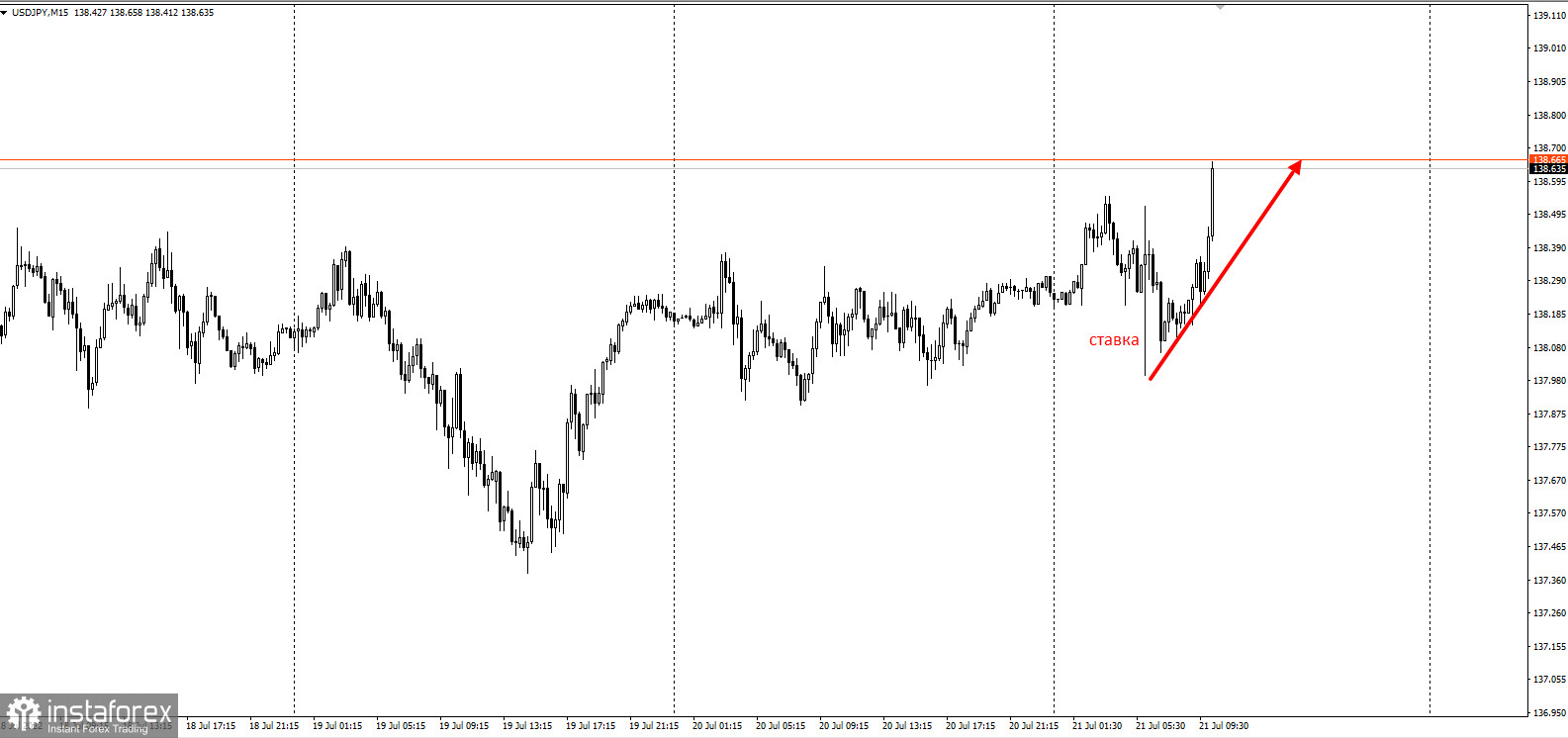

The Bank of Japan pushed yen to a multi-decade low (and USD/JPY to its highest) when it announced that they will keep interest rates unchanged and conduct daily operations to ensure a near-zero target for 10-year bond yields.

However, this decision will exacerbate the global yield divergence that has sent yen to its lowest level since the early 1970s.

The Bank of Japan believes that Japan's core economy is too fragile to tighten monetary policy, but this could upset politicians and the public as a weak yen drives up the price of imported goods.

"The BOJ didn't just reaffirm its dovish stance. It doubled down on its defense of yield curve control by committing to daily purchases [of bonds], effectively strengthening the policy divergence narrative," said Benjamin Shatil, FX strategist at JPMorgan.

Unsurprisingly, many industries and companies view yen's decline as negative, speculating that further decrease will trigger verbal intervention so as to prevent too-steep and too-sudden drop

But analysts are wondering if authorities would make such an effort, given the low likelihood of success. Mansoor Mohi-uddin, chief economist of the Bank of Singapore, said the BOJ is unlikely to change its dovish stance until Haruhiko Kuroda retires in April 2023.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română