On Wednesday, the GBP/USD currency pair likewise tested one of the Murray levels and then paused near it, failing to surpass it. The startling parallelism of the euro and pound's moves. In addition, a downward movement began in the afternoon, and the entire upward corrective appeared to be highly feeble at the time. However, there is one element that brings the entire analysis into question. Why have the euro and the pound continued to move in tandem this week? Recall that the ECB meeting results will be released today. Euro traders could begin preparing for this incident "in advance" at the start of the week. Then the rise of the European currency appears sensible and logical. But why was the pound simultaneously rising?

Additionally, inflation data for the EU and the United Kingdom were released on Tuesday and Wednesday. Again, it would make sense for the euro to exhibit an increase on Tuesday and the pound to do so on Wednesday. But both pairs have continued to behave identically in recent times. The volatility was essentially identical. Therefore, we can presume that it has nothing to do with macroeconomic statistics. The market eventually grew weary of dumping European currencies and realized a modest profit.

For this reason, we witnessed a move away from 20-year and 2-year lows, while macroeconomics played a supporting role. Today, we shall know whether this is true, as a reaction will inevitably follow the ECB meeting, but if the pound is traded similarly to the euro, then our hypothesis may be proven. The pound continues to trade near its local lows. On the 24-hour TF, it is crystal evident that the present correction is not even visible, regardless of how ridiculous that statement may sound. Therefore, the pound cannot currently rely on anything globally.

Kemi Badenoch is withdrawing from the election.

We were returning to the topic of the election of the new leader of the Conservative Party and Prime Minister of the United Kingdom. The previous day, the second round of voting took place, and Kemi Badenoch had the fewest votes (59) and was therefore eliminated from the competition. Former Finance Minister Rishi Sunak received 118 votes and also won this round. Penny Mordaunt got 92 votes, and Liz Truss got 86. As predicted, Rishi Sunak will secure one of the two positions in the final voting, while Penny Mordaunt or Liz Truss will secure the other. We believe Liz Truss will advance to the final round. The final preliminary voting round was scheduled to occur last night, and its results will be disclosed today. After that, the British Parliament will adjourn for the summer, and the final round, in which all 160 thousand Conservative Party members will vote, will take place in August. On September 5, the new Prime Minister's official announcement will occur.

Andrew Bailey, the chairman of the Bank of England, also delivered a speech on Tuesday evening. In his speech, he stated that the central bank's next meeting would explore the potential for an immediate 0.5% increase in the key rate. In essence, we have already discussed this, as 0.25 percent does not provide any results — inflation has been and continues to increase. Bailey reaffirmed that restoring inflation to 2% is the key objective of the British central bank. He added that the decision has not yet been made, as it will be determined by the votes of all nine monetary committee members.

In turn, we can assume that a favorable decision will be reached. Three members already supported an increase of 0.5% at the previous meeting. In light of yesterday's release of a new inflation report indicating an acceleration of the consumer price index, there is no doubt that the Bank of England will become considerably more active. The initiative to reduce the central bank's balance sheet by selling off securities acquired under the QE program will also be reviewed at the meeting in early August. That is, a scheme identical to the one the Fed has already begun to implement. This program's implementation can begin in September.

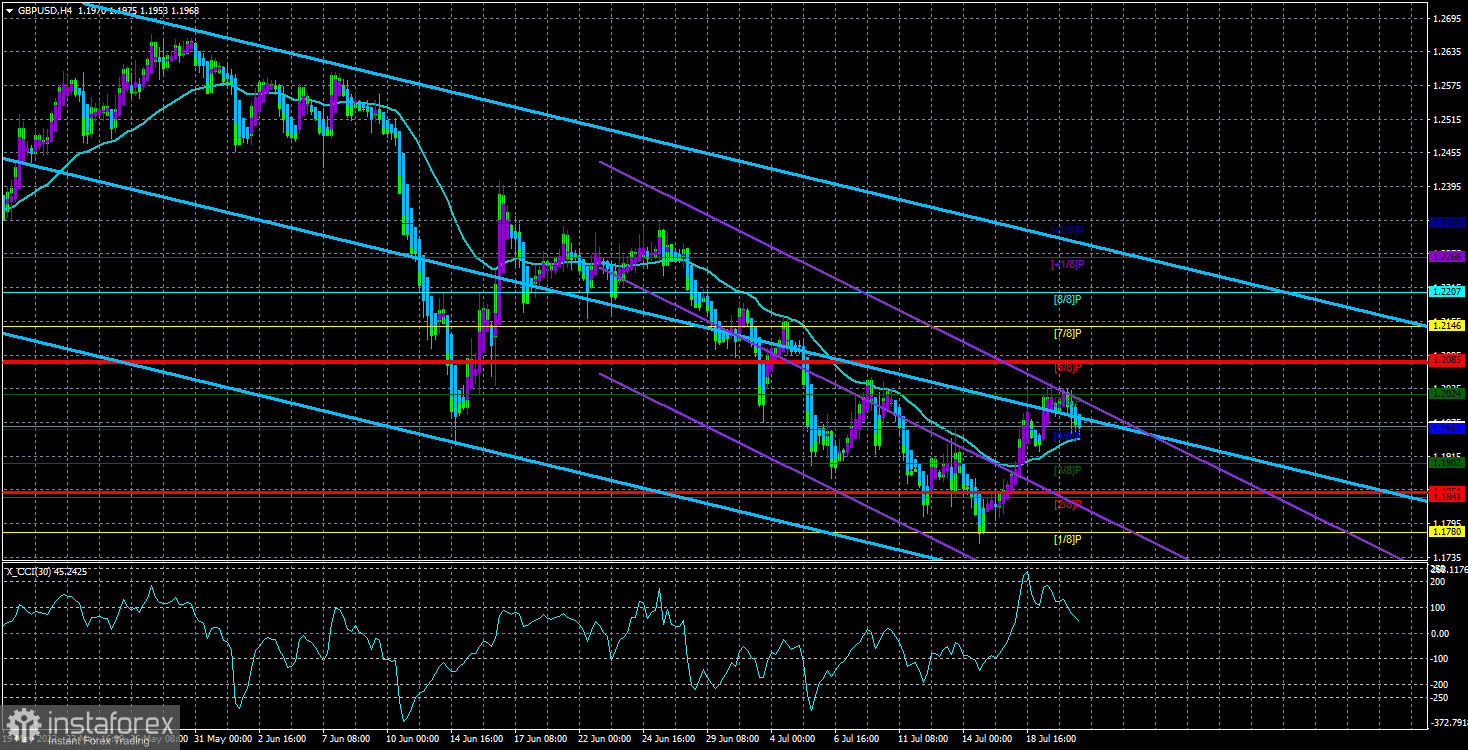

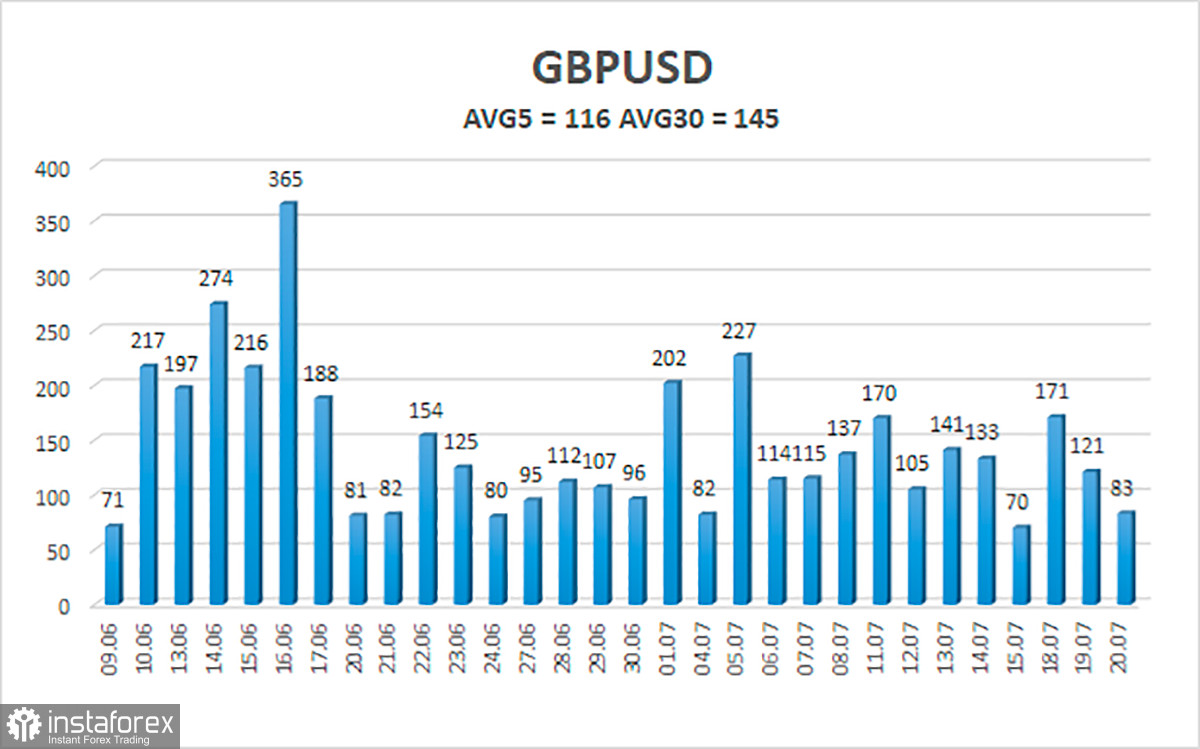

116 points is the average volatility of the GBP/USD pair over the last five trading days. This value for the pound/dollar combination is "high." Therefore, we anticipate interchannel volatility on Thursday, July 21, limited by the levels of 1.1851 and 1.2083. A reversal of the Heiken Ashi indicator to the upside may imply a continuation of the upward trend.

Nearest support levels:

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest resistance levels:

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

On the 4-hour time frame, the GBP/USD pair remains in an upward trend. Therefore, additional buy orders with targets of 1.2024 and 1.2083 should be considered if the Heiken Ashi indicator reverses to the upside. Open sell orders should be positioned between 1.1902 and 1.1852 below the moving average.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română