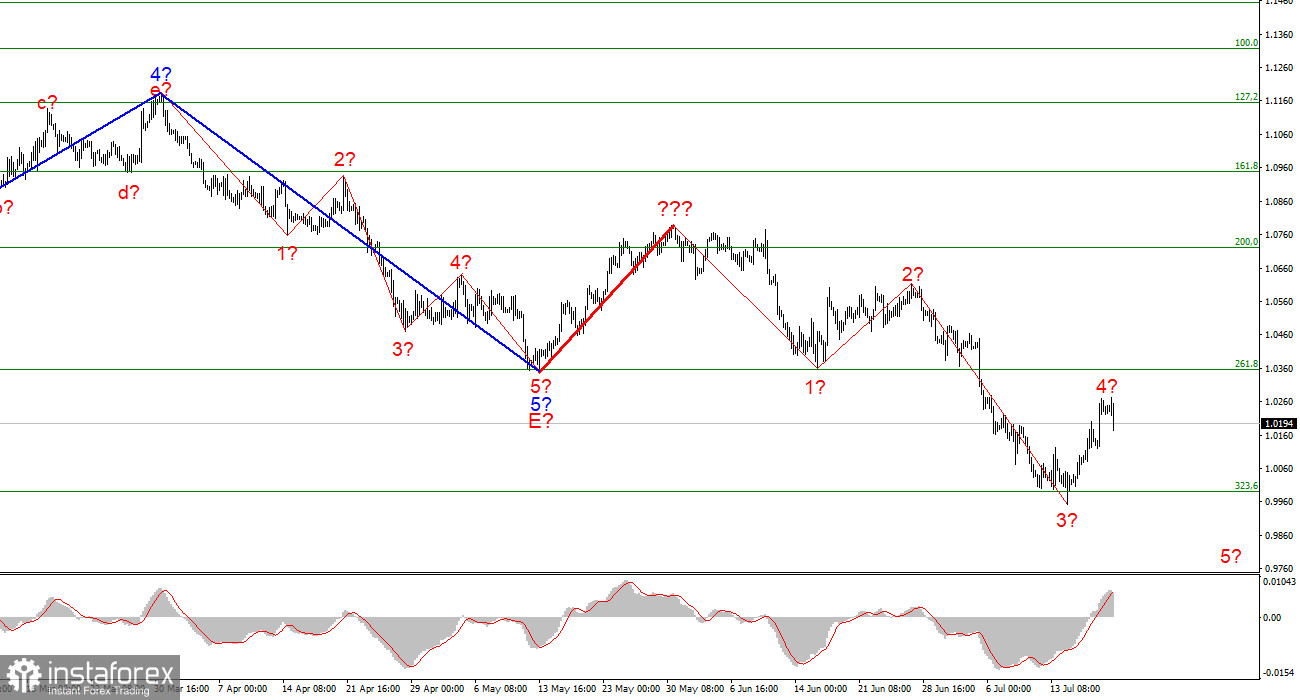

A few weeks ago, the wave markings on the 4-hour chart for the euro/dollar instrument got more complex and no longer had a holistic appearance. There was a successful attempt to break through the 261.8 percent Fibonacci level, which was also the low of the waves E and b; hence, these waves are no longer E and b. Thus, I have constructed a new wave markup that does not yet account for the ascending wave indicated by a bold red line. I've already stated that the entire wave structure can be complicated indefinitely. This is the drawback of wave analysis, as any structure is always capable of assuming a more complicated and extensive shape.

Consequently, I propose to now focus on simpler wave structures, including waves of a smaller scale. As shown, the creation of an upward wave, which may be wave 4 of a new downward trend section, is proceeding. If this estimate is accurate, the instrument might gain another 100-150 basis points before resuming its slide within wave 5 with objectives below 1.0000. Additionally, the development of the fifth wave may have already begun. So far, I see no reason to anticipate additional instrument moves.

Tomorrow, the ECB meeting will take place.

On Wednesday, the euro/dollar instrument declined 20 basis points. The steep decrease was lightning-fast, despite the absence of news context for the instrument on this day. The market can only await tomorrow's announcement of the outcome of the ECB meeting. Today's market activity is weaker than Tuesday's and Monday's. The desire for risk has diminished slightly.

Nevertheless, it is difficult to predict what will occur tomorrow. The market appears to have accounted for all possible changes to the ECB's monetary policy this week. Since more than a month ago, it has been known that the rate will be increased at the July meeting. Thus, there was ample time to implement this solution into the instrument's existing course. And the market may not respond to the decisions Christine Lagarde will reveal tomorrow.

Taking a little longer-term perspective, I believe that at this time, we should rely on wave analysis. I see no solid reason for the euro currency to cease falling at this time. The wave identification of the last descending segment of the trend raises no difficulties, and the absence of the final impulse wave is evident. Naturally, we could see a spike in the price of the instrument tomorrow since the market's reaction to such a significant event as a central bank meeting cannot be predicted. The entire downward segment of the trend may no longer be characterized as impulsive after wave 4 assumes a more drawn-out form and possibly surpasses the bottom of wave 1. However, this has not occurred thus far; I anticipate a 300-400 basis point decline in the instrument.

General observations.

I infer based on my findings that construction of the downward trend segment continues. Consequently, it is now viable to sell the instrument with goals near the predicted mark of 0.9397, which corresponds to 423.6 percent Fibonacci, for each "down" MACD signal, based on the building of wave 5. Wave 4 may have already concluded, but market sentiment and the internal wave structure of the current trend section may undergo a minor shift on Thursday.

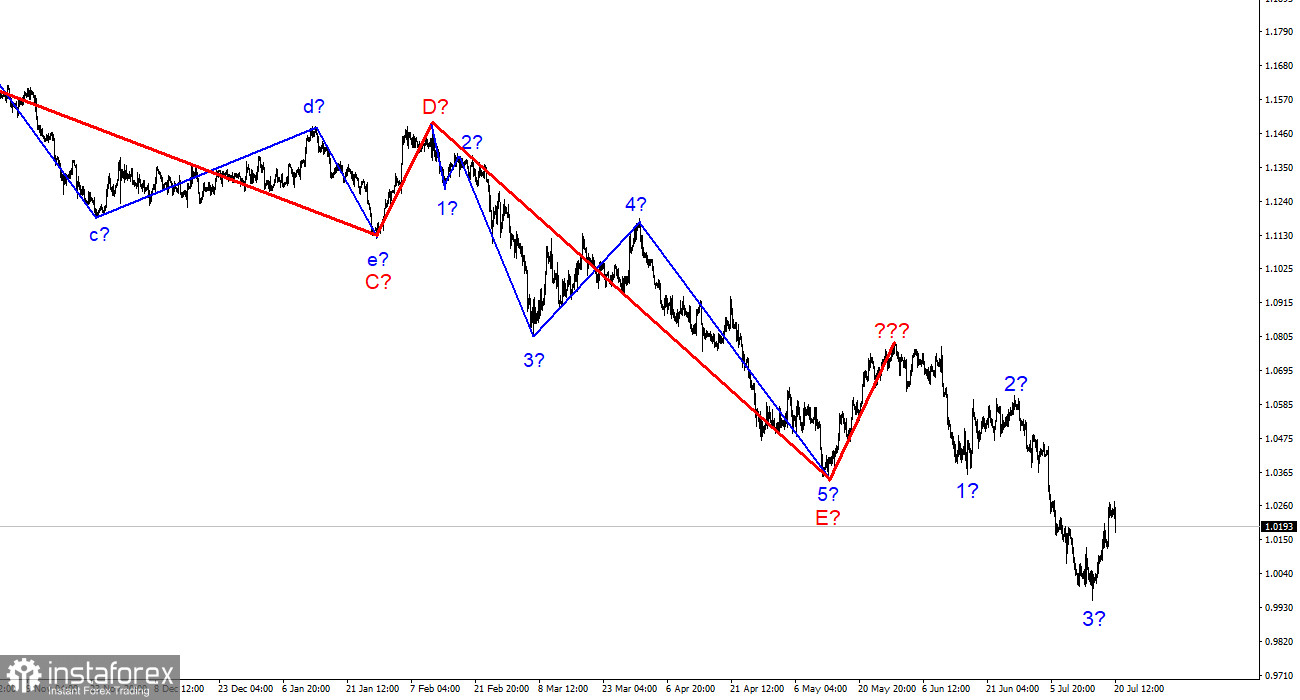

At the larger wave size, the wave marking of the descending trend segment becomes considerably more complex and extends in length. It can assume virtually any length, so I believe it is best to focus on three-and five-wave conventional wave shapes for the time being.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română