The USD/JPY pair shot up on Thursday, reacting to the dovish results of the Bank of Japan's July meeting. The central bank not only kept all the parameters of the monetary policy in the same form, but also traditionally voiced soft rhetoric, assuring the markets that the central bank would continue to adhere to the ultra-accommodative policy. After the announcement of the results of the July meeting, USD/JPY bulls were able to renew their weekly high, coming close to the borders of the 139th figure. However, the upward blitzkrieg broke down: latest data released on the growth of the consumer price index in Japan provided unexpected support to the yen, reflecting the growing price pressure.

Looking ahead, it must be said that the current decline in the pair is of a corrective nature: the upward trend is still in force, despite the bulls' inability to settle in the area of the 139th figure. Take a look at the weekly price chart: the pair has been consistently rising for seven weeks, rising from 127.00 to a price peak of 139.40 (July 14). That is, in a month and a half, the pair has overcome more than 1200 points. Therefore, it is not at all surprising that now we are witnessing a corrective rollback after such a protracted forced march. Moreover, the USD/JPY bears have a weighty argument for a downward rollback.

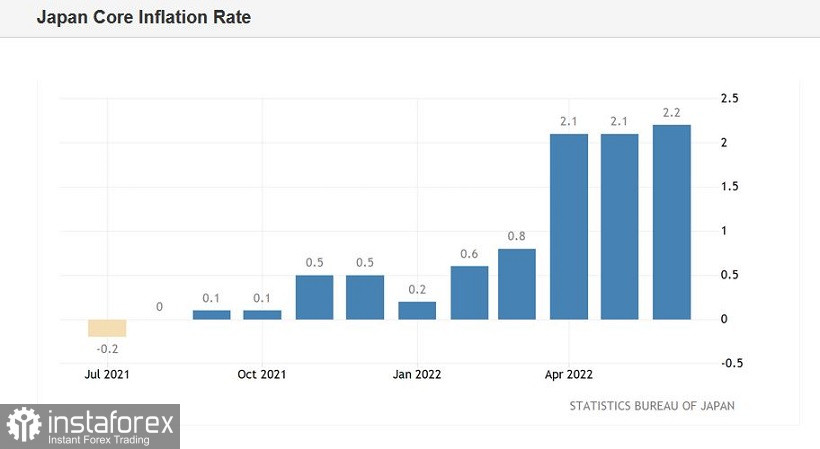

The latest release showed that consumer inflation continues to exceed the BOJ's 2% target for the third consecutive month. The overall consumer price index rose to 2.4% in June. This indicator was at the level of 2.5% in May and April. In general, this is the strongest growth rate of the indicator since November 2014. The consumer price index excluding fresh food prices (the most monitored inflation indicator by the central bank) also showed positive dynamics, rising to 2.2%. The growth rate of this indicator also became the highest since March 2015. The consumer price index, excluding food and energy prices, exceeded forecasts, rising to 1.0%, while most experts expected to see it at the May level (0.8%).

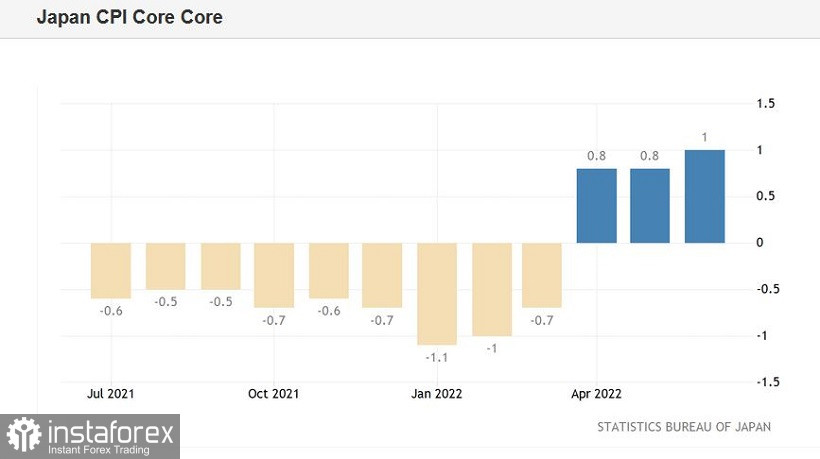

I repeat - inflation in Japan has been exceeding the central bank's target level for several months now. However, BOJ Governor Haruhiko Kuroda continues to persistently ignore this fact. Commenting on recent trends, he has repeatedly stated that the central bank needs to create conditions for "sustainable inflation" in the country's economy, while the increase in the consumer price index this year is "due to single factors, such as rising energy prices."Arguing his position, he pointed out that consumer prices, excluding food and energy, are growing at a rather weak pace. At the same time, he ignored the fact that this spring this indicator left the negative area for the first time in many months. It came out at around 0.8% in April and May, then it rose to 1.0% in June.

In other words, taking into account Kuroda's position voiced earlier, one should not expect tougher rhetoric from the Japanese central bank: the inflationary release will again be ignored by the central bank.

As a result of the July meeting, the BOJ left all parameters of monetary policy unchanged: only one member of the board of the central bank (Kataoka) voted against this decision. The BOJ decided to leave rates unchanged, and control the yield curve of 10-year bonds at 0.25%. At the same time, Kuroda repeated the mantra that the BOJ is ready to "not hesitate to take more steps to ease policy, given the impact of the pandemic on the economy."

Thus, the divergence of the positions of the Federal Reserve (which is preparing to once again raise the interest rate by at least 75 points) and the Bank of Japan will continue to push the pair up.

The current decline in the price of USD/JPY is connected not only with a rather strong release of data on the growth of Japanese inflation. The pair is also declining due to the weakening of the greenback. The PMI index for the services sector in the US, published on Friday, fell to 47 points, while the forecast was for growth to 53 points. This is the weakest result since June 2020, when strict quarantine restrictions were in effect in America. The current decline in the indicator points to an alarming deterioration in the US economy.

And yet, in my opinion, the current decline in the price of USD/JPY should be used to open long positions. All fundamental factors that are now pushing the pair down are temporary. The BOJ is likely to ignore the inflationary release, while a weak PMI in the US services sector will not stop the Fed, which is trying to curb inflation. Therefore, in the end, the divergence of the positions of the central bank will be on the side of the US currency.

Technically, the bears of the USD/JPY pair are trying to overcome the support level of 135.70 (the Kijun-sen line on the daily chart). At the same time, the price overcame the price barrier at 136.70 (the middle line of Bollinger Bands on the same timeframe). In my opinion, you can open longs when the price returns to 136.70: in this case, the path to the main resistance level of 139.00 (the upper line of the Bollinger Bands on D1) will be open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română