US stocks and futures were mixed today amid caution in global markets ahead of the Federal Reserve's interest rate hike and as European Union countries reached a political deal to cut gas consumption.

European energy and mining stocks rallied amid supply concerns, while retailers and banks fell on disappointing reports.

Traders brace for a widely anticipated 75 basis point Fed interest rate hike on Wednesday, part of the drive to tackle inflation, as well as corporate reports from Apple Inc. and Alphabet Inc.

Commodity prices rose amid signs of a deficit and natural gas prices in Europe rose to the highest level in more than four months. Oil and copper also jumped. Treasury yields slipped while the dollar indicator surged.

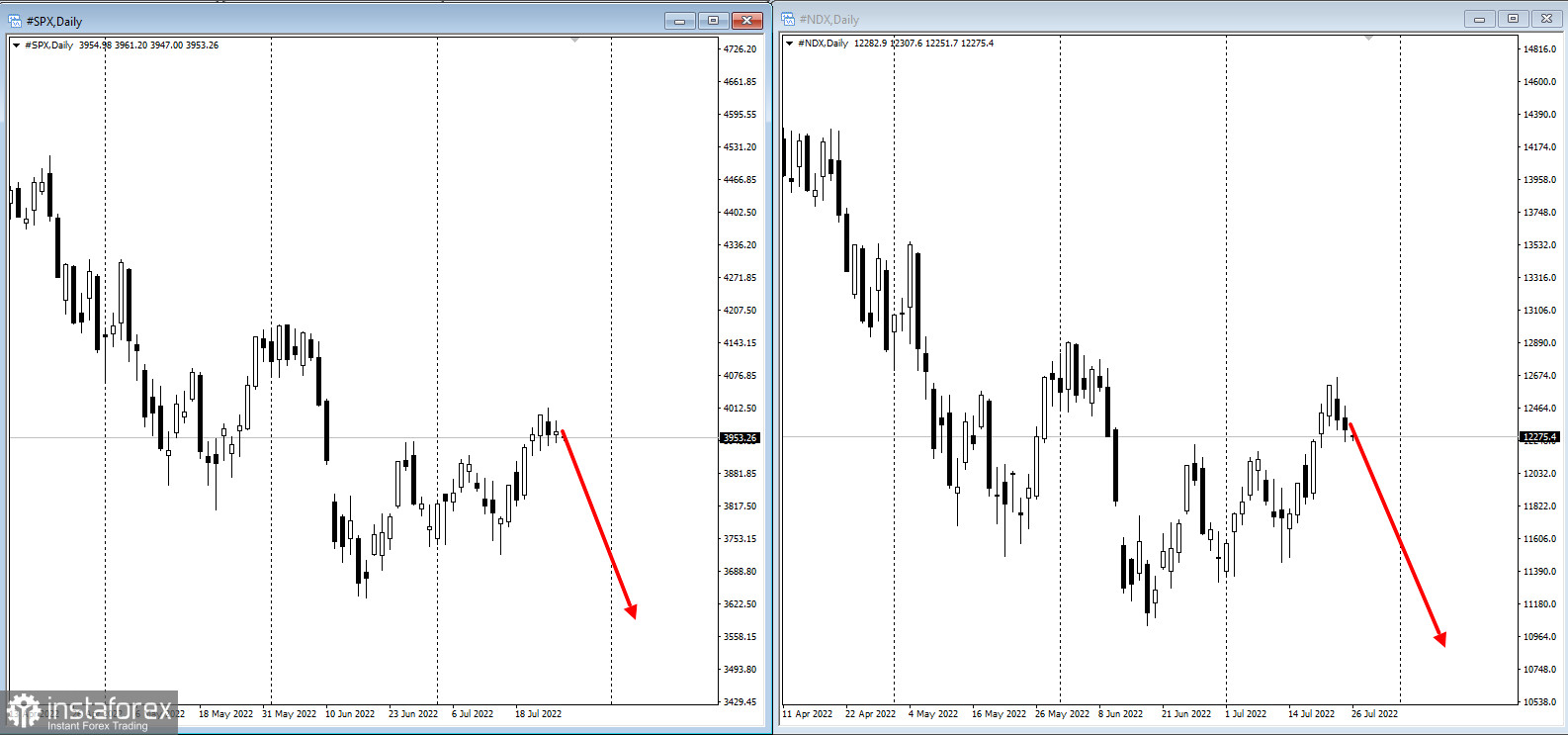

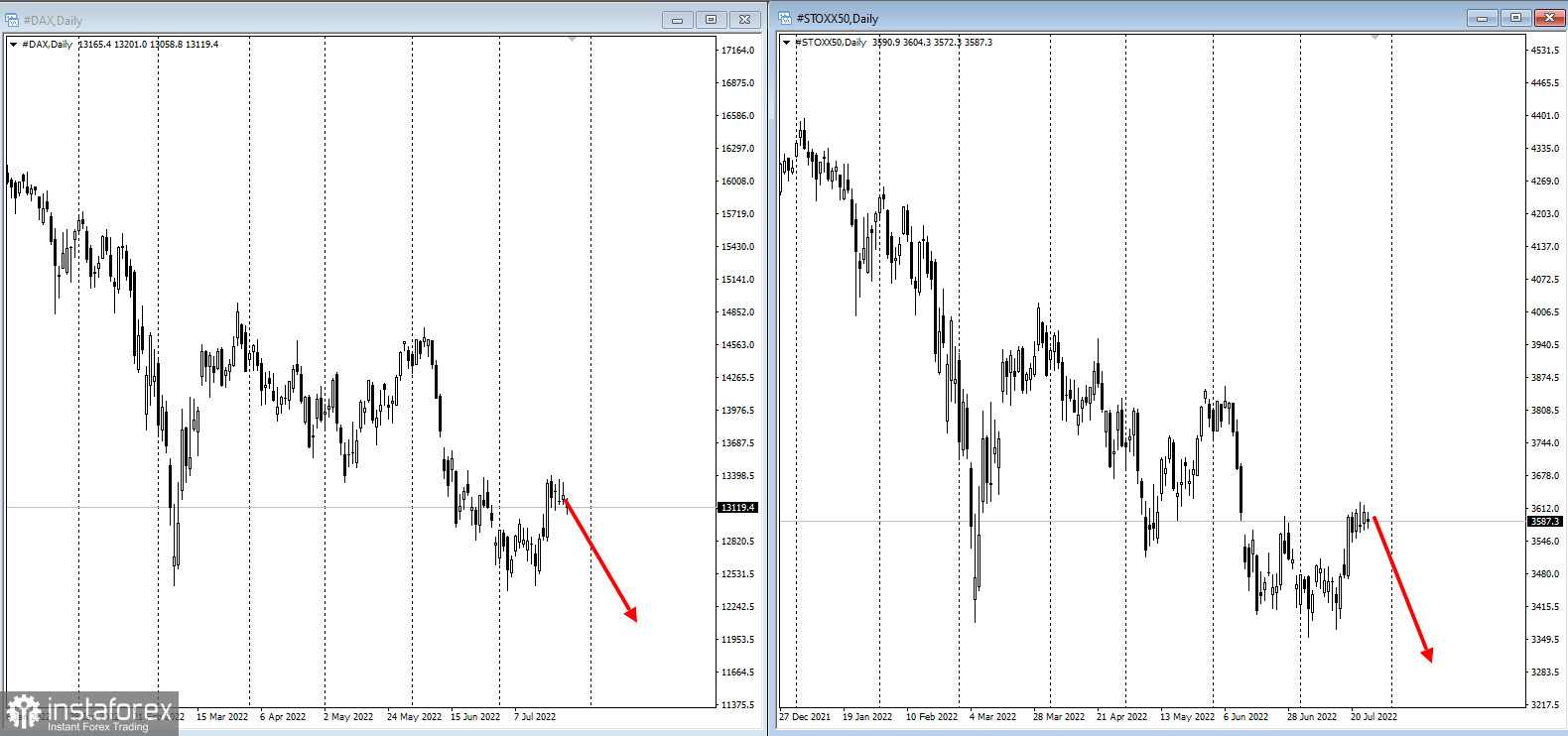

Major investment houses expect the stock market to decline until at least the end of the year.

Key events to watch this week:

- Alphabet, Apple, Amazon, Microsoft, Meta earnings due this week

- US new home sales, Tuesday

- IMF's world economic outlook update, Tuesday

- EU energy ministers emergency meeting, Tuesday

- Fed policy decision, briefing, Wednesday

- Australia CPI, Wednesday

- US GDP, Thursday

- Euro-area CPI, Friday

- PCE price index, US consumer income, University of Michigan consumer sentiment, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română