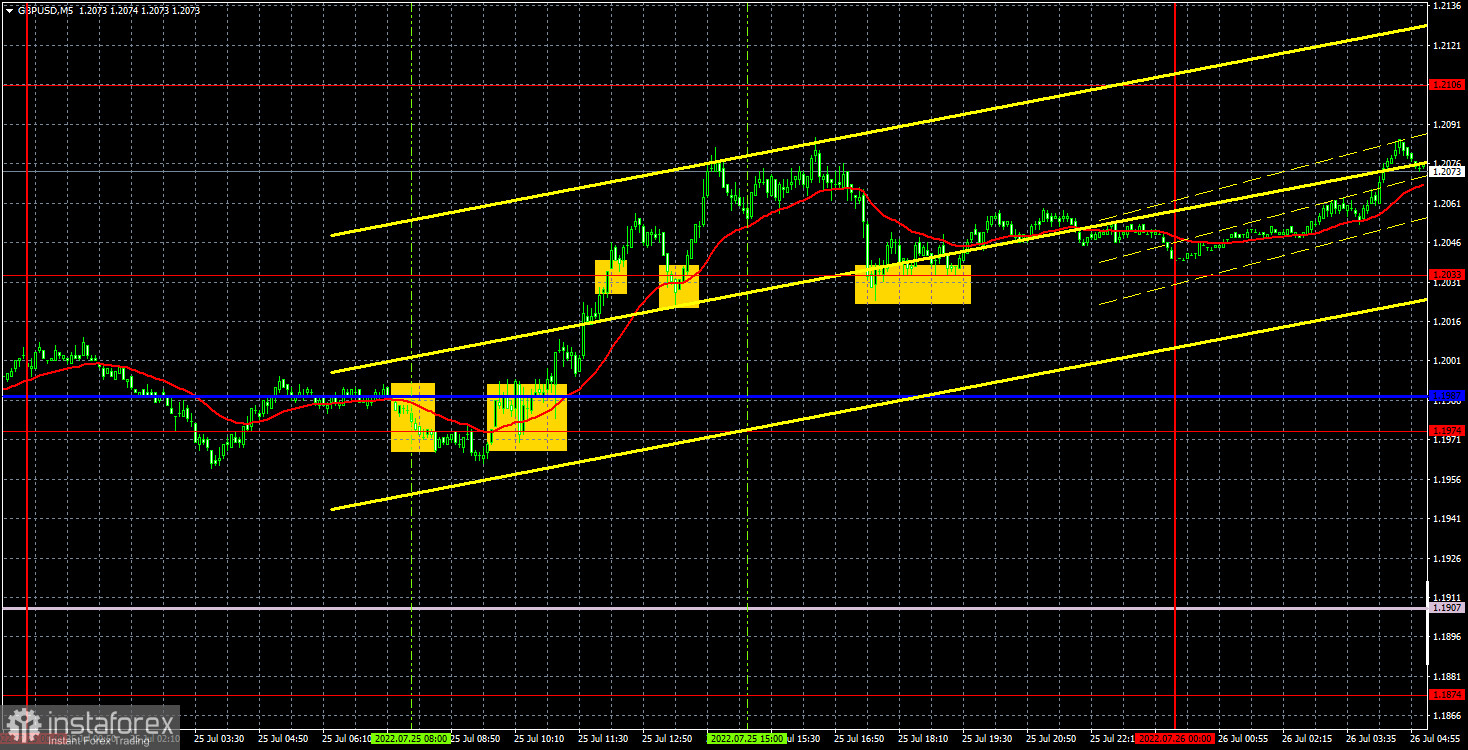

GBP/USD 5M

The GBP/USD currency pair traded even more oddly than the EUR/USD pair on Monday. Firstly, the pound and the euro have been trading almost identical lately. Secondly, it was more logical to expect a flat than a trend on Monday. However, the pound, not without facing problems, overcame the important level of 1.2033 and rose to almost 1.2106. It is rather difficult to say what provoked this movement, since there was not a single significant event in the UK on Monday either. However, traders found grounds for buying the pound, although more than a week remains before the Bank of England meeting, at which hypothetically the rate can be increased by 0.5%. It is unlikely that the market has already begun to win back the increase in the BoE rate, when the Federal Reserve meeting is held tomorrow evening. One way or another, but the pound rose and can now continue its upward movement. We have formed an ascending trend line, which shows what is happening in the market and provides certain guidelines. But at the same time, we consider the pound's growth on Monday to some extent an accident, as there are still few grounds for growth.

Since there was still a trend movement in the pound, there were more trading signals than in the euro, and they were not so bad. The first sell signal turned out to be false and it was not even possible to set Stop Loss to breakeven. However, the second signal to buy (consolidating above the critical line) turned out to be quite good and the pair went up in total 80 points, breaking 1.2033 on the way. It failed to settle below this level, to reach the target level of 1.2106. Therefore, a long position should have been closed manually in the late afternoon. Profit on it amounted to about 45 points.

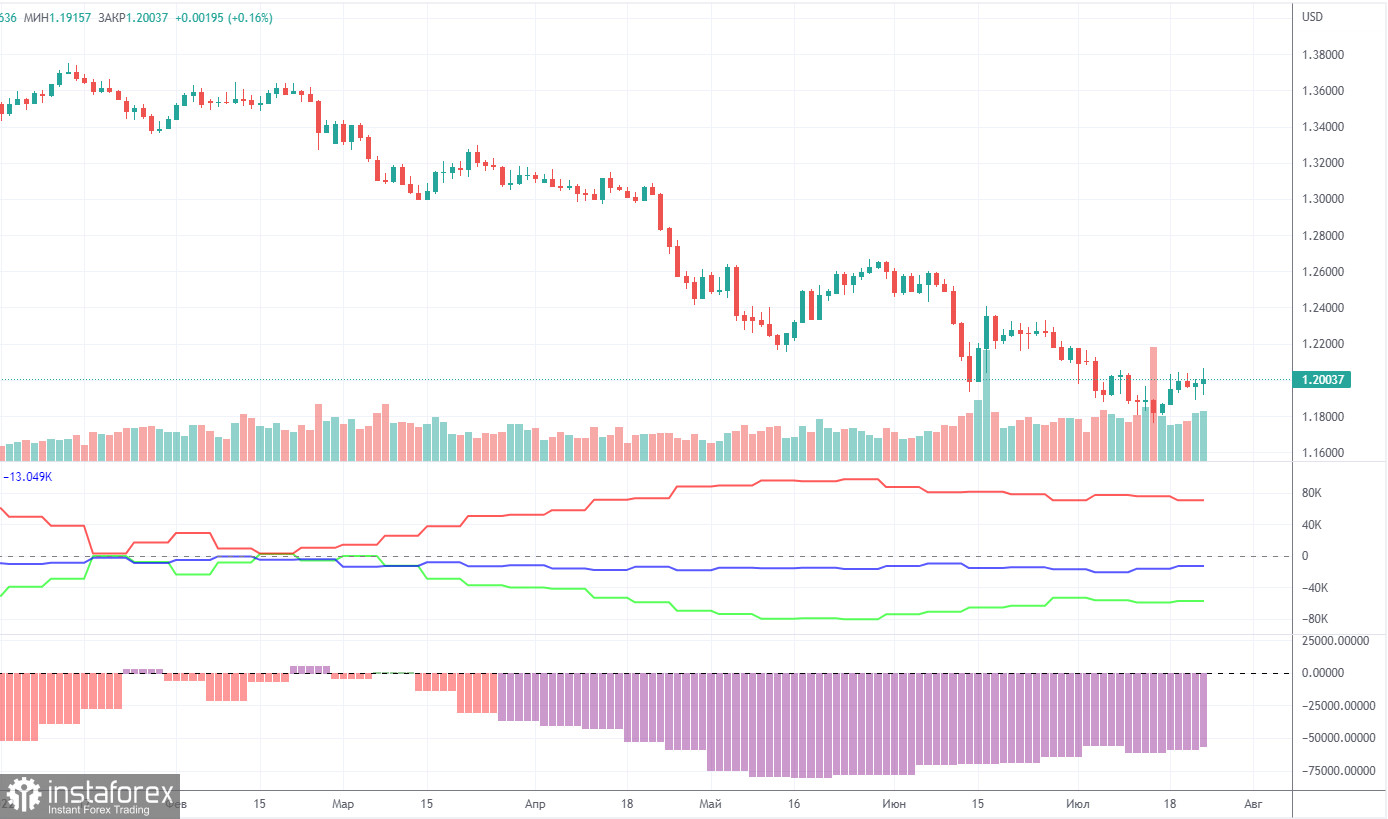

COT report:

The latest Commitment of Traders (COT) report on the British pound again showed insignificant changes. During the week, the non-commercial group closed 1,900 long positions and 3,700 short positions. Thus, the net position of non-commercial traders increased by 1,800. But what does it matter if the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above? And the pound, in spite of everything, still cannot show even a tangible upward correction? The net position has been falling for three months, now it has been slowly growing for several months, but what difference does it make if the British currency still continues to depreciate against the US dollar? We have already said that the COT reports do not take into account the demand for the dollar, which is probably still very high right now. Therefore, even for the strengthening of the British currency, the demand for it must grow faster and stronger than the demand for the dollar. The non-commercial group currently has a total of 89,000 shorts open and only 32,000 longs. The net position will have to show growth for a long time to at least equalize these figures. Neither macroeconomic statistics nor fundamental events support the UK currency. As before, we can only count on corrective growth, but we believe that in the medium term, the pound will continue to fall.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. July 26. What does the new week have in store for us?

Overview of the GBP/USD pair. July 26. The pound is trying to make the most of the last days before the Fed's 0.75% rate hike.

Forecast and trading signals for EUR/USD on July 26. Detailed analysis of the movement of the pair and trading transactions.

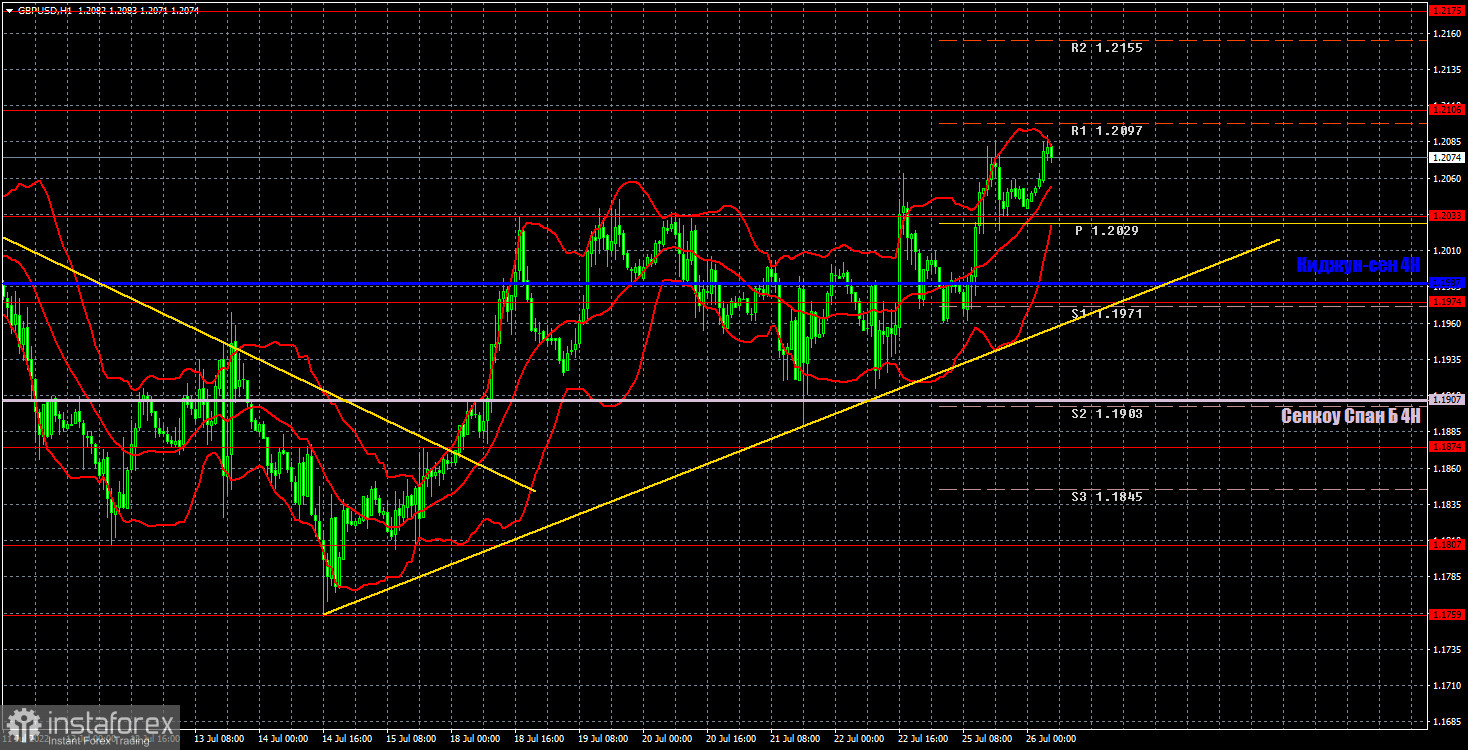

GBP/USD 1H

On the hourly timeframe, the British currency managed to do what the euro has not been able to do so far – continue to grow. Although this growth raises a huge number of questions (but from a technical point of view it is very logical), we still do not believe that the pound can continue it for a long period of time. However, now we have a trend line, so the completion of the upward move can be determined quite easily. We highlight the following important levels for July 26: 1.1807, 1.1874, 1.1974, 1.2033, 1.2106, 1.2175. The Senkou Span B (1.1907) and Kijun-sen (1.1987) lines can also be sources of signals. Signals can be "rebounds" and "breakthroughs" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. No important events are scheduled again in the UK and the US, so traders will again have nothing to react to during the day. Today we will see whether the pound's growth from yesterday was an accident or whether traders really began to believe in the British currency.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română