EUR/USD

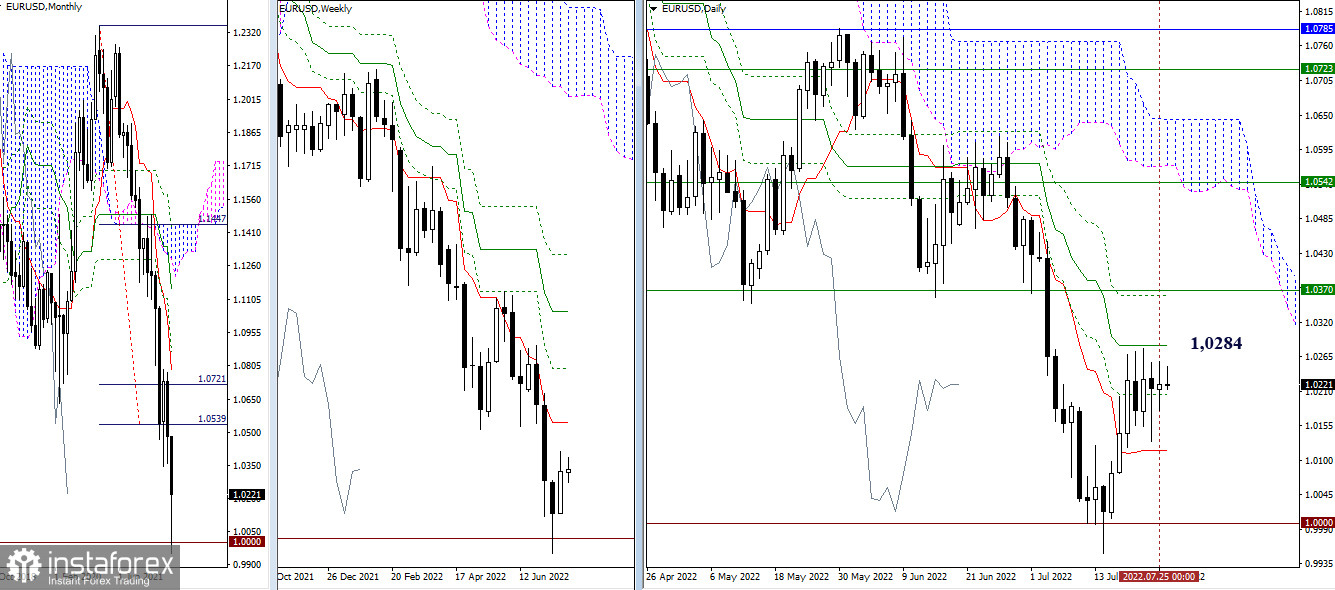

Higher timeframes

The situation over the past day has not changed significantly. The pair remains in the consolidation zone formed under the resistance of the daily medium-term trend (1.0284). The next target for the rise in case of a breakdown of 1.0284 will be the area of 1.0370 (the final level of the daily death cross + weekly short-term trend). If the bears are the first to leave the consolidation zone, then their attention will focus on passing the support of the daily short-term trend (1.0115) and breaking through the boundaries of 1.0000 – 0.9952 (psychological level + local low), separating the pair from the restoration of the downward trend at all higher timeframes.

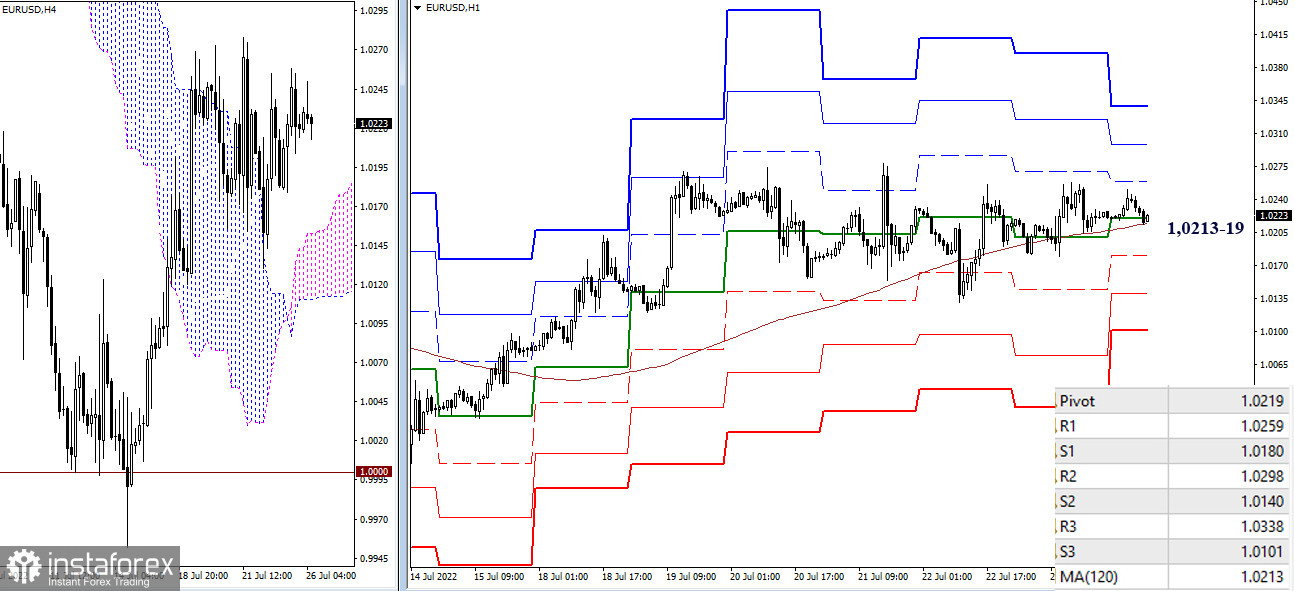

H4 – H1

The key levels of the lower timeframes have united today in the area of 1.0213–19 (the central pivot point of the day + a weekly long-term trend). They are currently being tested by the market. The location and operation of the pair above the levels will favor the bulls. Consolidation and holding below key levels will serve as an opportunity to reinforce bearish sentiment. The reference points for the development of movements in the current situation within the day are the classic pivot points: for bulls, the resistance is 1.0259 – 1.0298 – 1.0338, and for bears, the support is 1.0180 – 1.0140 – 1.0101.

***

GBP/USD

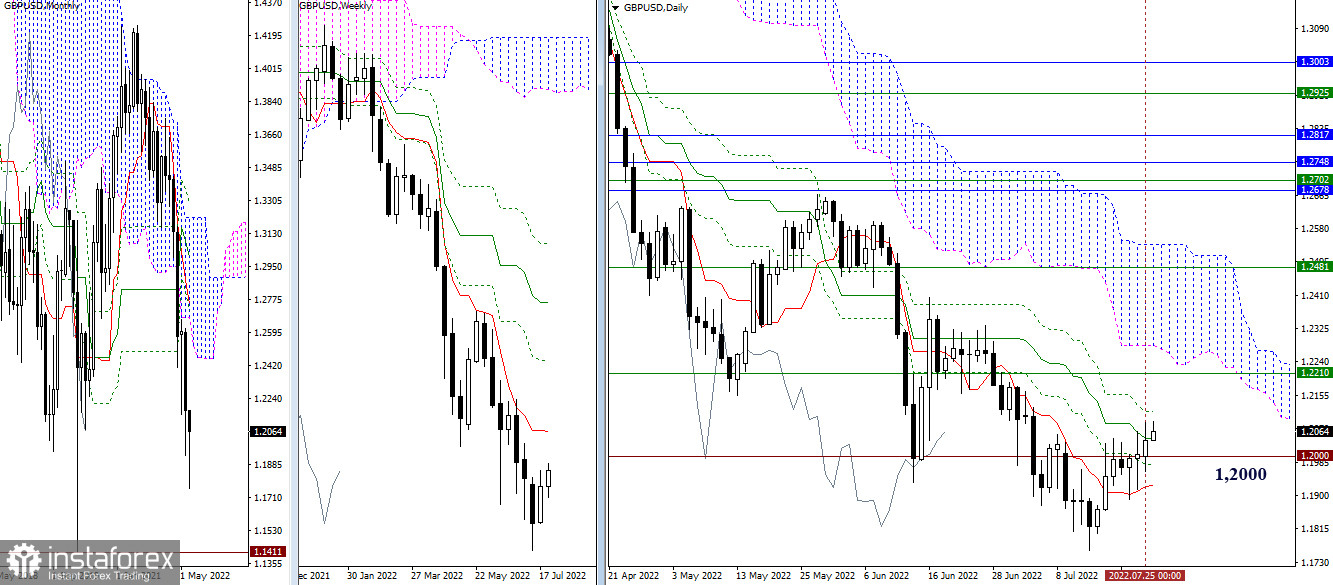

Higher timeframes

The bulls do not give up hope to get out of the situation as winners. At the same time, their primary tasks are to leave the zone of attraction and influence of the important psychological level 1.2000 and the elimination of the daily death cross (1.2046 – 1.2113 final levels of the cross). Followed by testing the strength of the resistance of the weekly short-term trend, which is now at the turn of 1.2210, and the lower boundary of the daily cloud. It is also important for bears to leave the zone of attraction and influence at 1.2000, regain the daily short-term trend (1.1924) and update the low (1.1759).

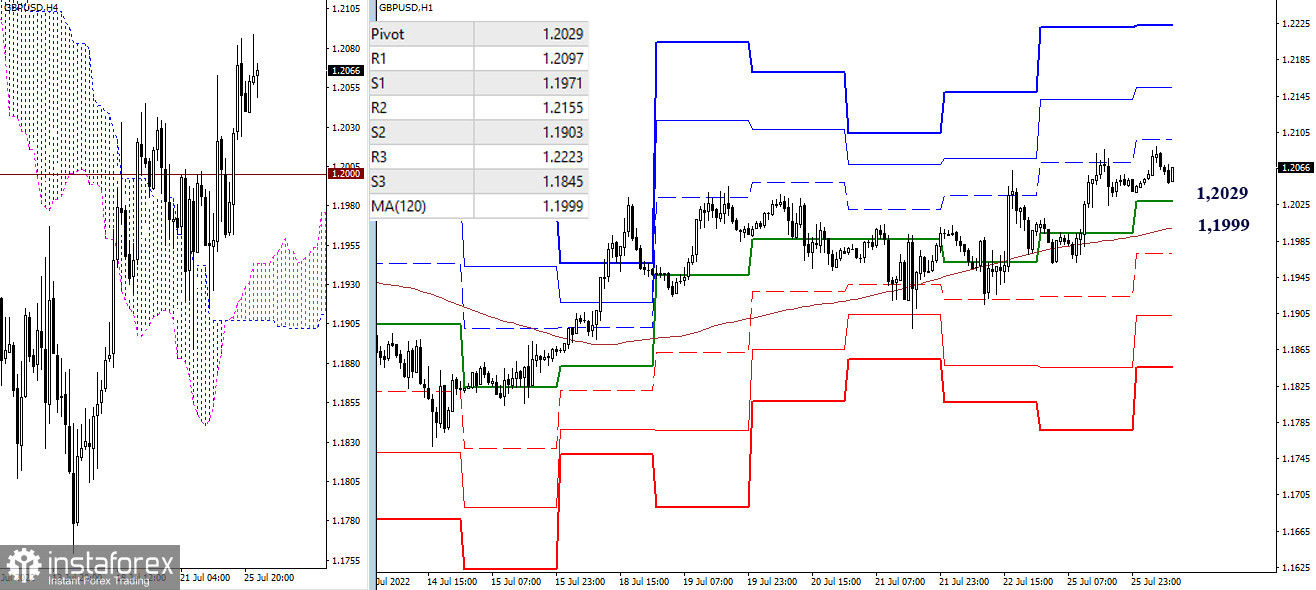

H4 – H1

On the lower timeframes, the main advantage now belongs to bulls. The reference points for the continuation of the rise within the day are the resistance of the classic pivot points (1.2097 – 1.2155 – 1.2223). The key levels responsible for changing the current balance of power are located today in the area of 1.2029 – 1.1999 (the central pivot point of the day + a weekly long-term trend). Consolidation below these levels may return bearish activity to the market. The targets for the decline, in this case, will be the support of the classic pivot points (1.1971 – 1.1903 – 1.1845).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română