Following a brief adjustment, the GBP/USD currency pair continued its upward march on Tuesday but was considerably weaker than the EUR/USD combination. In principle, this is understandable since the European currency is waiting for the ECB meeting this week, and yesterday an important report on inflation in the EU was also published. The British pound did not have such important macroeconomic data yesterday, and important events are not looming on the horizon. Therefore, the expansion of the British pound was much more modest. But why was it there at all? On the one hand, this is a rather stupid question since the pair cannot constantly move in one direction, and the current growth is not strong enough to sound the alarm. On the other hand, it is evident why the euro currency was increasing, but why was the pound growing simultaneously? We can explain this movement simply by the necessity to modify it from time to time. Bears, who have been selling off the pair for a long time, take profits from time to time. Accordingly, the volume of short positions diminishes on such occasions, and a countertrend movement begins. That's the complete reason.

The broad fundamental foundation for the British currency also remains not the worst, given the Bank of England has already raised the key rate five times and may raise it for the sixth time in early August. There are no such concerns with gas and oil as the European Union in the UK. Of course, there are difficulties, such as another political crisis, the "Northern Ireland Protocol," a probable trade war with the EU, the "Scottish" issue, and many others. But these are all problems for the future. Now they do not affect the mobility of the pair.

Tom Tugendhat leaves the electoral race

As stated previously, the election of a new prime minister in the United Kingdom is a matter "for the future." The change in Conservative leadership is unlikely to impose pressure or support on the British pound. Nonetheless, a great deal also depends on who becomes the new economic leader. For instance, Rishi Sunak, who has served as finance minister for a considerable time, will be the most desirable candidate for the economy. However, many criticize his lack of leadership characteristics and international political expertise. A two-edged sword. In any case, Rishi Sunak also won the third round of elections, garnering 115 votes from his fellow party members of the legislature. Penny Mordaunt received 82 votes from colleagues, followed by Liz Truss with 71 and Kemi Badenoch with 58. Consequently, there is no doubt that Rishi Sunak will advance to the final round. The second winner may be Liz Truss or Penny Mordaunt, however.

We continue to feel that a probable winner could change in the last round of elections. In reality, all about 160 thousand members of the Conservative Party will participate in the final round of voting. Thus, Rishi Sunak's leadership can be quickly lost. Two additional rounds are scheduled this week, after which only two candidates will remain.The British pound has no choice but to continue to await the release of today's inflation report and the Bank of England's August meeting. If the British regulator increases the rate by 0.5%, the pound may finally be supported. Otherwise, the market can revert to the pair's sales. Regarding the inflation statistics, there is no question that it will continue to rise, despite the five rate increases. Currently, the United States is experiencing a similar situation.

Regarding monetary policy, it appears that the ECB is not taking such a failed stance since the rate of inflation growth makes little difference. With or without an increase in bids? Perhaps the ECB is similarly waiting for inflation to stop rising before implementing a rate increase.

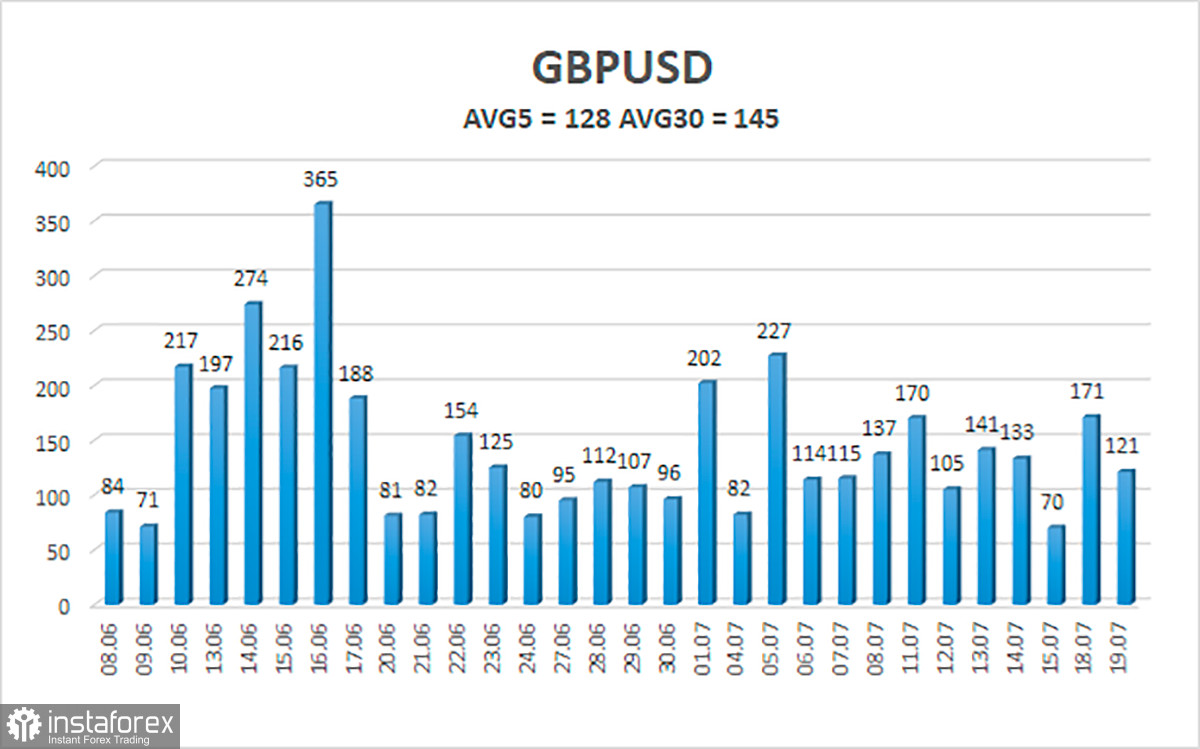

The average five-day volatility of the GBP/USD pair is 128 points. This value for the pound/dollar pair is high. On Wednesday, July 20, we anticipate activity within the channel, bounded by 1.1892 and 1.2149. The downward reversion of the Heiken Ashi indicator indicates a potential reversal of the corrective movement.

Nearest support levels:

S1 – 1.1963;

S2 – 1.1902;

S3 – 1.1841.

Nearest resistance levels:

R1 – 1.2024;

R2 – 1.2085;

R3 – 1.2146.

The GBP/USD pair has surpassed the moving average in the 4-hour timeframe and is continuing its upward trend. You should thus maintain purchase orders with goals of 1.2085 and 1.2146 until the Heiken Ashi indicator turns bearish. Open sell orders should be placed with targets of 1.1841 and 1.1771 below the moving average.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the current trend is strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction;

Murray levels - movement and correction target levels;

Volatility levels (red lines) represent the price channel in which the pair is anticipated to trade tomorrow, based on current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română