US stock futures are rising weakly amid choppy trading as investors analyze a series of high-profile second-quarter earnings, looking for clues about the impact of high inflation on companies. Bonds have also surged.

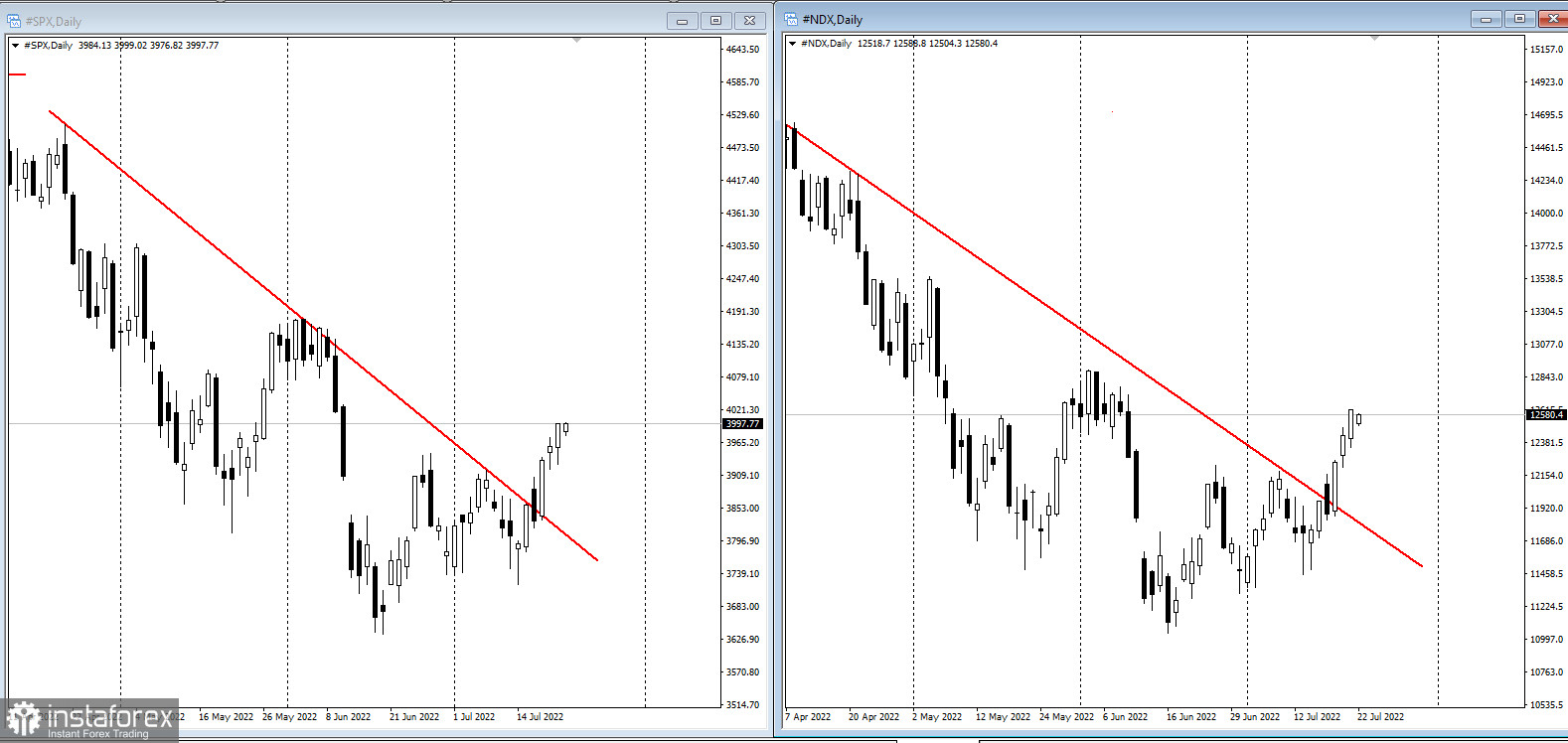

Contracts on the tech-heavy Nasdaq 100 slumped by about 0.3% under pressure from Snap Inc.'s poor results. Futures on the S&P 500 fell from session lows after American Express Co. reported record earnings and raised full-year forecasts.

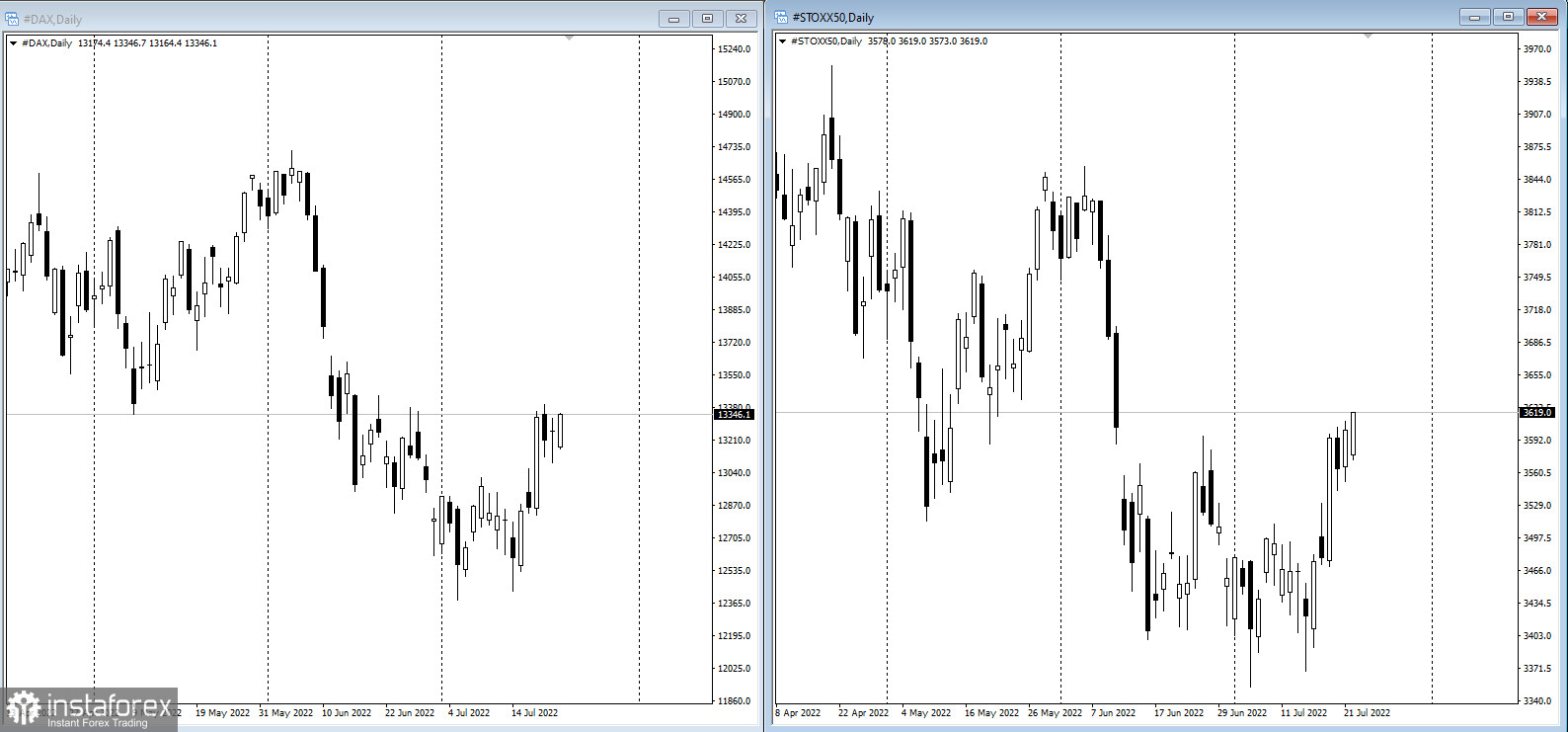

The Stoxx50 index added 0.6%, closing the week in positive territory.

- Twitter Inc. fell in premarket trading after the company reported disappointing second-quarter results.

- Verizon Communications Inc. plunged sharply after failing to estimate earnings and cut forecast.

- AT&T Inc. fell the most in 20 years after cutting its forecast for free cash flow this year.

- Shares in HCA Healthcare Inc. soared.

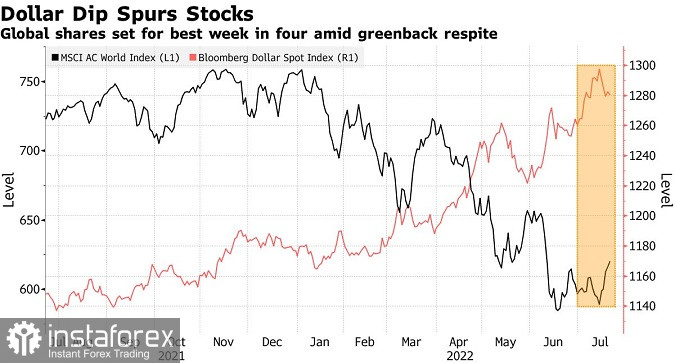

Global stocks remain on course for their best week in a month, paring this year's equity market rout to about 18%. Speculation that the worst of the selloff has passed is partly behind the move. Angst about the damage from inflation and rapidly rising interest rates is proving hard to shake, despite a tempering in expectations of just how aggressive the Federal Reserve will be.

"It's still very early days but we've seen numerous cases now of earnings surprises driven by the 'it's not as bad as we feared' argument," Craig Erlam, a senior market analyst at Oanda, said. "That's a relief of course, but surely not a case for a sustainable rebound."

Underscoring recession fears, Treasuries extended an advance, pushing the 10-year yield to around 2.8%. Meanwhile, German short-term bonds soared as investors trimmed bets on European Central Bank rate hikes after weaker-than-expected PMI data in the region fanned fears of a recession. US PMIs are due at 9:45 a.m.

The focus will now be on next week's Fed meeting. The central bank is expected to raise interest rates again to curb soaring inflation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română