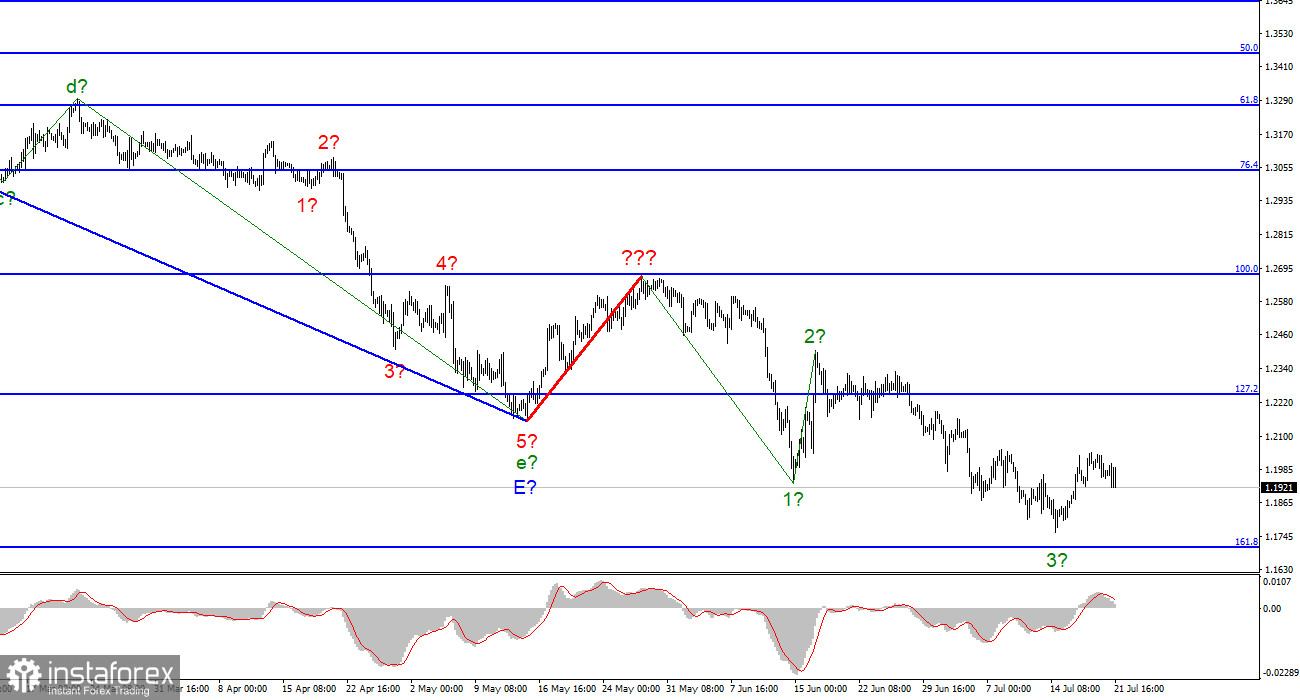

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. Now that waves 1 and 2 have been completed, we may infer that the instrument is in the process of constructing wave 3. However, this wave proved unconvincing (if finished at this time), as its low is not significantly lower than wave 1's low. Consequently, the current downturn cannot be characterized as impulsive, but it may be a complex correction. Focus on the wave marking of the EUR/USD instrument in this regard.

The British no longer have any economic news, but there are others.

The pound and dollar exchange rates declined by 75 basis points on July 21. Although there was no news context for the pound today, it mimicked the euro's actions practically verbatim, which I find pretty odd. The conclusions of the ECB meeting were summarized today in the European Union, and President Christine Lagarde will deliver a speech shortly. Consequently, the sharp and significant euro swings do not raise any concerns. But why did the pound move with the same sharpness and vigor? The question remains open. The most significant reports of the week have already been released in the United Kingdom. Tomorrow, there will be a retail trade report, which is less significant than reports on inflation or unemployment. Nonetheless, there is additional news from Scotland.

Edinburgh has not abandoned the notion of holding a referendum, but it wants to hold a consultative referendum first, for which it must also receive authorization from London. The Scottish National Party, led by Nicola Sturgeon, who promised the Scots a referendum by the end of 2023 but was unable to secure authorization, petitioned the Supreme Court of Great Britain to explain the difficulty of obtaining permission from London. According to reports, if the Supreme Court declines, Sturgeon would push the issue of a referendum to the 2024 general election. In this event, the SNP will make independence from the United Kingdom the central issue in the upcoming election. Therefore, Edinburgh will not forsake the independence referendum, and a change in the British Prime Minister could work in his favor. Boris Johnson categorically rejected any referendum, noting that a referendum had already been held in 2014, and the majority of Scots voted in favor of a union between the United Kingdom and Scotland. But perhaps the incoming Prime Minister will alter the situation.

General observations.

The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8 percent Fibonacci. Now, there is a prospect of an upward wave forming, but I do not anticipate it to be robust and protracted.

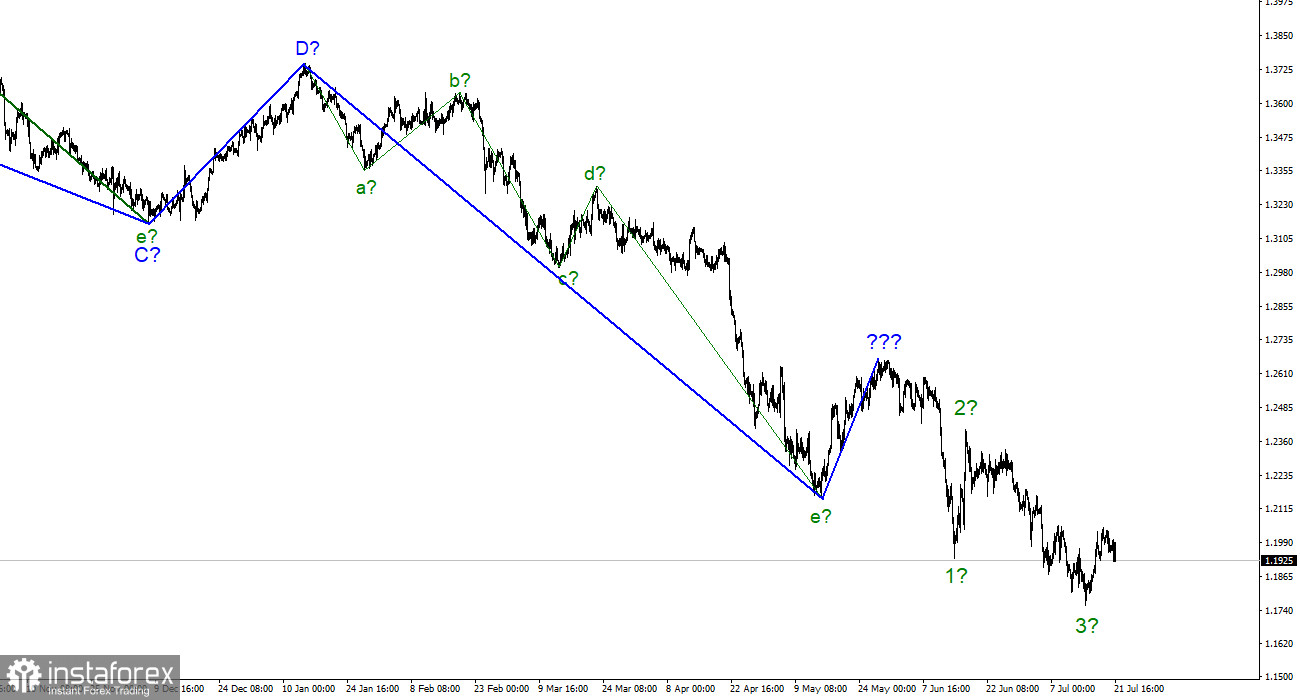

At the higher wave scale, the image closely resembles the euro/dollar instrument. The same ascending wave does not conform to the present wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach practically any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română