Analysis of Tuesday's deals:

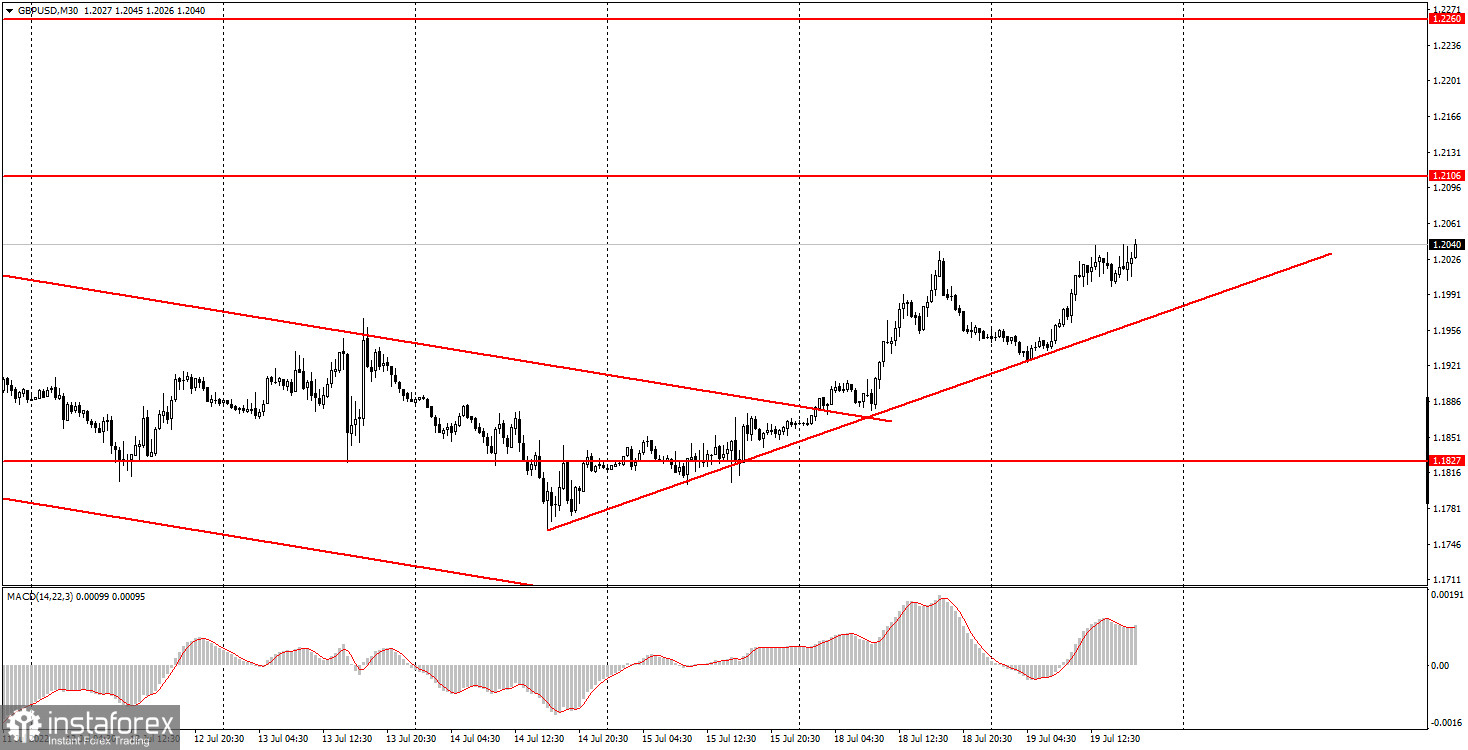

30M chart of the GBP/USD pair

The GBP/USD pair also continued its upward movement on Tuesday, but less strong than the EUR/USD pair. An ascending trend line was also formed along three reference points. However, this trend line is weaker than the one for the euro. In any case, the euro and the pound are trading very similarly, so overcoming one trend line will most likely mean the fall of both pairs. Thus, the British currency is still fully enjoying the given chance for growth, but how long it will continue is an open question. Today's British statistics did not provide any support to the pound, but did not provoke shorts either. The unemployment rate remained unchanged in June, while wages grew weaker than expected. Both reports ended up being extremely tasteless and should have caused the pound to fall rather than rise. However, following the general trend of the weakening of the US currency, the pound/dollar pair still continued its upward movement. The most important inflation report will be released in Britain on Wednesday, after which it will be possible to draw certain conclusions.

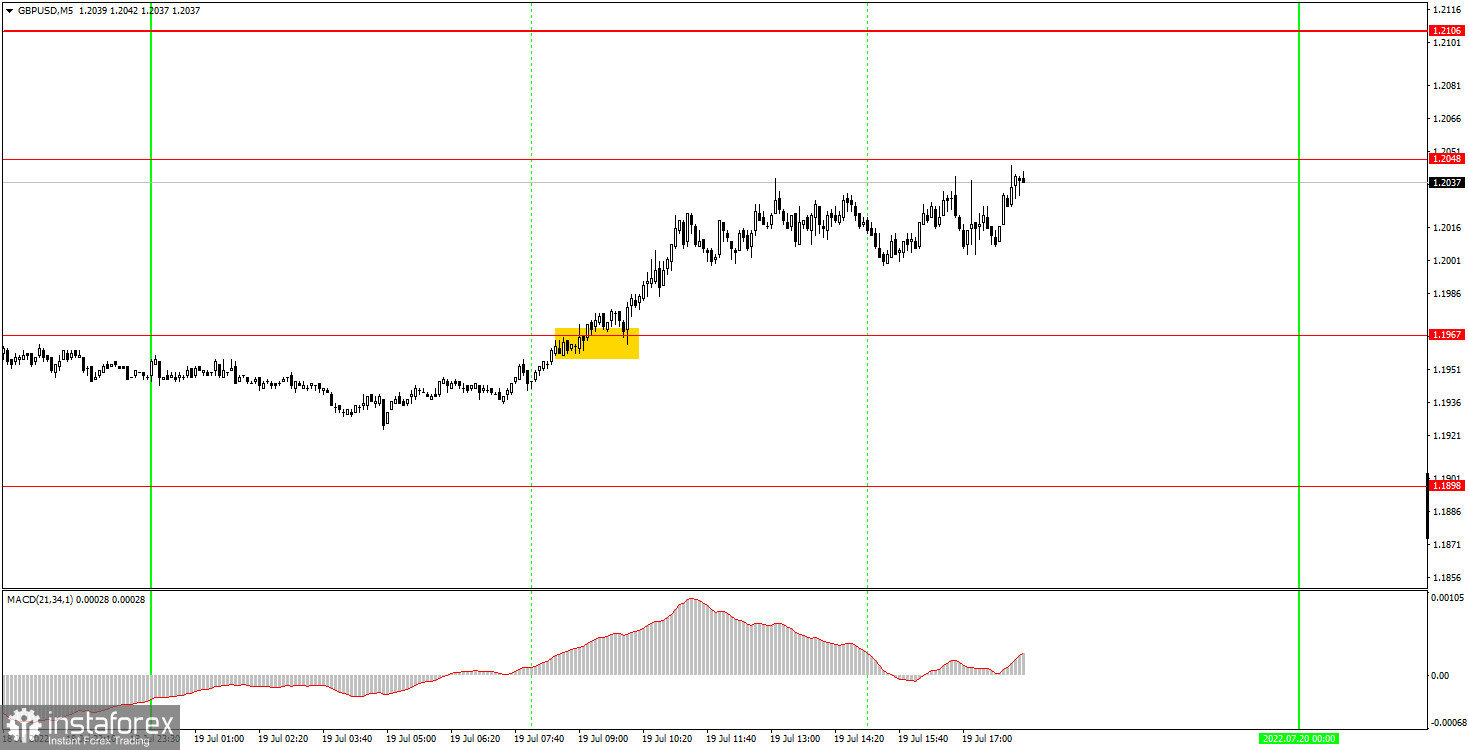

5M chart of the GBP/USD pair

The movement and signals on the 5-minute timeframe on Tuesday were also almost perfect. The pair moved only in one direction all day, and only one trading signal was formed. The pair overcame the level of 1.1967 at the beginning of the European trading session, after which it managed to rise almost to the target level of 1.2048, only three points short of it. However, this shortfall can be considered a "rebound with an error." Therefore, a long position should have been closed on this sell signal. Profit on a long position was about 50 points. Clearly, it was not necessary to work out the sell signal, since it was formed too late in time. Thus, one signal, one trade, profit - a perfect trading day. We can only hope that there are more days like this.

How to trade on Wednesday:

The pair continues its upward movement on the 30-minute TF, which is already supported by the trend line. Thus, for now, the pound has a good chance of growth, although it is growing slightly weaker than the euro. However, if the inflation report fails again today, this could trigger an increase in the upward movement, as it will mean an increase in the likelihood of a stronger tightening of monetary policy by the Bank of England at the next meeting, which will be held in early August. On the 5-minute TF on Wednesday it is recommended to trade at the levels 1.1807-1.1827, 1.1898, 1.1967, 1.2048, 1.2106, 1.2170. When the price passes after opening a deal in the right direction for 20 points, Stop Loss should be set to breakeven. The UK inflation report will be released on Wednesday, and the calendar of events in the US is completely empty. Thus, early in the morning, traders will receive momentum for the whole day. Of course, this momentum will not be related to the euro/dollar pair, but there were no reasons for the growth of the British currency on Tuesday either, nevertheless, we saw its new strengthening.

Basic rules of the trading system:

1) The signal strength is calculated by the time it took to form the signal (bounce or overcome the level). The less time it took, the stronger the signal.

2) If two or more deals were opened near a certain level based on false signals (which did not trigger Take Profit or the nearest target level), then all subsequent signals from this level should be ignored.

3) In a flat, any pair can form a lot of false signals or not form them at all. But in any case, at the first signs of a flat, it is better to stop trading.

4) Trade deals are opened in the time period between the beginning of the European session and until the middle of the US one, when all deals must be closed manually.

5) On the 30-minute TF, using signals from the MACD indicator, you can trade only if there is good volatility and a trend, which is confirmed by a trend line or a trend channel.

6) If two levels are located too close to each other (from 5 to 15 points), then they should be considered as an area of support or resistance.

On the chart:

Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now.

The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines).

Important speeches and reports (always contained in the news calendar) can greatly influence the movement of a currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română