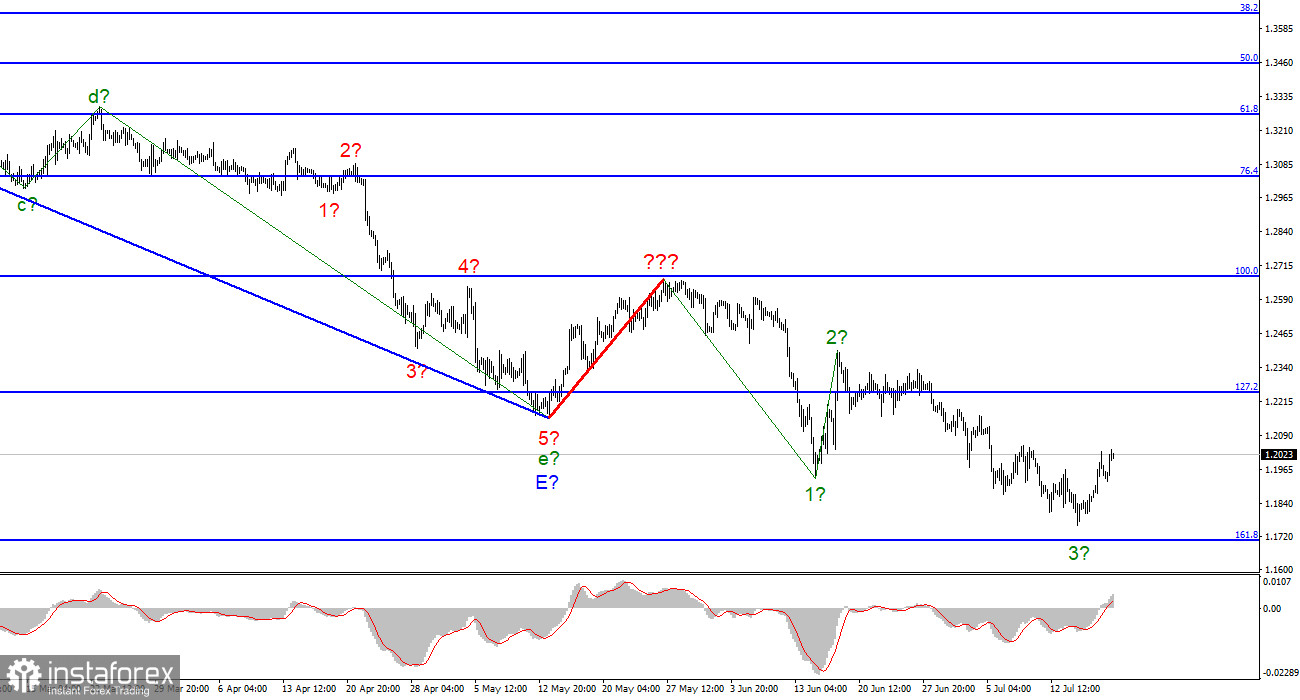

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. It would be far more practical to recognize rare corrective waves, after which new impulse structures will be built. Now that waves 1 and 2 have been completed, we may infer that the instrument is in the process of constructing wave 3. However, this wave proved unconvincing (if finished now), as its low is not significantly lower than wave 1's low. Consequently, the current downturn cannot be characterized as impulsive, but it may be a complex correction. Focus on the wave marking of the EUR/USD instrument in this regard.

The unemployment rate remained steady in the United Kingdom.

The exchange rate between the pound and the dollar jumped by 80 basis points on July 19. The demand for the British pound continues to rise, which is positive news. However, the current wave pattern indicates a decline in the instrument. Thus, the British pound's rise may be temporary. Several reports were released in Britain today that may have bolstered the pound but did not. The unemployment rate ended up being completely neutral at 3.8%. The 6.2% increase in salaries, including bonuses, fell short of market forecasts. The increase in wages, excluding bonuses, was in line with market estimates, at 4.3%. Consequently, none of the three reports revealed values exceeding expectations. Therefore, the British pound has increased far less today than the euro.

Andrew Bailey, Governor of the Bank of England, will also deliver a speech tonight. In two weeks, there will be a meeting of the Bank of England at which the interest rate is set to rise for the sixth consecutive time. The only question is its growth rate. And Andrew Bailey may provide the market with a response to this query. If he does, we will not have to wait long for a response. However, I believe Bailey will remain silent so as not to agitate the market prematurely. In addition, the rate decision has not yet been made, and the Bank of England can raise it by either 25 or 50 basis points. A report on inflation in the United Kingdom will be revealed tomorrow, which may provide insight into what to expect from the British regulator. If it turns out that inflation is on the rise once more, the Bank of England will have to consider a 50-point hike all at once. Several members of the PEPP committee voted for a 50-point hike at their most recent meeting. I believe the likelihood of this scenario occurring at the next meeting is even greater than the likelihood of a 25-point hike.

General observations.

The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8 percent Fibonacci. Now, there is a prospect of an upward wave forming, but I do not anticipate it to be robust and protracted.

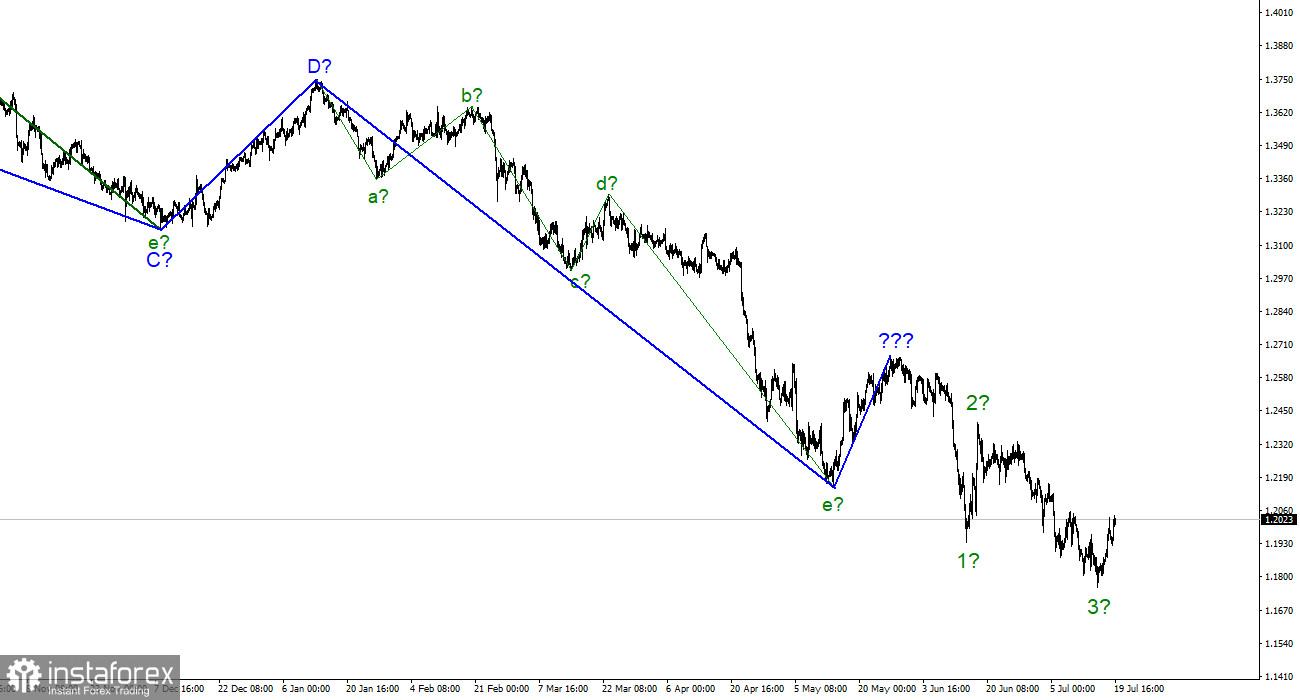

At the higher wave scale, the image closely resembles the euro/dollar instrument. The same ascending wave does not conform to the present wave pattern followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach practically any length.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română