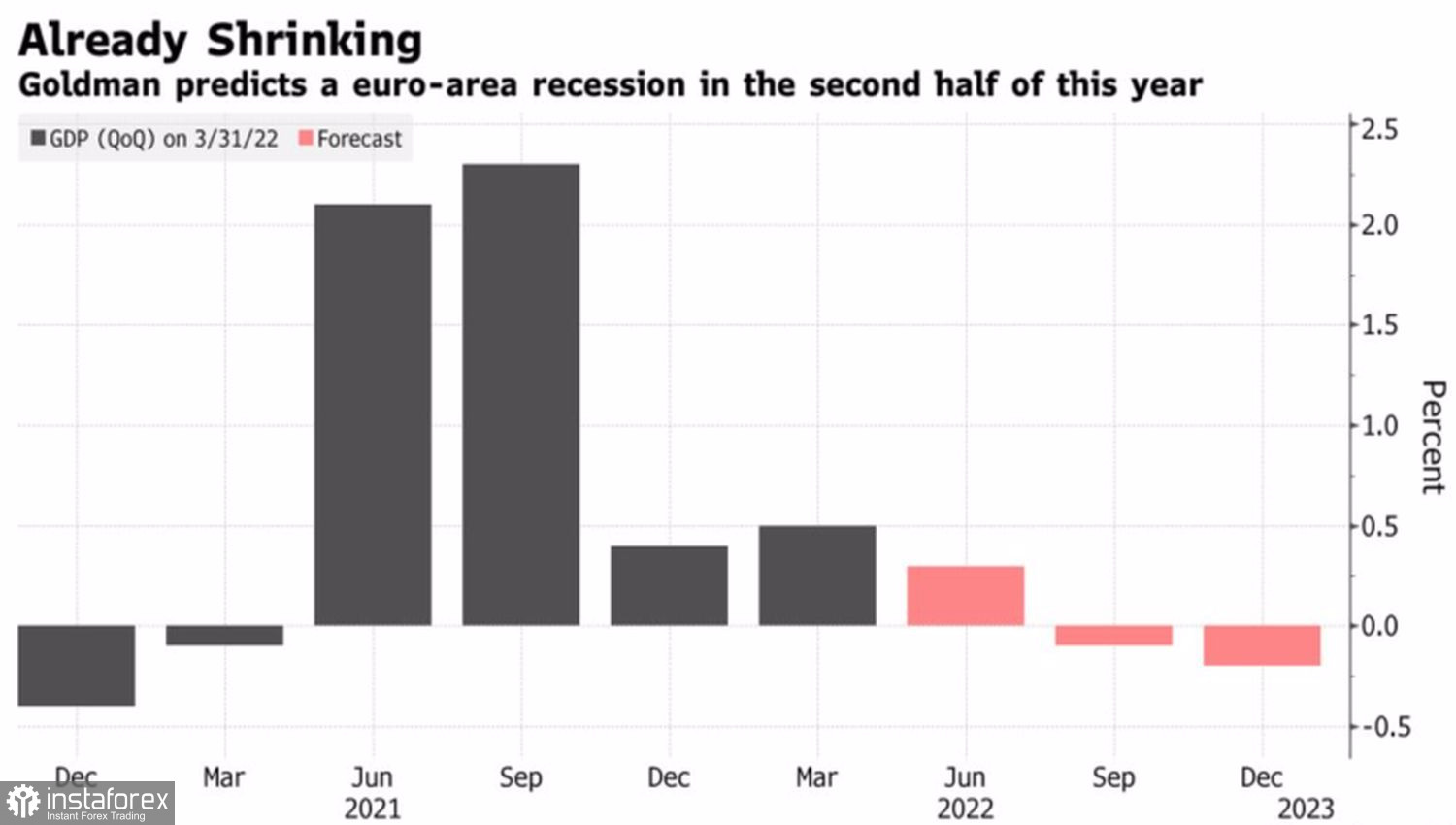

Goldman Sachs says the currency bloc is already in a recession, which will last at least until the end of this year. The bank estimates GDP contraction at 0.1% in the third and 0.2% in the fourth quarter, but notes that the numbers could rise significantly if the energy crisis worsens, debt markets become stressed, and the US gross domestic product shrinks. Goldman Sachs believes that the economies of Germany and Italy are already facing a recession, while Spain and France continue to grow.

Eurozone GDP forecasts by Goldman Sachs

Curiously, the IMF reduced its forecast for Eurozone GDP for 2022 by only 0.2 percentage points, while for its American counterpart by 1.4 percentage points, citing the aggressive tightening of the Fed's monetary policy. The leading indicator from the Atlanta Fed signals that the US has also already plunged into recession. Quite possibly, this will be confirmed by the official statistics for the second quarter, which will be released the next day after the FOMC meeting.

Under such conditions, the Fed could play along with financial markets that see a 75 bps rate hike in July and by 100 bps following the results of the remaining three meetings of the Committee in 2022. A slower monetary restriction will lead to an increase in stock indices, a fall in Treasury bond yields, and a weakening of the US dollar against major world currencies.

On the other hand, the Fed has a sad example of the sluggishness of its predecessors, which turned into two whole recessions. Why fall back on the old trap when you can strengthen the dollar with determination and thus take another step to suppress high inflation?

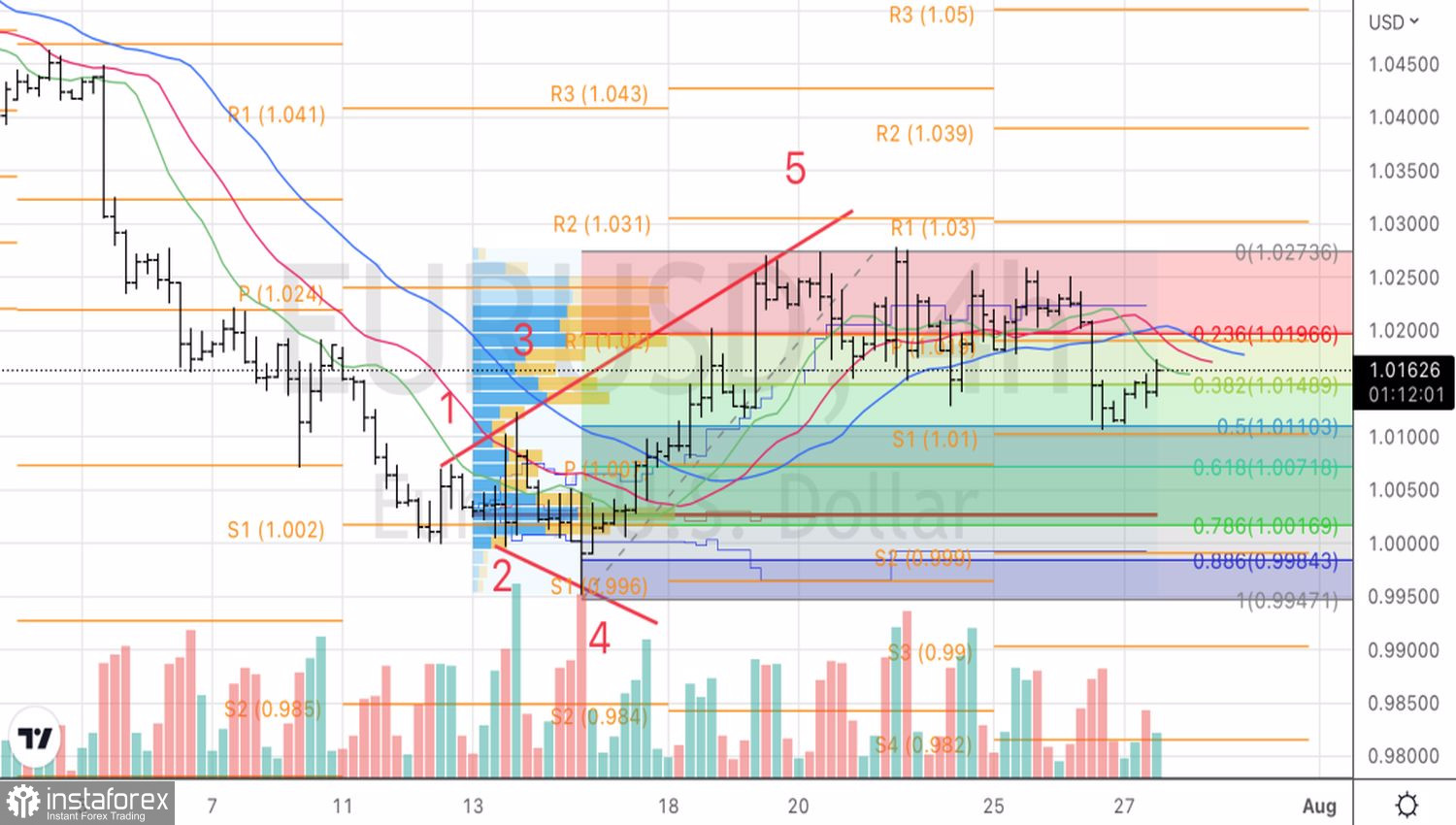

Technically, on the EURUSD 4-hour chart, the return of quotes to 1.02 can activate the false breakout pattern, which, in combination with the Broadening Wedge, will become a strong argument for buying the euro against the US dollar. On the contrary, the fall of the pair below 1.011 is a reason for its sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română