When you fight with one monster, there is hope of winning, but when there are several such monsters at once, the chances of celebrating success in battle fade before your eyes. If the Fed has to fight inflation based on strong domestic demand, which can be suppressed by raising rates, then the situation in Europe is quite different. The supply shock due to the armed conflict in Ukraine makes the ECB's tightening monetary policy useless and dangerous. An excessive increase in the deposit rate threatens a recession. And this is far from the only reason for EURUSD migraines.

The transition of the Nord Stream to work at 20% of its capacity has exacerbated the already difficult situation in the eurozone economy. In this scenario, Germany is unlikely to be able to fill its gas storage by 75% and the EU by 80%. Moreover, Wood Mackenzie warns that a complete shutdown of supplies will deplete blue fuel stocks by February. The European economy is undergoing a structural rather than a cyclical shift, suggesting a prolonged weakness for the euro.

The approval by the EU countries, with the exception of Hungary, of a voluntary reduction in gas consumption by 15% looks like a belated and ineffective measure. How this mechanism will work, no one knows yet.

Blue fuel is far from the only problem facing the ECB. The US labor market is stronger than its European counterpart, as evidenced by lower unemployment. Therefore, the US economy is able to withstand a rate increase, but can the eurozone? In addition, the currency bloc is very heterogeneous in its economic development. For some, a 1% deposit rate is no big deal, but for others it's a guaranteed recession.

If we add to the above political difficulties, including the loss of the majority in the French parliament by Emmanuel Macron's party, the departure of Italian Prime Minister Mario Draghi, and the gas war of the new German chancellor Olaf Scholz, the return of EURUSD to parity looks more than real.

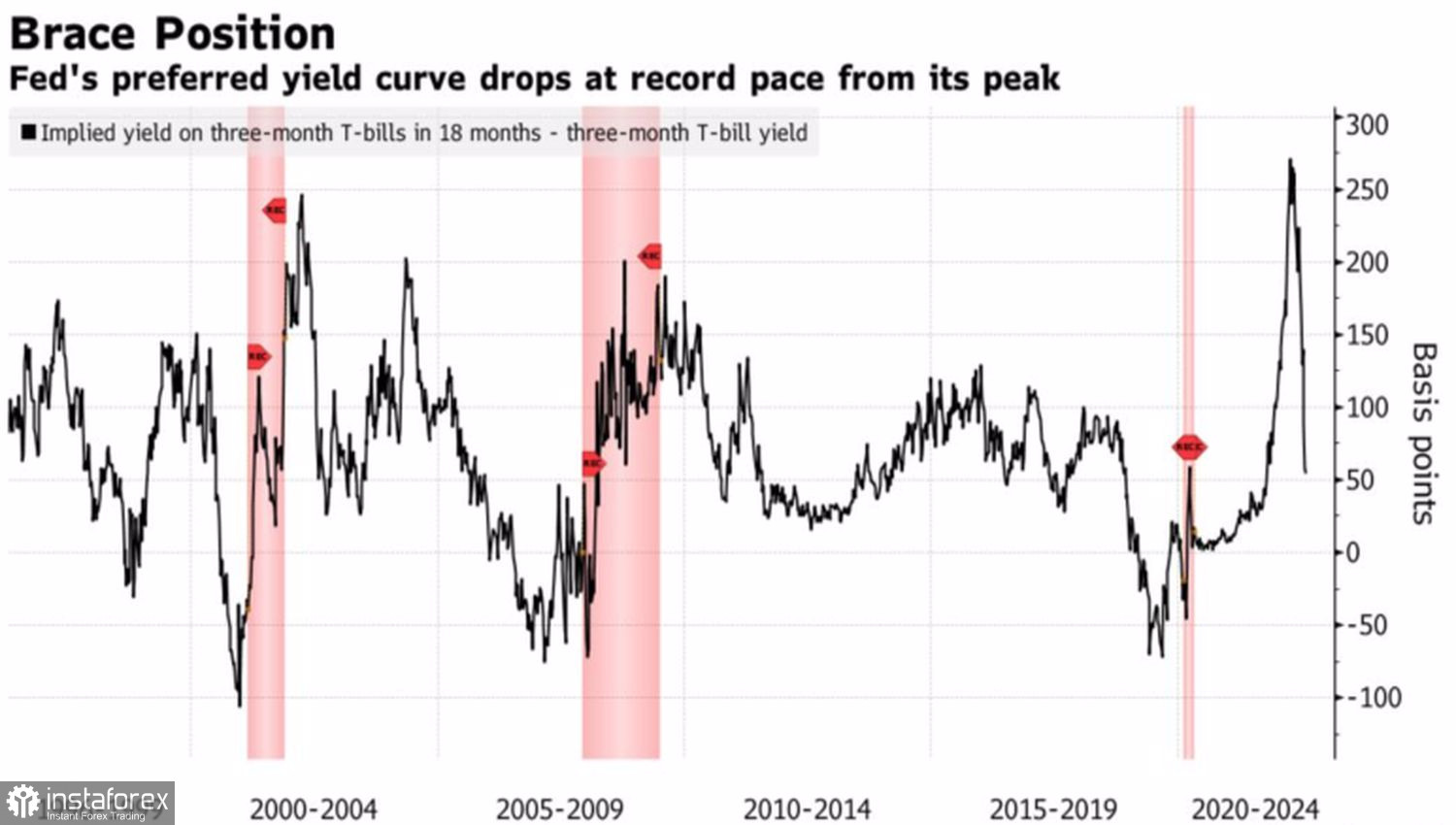

US yield curve dynamics

Another thing is that the US dollar is experiencing bouts of weakness. The fall in the yield curve in the form of the difference between 18 and 3-month bills, which Jerome Powell called the most important indicator of the impending recession in the US economy, was the largest since 1996.

Many other curves have long since inverted, and the spread between 10- and 2-year debt rates is at its lowest since 2000. Markets clearly want recession fears to push the Fed back. If it does, even such a weak currency as the euro will benefit.

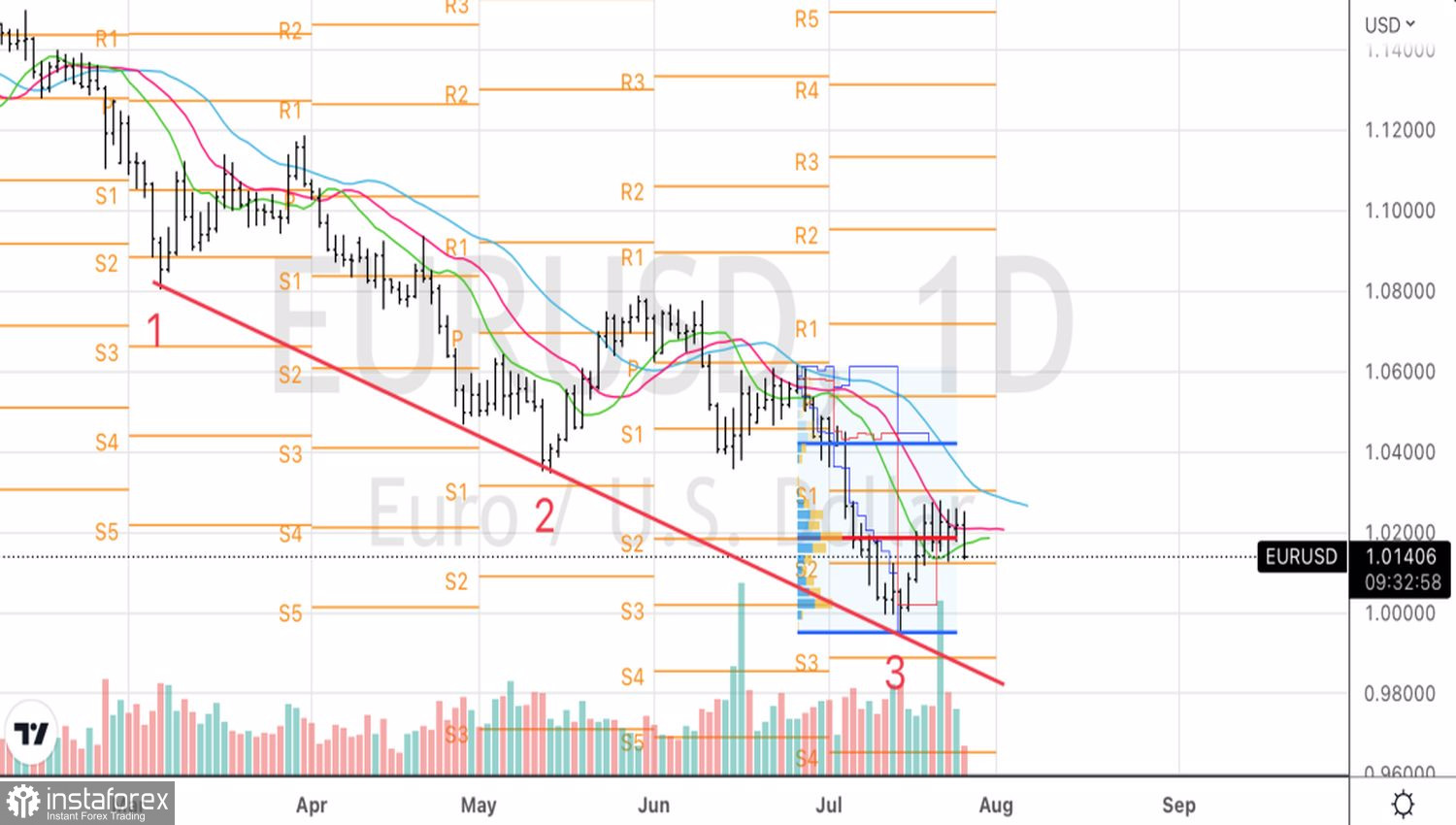

Technically, the return of EURUSD to the lower border of the shelf 1.012–1.027 of the Splash and shelf pattern indicates the bulls' weakness. The shorts formed on the break of the fair value at 1.018 make sense to build up in case of a successful assault on the support at 1.012.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română