The pound sterling failed to hold on to 1.2030 following yesterday's labor market report, indicating that unlike the euro, market players are unwilling to go long on GBP even at its current price, despite its weak upward correction. The latest hot inflation data put additional pressure on GBP bulls today.

Earlier, Andrew Bailey, the Governor of the Bank of England, stated that policymakers are ready to increase interest rates faster if necessary to bring inflation under control. The latest statistic data clearly suggests the UK regulator will tighten its monetary policy even further.

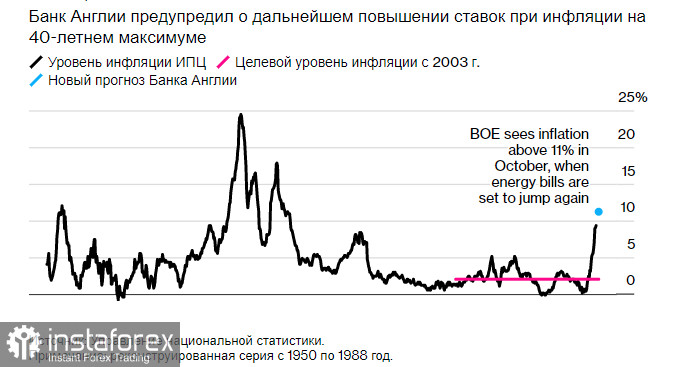

"Bringing inflation back down to the 2% target sustainably is our job, no ifs or buts," the BoE Governor said. "We want people to see that there are more options on the table than another 25 basis points," he added.According to the latest inflation data, which was released today, consumer prices in the UK increased by 9.4% year-over-year, the biggest increase since February 1982. Prices accelerated from 9.1% in May due to a 9.3% increase in fuel prices, the Office for National Statistics said.

At this point, wages obviously cannot catch up to inflation. Furthermore, inflation is expected to surpass 11% in October due to rising energy prices, bringing more pain to households. Real wages have decreased by 2.8%, leading to strikes in the UK. Workers are pushing trade unions to make employers raise wages, which in turn boosts inflation. The Bank of England is concerned that the current situation could lead to a wage-price spiral. Taking into account increased inflationary expectations and an overheated labor market, the UK regulator will likely pursue a more hawkish course and hike interest rates by 50 basis points in August.

Falling purchasing power of consumers is now beginning to undermine economic growth, weighing down on its recovery after the pandemic. There is now speculation that the Treasury is set to increase public sector pay by 5%, well above the 3% mark suggested earlier. Private sector pay rose by 7.2% on average over the past 3 months.

Besides the energy sector, prices are rising in the other sectors of the UK economy, such as hospitality. Restaurants and accommodation rose by 8.6% y/y, up from 7.6% in May. Prices of food and non-alcoholic beverages surged by 9.8% from a year ago, the biggest such increase since March 2009.

The core CPI, which excludes prices of food, beverages, tobacco, and energy, increased by 5.8% y/y in June.

Until recently, the Bank of England made small steps in its effort to return the interest rate to its 2009 level. However, surging inflation will likely force the BoE's Monetary Policy Committee to impose more aggressive policy measures at its meeting on August 4. A half percentage point hike is already priced in by the market, so this move is unlikely to give support to GBP/USD's upward correction.

GBP corrected slightly after the data release and failed to break above the weekly high. The pair must break through the resistance at 1.2030 to rise further in these conditions. From there, it could surge into the 1.2080 area, where bulls would face greater difficulty. If GBP/USD rises even higher, it could hit 1.2120 and 1.2160. If bears push the pair below 1.1940, it would open the way towards 1.1900. A breakout below that range would send the pair towards the low at 1.1810.

The lengthy upward correction of EUR/USD towards 1.0200 seems to be coming to an end. With the Fed policy meeting in sight, a more significant uptrend is unlikely – it is unknown how the FOMC board members will act during the meeting. It would take quite an effort for bulls to regain 1.0200, which would extend the correction. If EUR/USD settles at 1.0200, it could then move higher towards 1.0270 and 1.0340. If the pair sinks below 1.0120, it could then fall towards 1.0080. A breakout below 1.0080 would put additional pressure on the instrument, allowing the pair to test 1.0040.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română