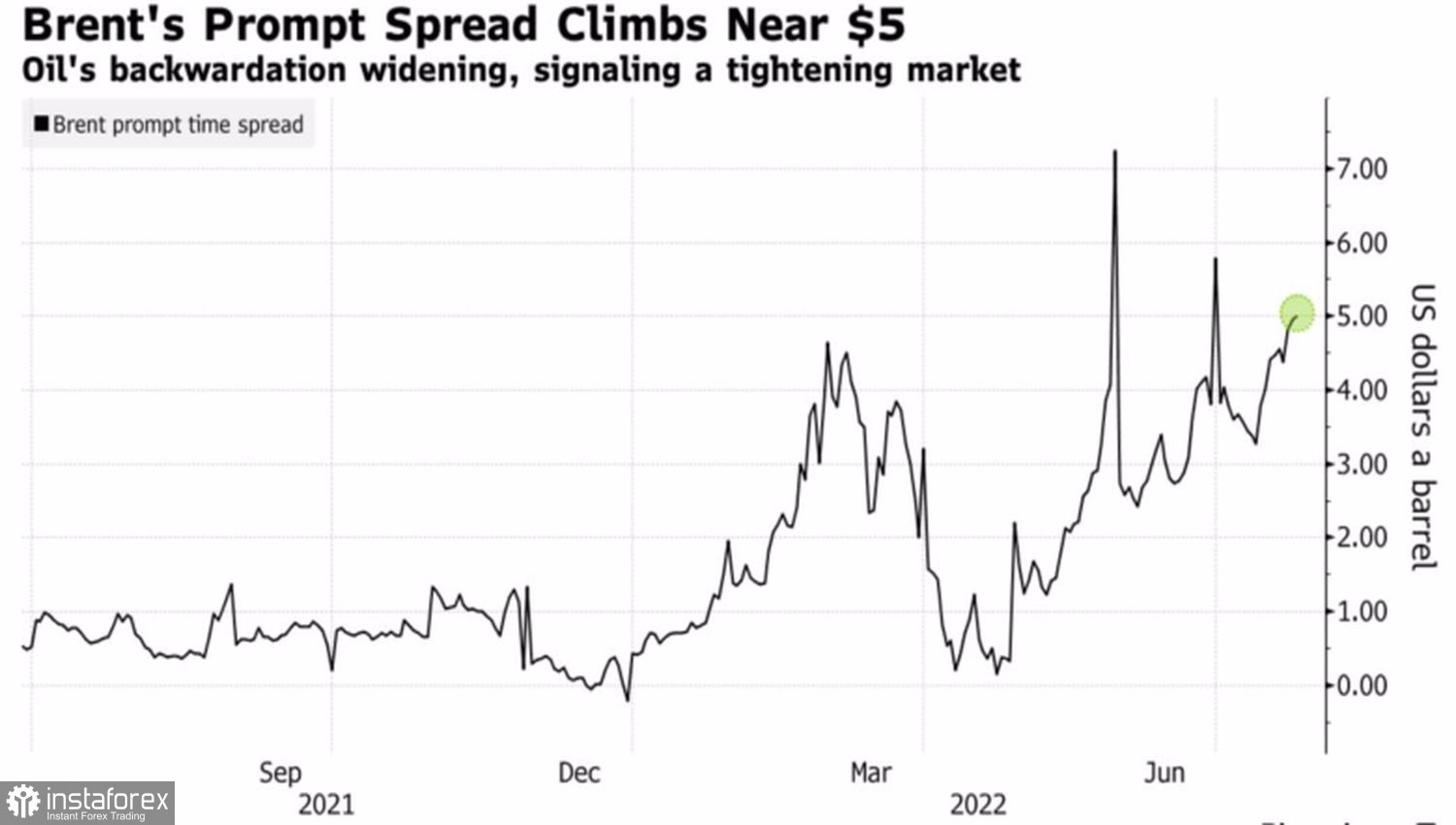

Don't feed speculators with bread—let them muddy the waters in the financial markets. Recently, the oil trade has been characterized by increased volatility, as investors could not determine what was more important—a potential slowdown in demand against the backdrop of an approaching recession or supply problems. The fall of Brent from June highs of $125 a barrel indicates serious fears about a downturn in the global economy, which will undermine interest in black gold. On the contrary, backwardation expansion speaks of the difficulties of the proposal. The spread between closely related futures contracts for the North Sea grade widened to $5 per barrel. The market is bullish, but will buyers find the strength to restore the upward trend?

Spread dynamics between Brent futures contracts

Over the past two years, Brent has traded at $19 and $139 a barrel. Such a spread in prices has not been seen since the financial crisis of 2008, when the North Sea variety was thrown into the heat at $150, then into the cold at $40 per barrel. Then fears about a decrease in demand due to a recession led to a drop in futures quotes. Now many reasons are intertwined in a ball: the COVID-19 pandemic, the redistribution of the energy market, OPEC policy, and the unpredictability of Russia.

The main driver of the 2-day Brent rally at the beginning of the last week of July was Gazprom's reduction of gas supplies through the Nord Stream pipeline from 40% to 20% of its capacity. The jump in prices for natural gas by 16% and more than doubled since the beginning of the year increases the demand for petroleum products, particularly diesel fuel, which can be used for partial replacement of gas. Obviously, the current peak for blue fuel is far from the limit, prices will rise as winter approaches. At the same time, the EU embargo imposed on Russian oil further aggravates the situation.

If the EU were not so dependent on Moscow for energy, the situation would not look so tense. The United States proves it with its falling gasoline prices and slower growth of WTI compared to Brent. The spread between the two major oil grades has widened to levels not seen since summer 2019, suggesting that supply pressures are more acute in Europe than in North America.

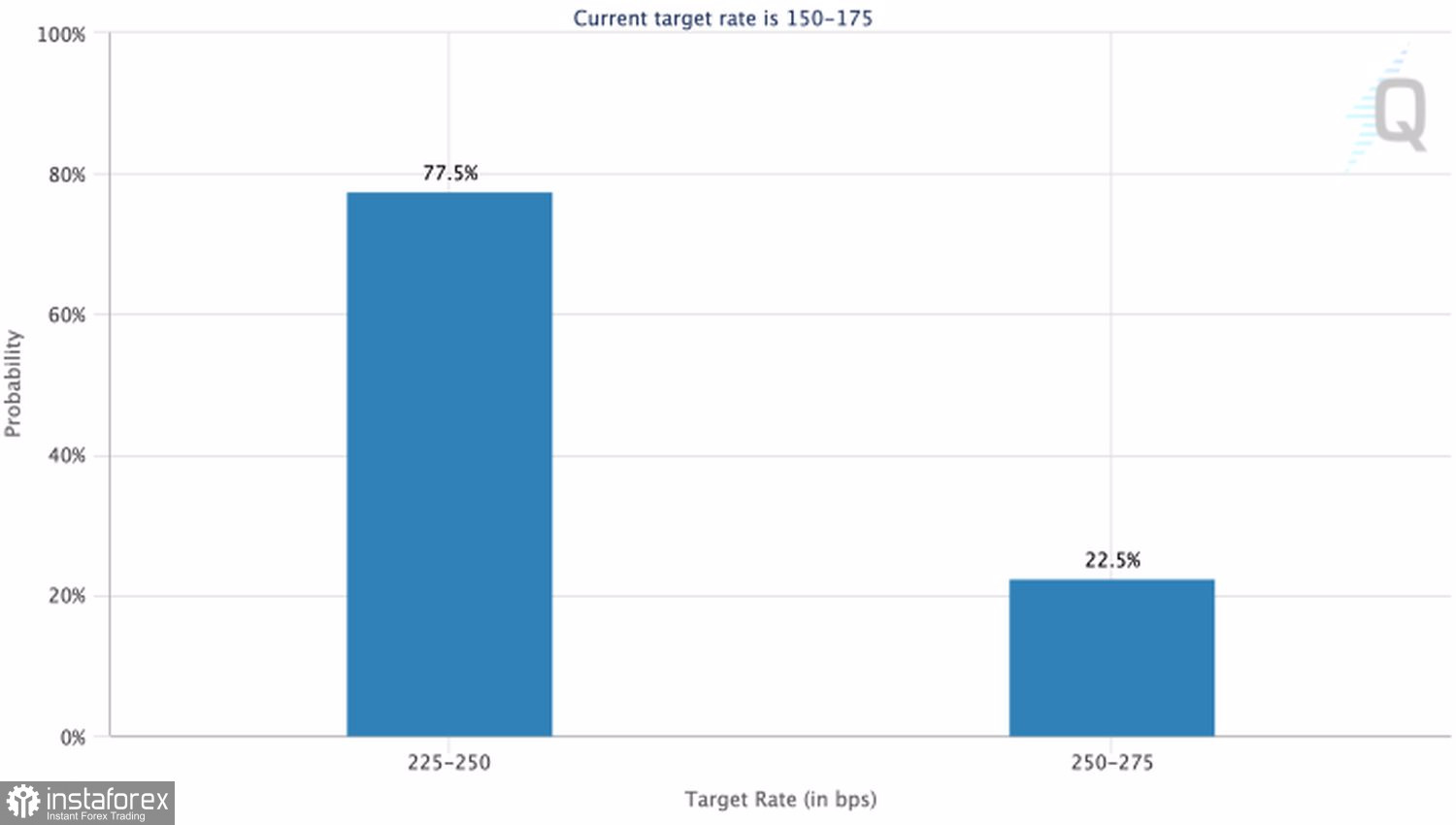

Probability of the Fed rate change

Oil is also supported by the weakness of the US dollar. Investors expect that at the FOMC meeting on July 26–27, the Fed will raise the rate by 75 bps, the probability of which is 77.5%. In September, markets expect the Fed to increase borrowing costs by only 50 bps. The slowdown in monetary restrictions is bad news for the USD index and good news for oil.

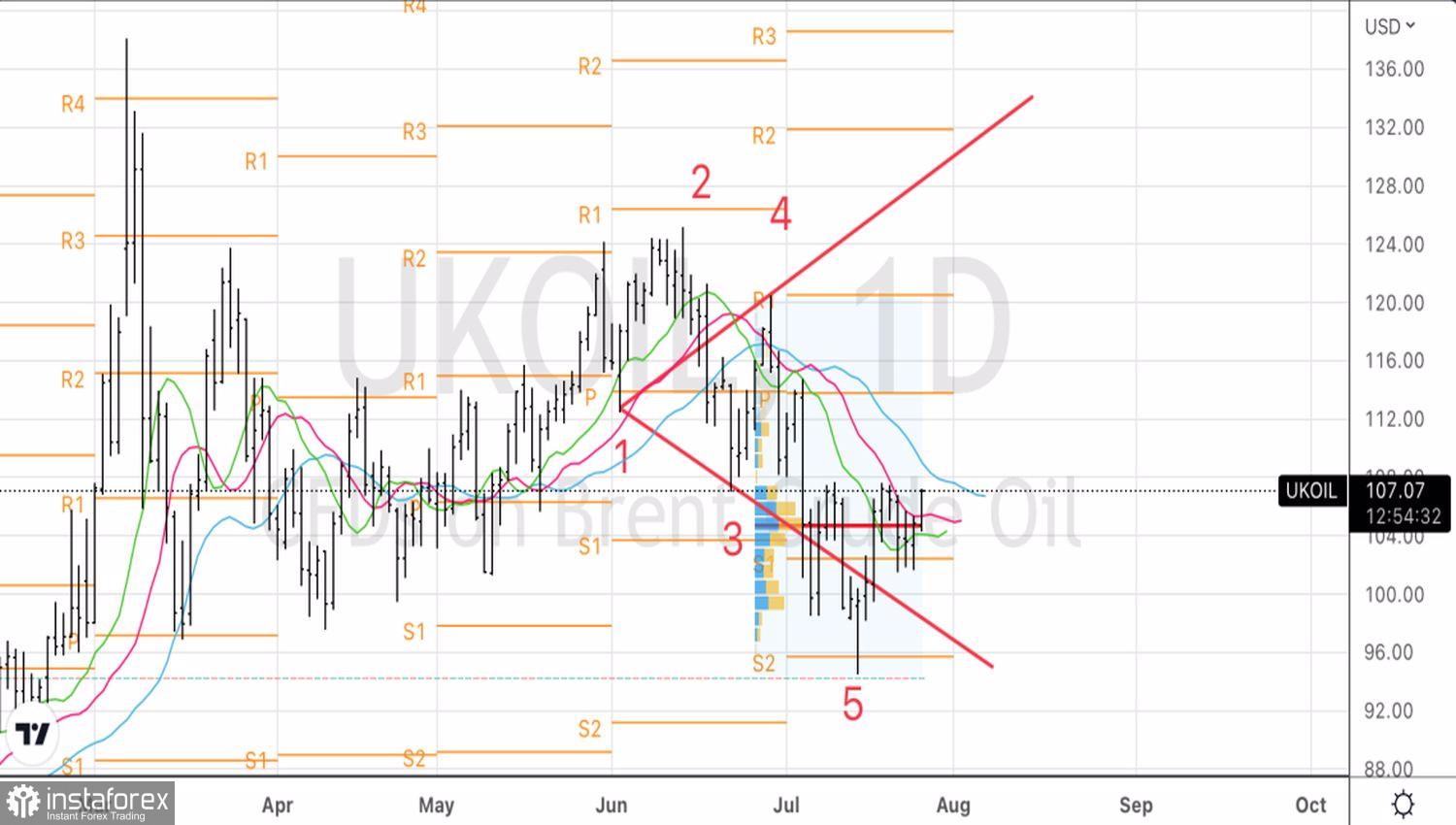

Technically, there is a combination of Wolfe Wave and 1-2-3 patterns on the Brent daily chart. A break of resistance at $107 per barrel near the local high of the last model or point 2 is a signal of the potential development of a corrective movement and a reason to open long positions in the North Sea variety.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română