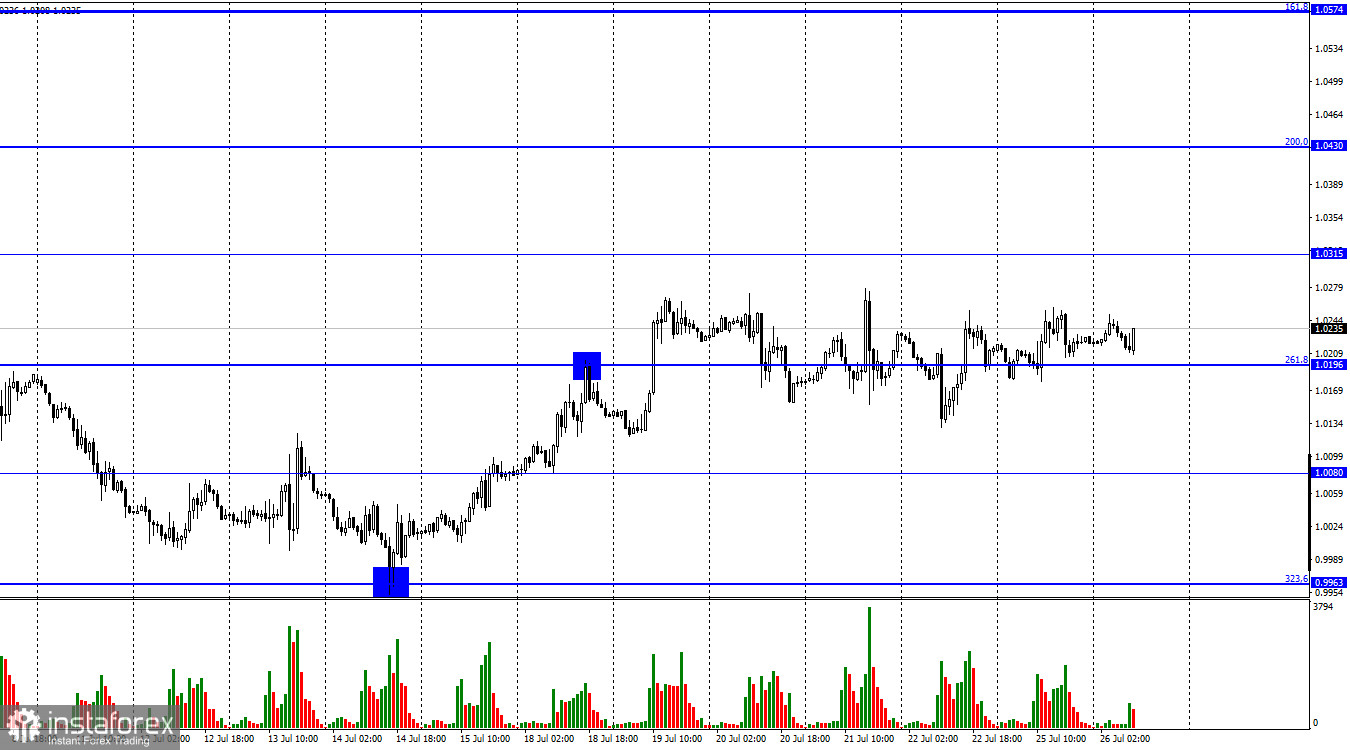

On Tuesday, the EUR/USD pair continued to trade near the corrective level of 261.8% (1.0196). Thus, traders did not desire to move the pair in any particular direction on Monday, Tuesday, or last week. I did not build a side trend corridor since the direction of movement is perfectly visible without it. In such a situation, each trader decides for himself what to do. It isn't easy to trade at this time, as the quotes practically do not move from the spot. There is hope that the mood of traders will become clearer on Wednesday evening, but Wednesday evening is still a long way off. One could hope that the next economic report will bring traders out of their stupor, but the next report is also on Wednesday. I don't expect any changes in the movement of the euro-dollar pair until tomorrow. What could happen on Wednesday evening? There are three main options. The first is that the European currency will resume its growth. From my point of view, this will happen if the Fed raises the rate by 0.75%, as most traders expect. The second option is that the US dollar will resume its growth.

I think this will happen if the rate is increased by 1.00% or more. The third option is something we very often observe after a meeting of any central bank. First, there will be a sharp jump up, then the same sharp down, and then the quotes will return to the values they were at before the meeting. Even a rate increase of 1.00% will not surprise traders, as many expert specialists have been talking about this in recent weeks. It seems that the situation will not change on Wednesday evening, except that the movements will be stronger than now.

Nevertheless, it is impossible to predict 100% what will happen to the pair two days after the results of the Fed meeting become known. I recommend preparing for any option and not stopping at anyone. Last week, the ECB meeting caused a reaction to the "third option," although few expected that the rate would rise by 0.5% at once.

On the 4-hour chart, the pair is held above the corrective level of 127.2% (1.0173). Thus, it retains the chances of growth in the direction of the upper line of the descending trend corridor. Although given the pace it has been showing recently, the line is likely to fall to euro quotes. Fixing the pair's exchange rate below the level of 1.0173 will still work in favor of the dollar and cause it to resume falling at 161.8% (0.9581). Emerging divergences are not observed in any indicator today.

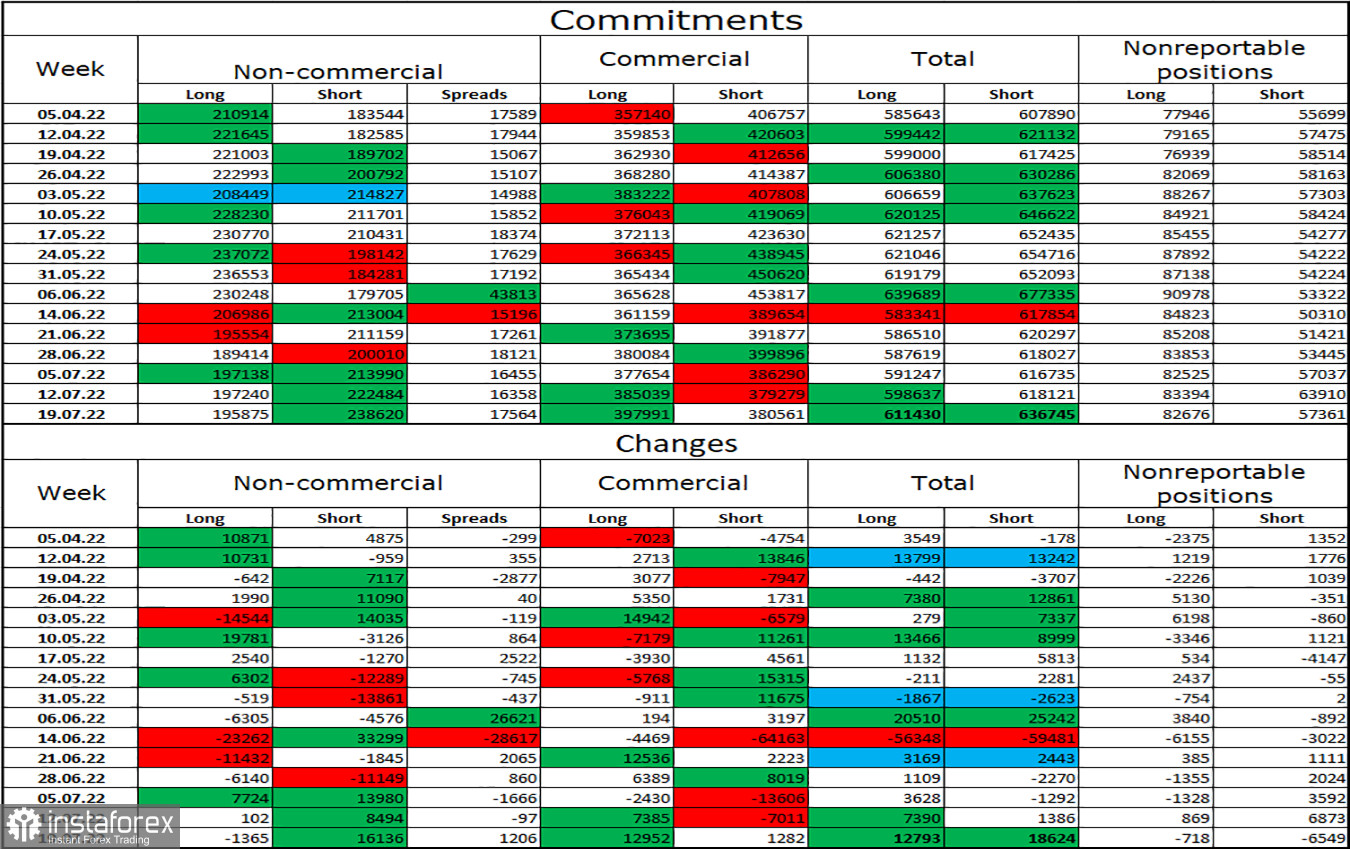

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 1,365 long contracts and opened 16,136 short contracts. It means that the "bearish" mood of the major players has intensified again. The total number of long contracts concentrated in the hands of speculators now amounts to 238 thousand, and short contracts – 195 thousand. The difference between these figures is still not too big, but it remains not in favor of the bulls. In the last few weeks, the chances of a rise in the euro currency have been gradually increasing, but recent COT reports have shown that new sales may now follow, as the mood of speculators has changed from "bullish" to "bearish," and it is intensifying. Thus, it is still difficult for me to count on strong growth of the euro currency.

News calendar for the USA and the European Union:

US - new home sales (14:00 UTC).

On July 26, the calendars of economic events of the European Union and the United States are almost empty. One report in the US is unlikely to affect the mood of traders so much that the sideways movement will end.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when closing below the level of 1.0173 on a 4-hour chart with targets of 1.0080 and 0.9963. I recommend buying the euro currency when anchoring above the corridor on a 4-hour chart with a target of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română