The EUR/USD currency pair reached the Murray level of "4/8"-1.0254 on Wednesday but could not surpass it. The second half of the trading day was marked by a sharp decline, and it now appears that the European currency's upward trend has ended. Recall that the ECB meeting results will be released today. In anticipation of a rate hike by the ECB, traders might purchase the euro currency "in advance" during the first half of the week. However, when it occurs, i.e., today, there may be a backlash. Also, we should not overlook the corrective character of the pair's rise this week since there were not always explicit reasons for the increase. The pair has generally recovered from its 20-year lows, but it is unlikely to initiate a new upward trend. In any event, though, conclusions will need to be reached no earlier than Friday, given the potential for a lengthy and intense reaction.Considering the entire situation, a single hike in the ECB rate, even by 0.5%, has little effect. Although inflation in the EU is slightly lower than in the United States and the United Kingdom, it is still quite high. As the ECB is just beginning to raise the main rate, it is unlikely that price growth rates will decelerate over the next few months. The Fed may increase its interest rate to 2.5% next week. Thus, the underlying environment, which was favorable to the US dollar, will continue to be favorable. Based on this, we anticipate that the pair's downward trend will continue.

ECB meeting: what can we anticipate?

In general, there is no extra intrigue preceding the release of the meeting's results. Everyone is already aware that the interest rate will be increased by such a negligible amount that the market might not even notice. It should also be noted that the current deposit rate is -0.5 percent. In other words, a rise of 0.25 percent would result in a negative exchange rate. We would also want to remind you that a negative deposit rate is a stimulative measure because when you invest in bank deposits, you pay the bank to store your capital, not the other way around. This strategy is intended to divert capital flows to the current sector of the economy. It turns out that this measure will retain its effectiveness.

Increasing the basic rate to 0.25 percent has no special significance. Ultimately, it should be realized that the rate increase is justified. If there were no significant inflation, then few individuals would be engaged in monetary policy tightening at this time. The global economy has recently "moved away" from two years of pandemics, lockdowns, and quarantines, and an increase in the rate will reduce economic growth at its source. Increasing the rate is, therefore, an essential measure. However, it must be hiked significantly and persistently so that inflation returns to 2 percent. Like the Fed, is the ECB prepared for a full cycle of rate hikes? From our perspective, no. We expect the ECB will occasionally boost interest rates, as its primary objective is to preserve sluggish economic development and not to combat inflation. However, under pressure from the public (high price increases) and the central banks of the EU's member states, the ECB can no longer pretend inflation problems do not bother it. Therefore, a similarly forceful strategy as the Fed's should be disregarded. The bid will be increased for display only.

Given the above, it makes no difference whether the rate will be increased by 0.25 percent or by 0.5 percent today. The euro currency will stay in an adverse position from the perspective of the "foundation" in any circumstance. In that case, its decline might continue at any moment. Additionally, it would be best if you considered the technical picture. On a 24-hour timescale, for instance, the weakness of the present upward corrective and all past similar corrections are evident. In other words, the euro currency has become accustomed to changing by 300-400 points in recent months and even years, and this is plenty. Consequently, the euro/dollar pair may continue its decline immediately.

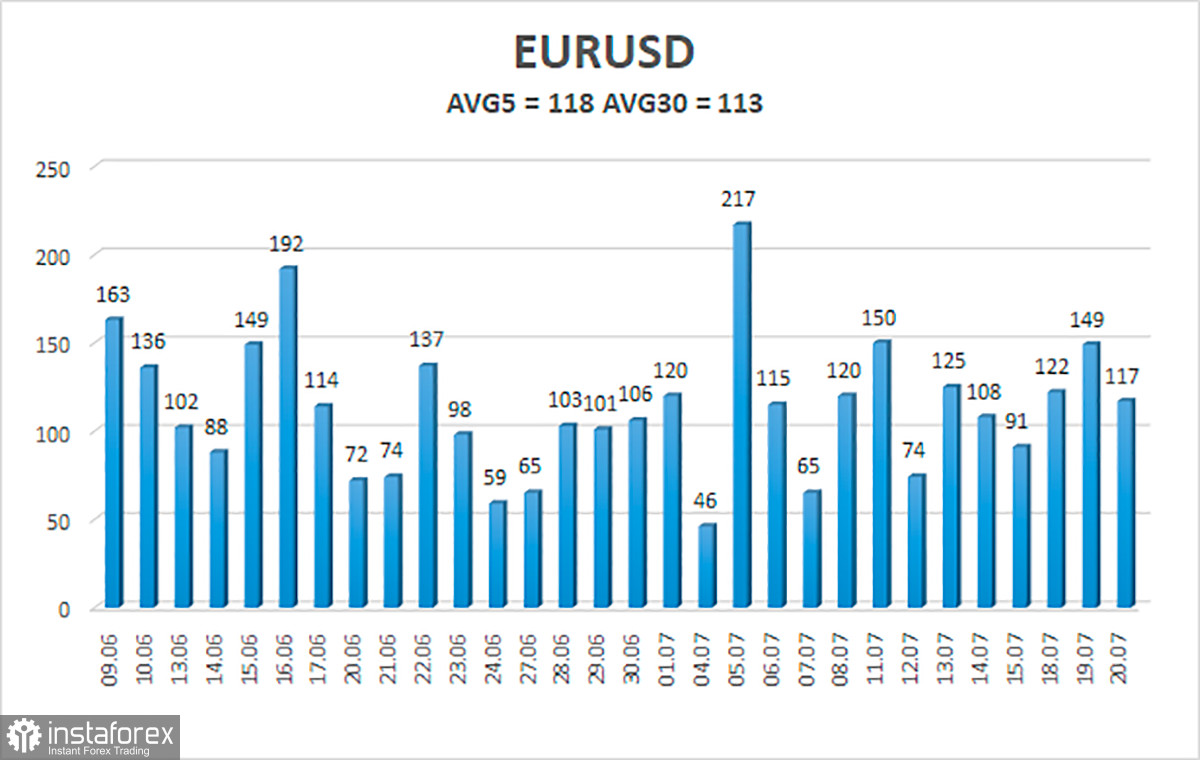

As of July 21, the average volatility of the euro/dollar currency pair over the previous five trading days was 118 points, which is considered "high." Thus, we anticipate the pair to trade between 1.0056 and 1.0293 today. A likely continuation of the upward trend will be signaled by the reversal of the Heiken Ashi indicator back to the top.

Nearest support levels:

S1 – 1.0132

S2 – 1.0010

S3 – 0.9888

Nearest resistance levels:

R1 – 1.0254

R2 – 1.0376

R3 – 1.0498

Trading Recommendations:

The EUR/USD currency pair has begun a new phase of adjustment. Consequently, we should now explore additional long positions with goals of 1.0254 and 1.0293 if the Heiken Ashi indicator reverses to the upside. Selling will regain importance when the pair is anchored below the moving average with targets of 1.0056 and 1.0010.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română