Although the macroeconomic calendar was completely empty, the pound was able to continue its growth. Albeit not too much, but still noticeable. And strangely enough, the reason for this was the next debate of candidates for the post of prime minister of Great Britain. Although if you think about what exactly Sunak and Truss said, you should rather get rid of the pound than increase your investments in it. But the fact is that both candidates spoke rather sharply against China, and declared the need for a tougher policy towards China. First of all, in terms of trade relations. They say it is necessary to urgently impose restrictions on the activities of Chinese companies, and seek more favorable trading conditions. Such games with the largest economy in the world can lead to sad consequences for the United Kingdom itself. And everything looks as if the pound's growth is purely speculative.

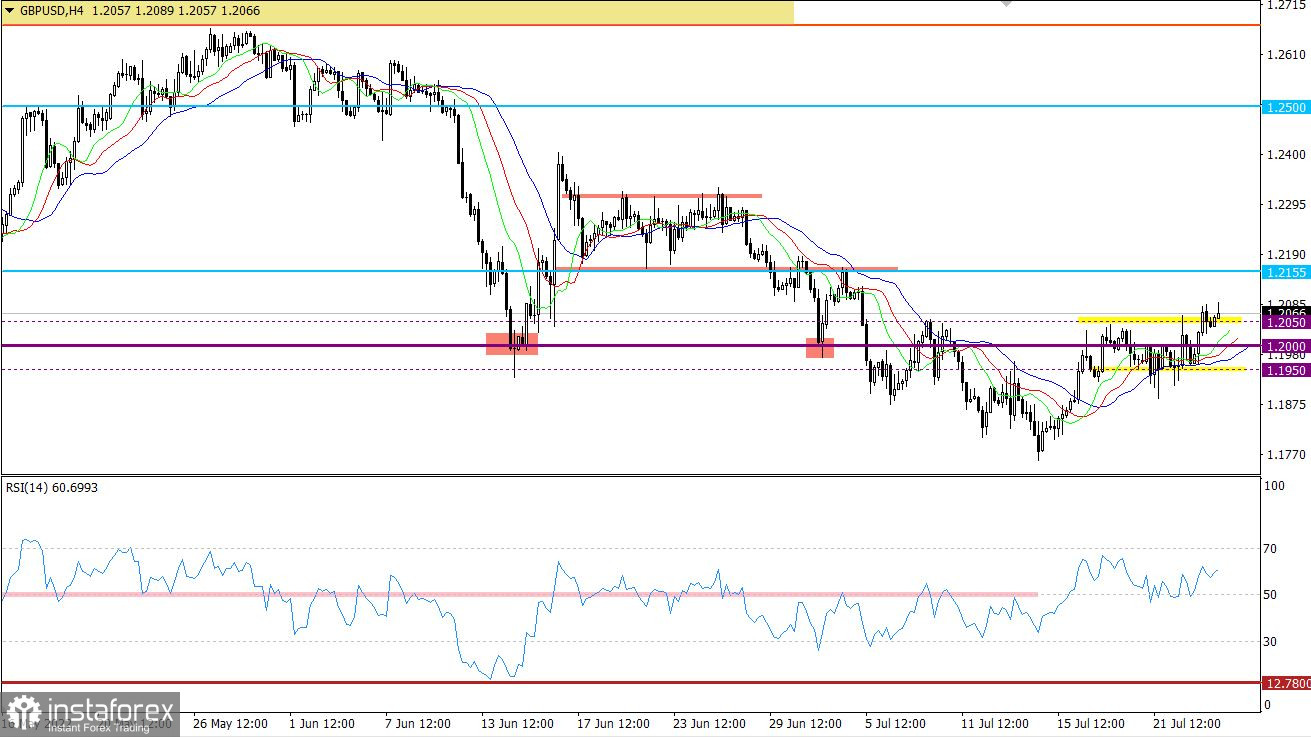

For the first time since the beginning of the month, the GBPUSD currency pair managed to stay above 1.2050. This step led to the prolongation of the current correction from the local low of the downward trend at 1.1759.

The RSI H4 technical instrument is moving in the upper area of the 50/70 indicator, which indicates the interest of traders in the upward cycle. RSI D1 is on the verge of a change in trading interest, if the indicator stays above the 50 middle line.

The moving MA lines on the Alligator H4 indicator are directed upwards, which corresponds to a corrective move. While the lines on Alligator D1 have a primary intersection between the green and red MA, which indicates a slowdown in the downward trend.

Expectations and prospects

At the moment, there is a buy signal due to the price staying above the control value. In case expectations regarding the prolongation of the correction are confirmed, the pound may strengthen in the direction of 1.2155.

The alternative scenario sees the current breakout as a bull trap. In this case, returning to the area below the level of 1.2000 will lead to the cancellation of the previously received signal.

Complex indicator analysis has a buy signal in the short-term and intraday periods due to the prolongation of the correction. Technical instruments in the medium term have a variable signal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română