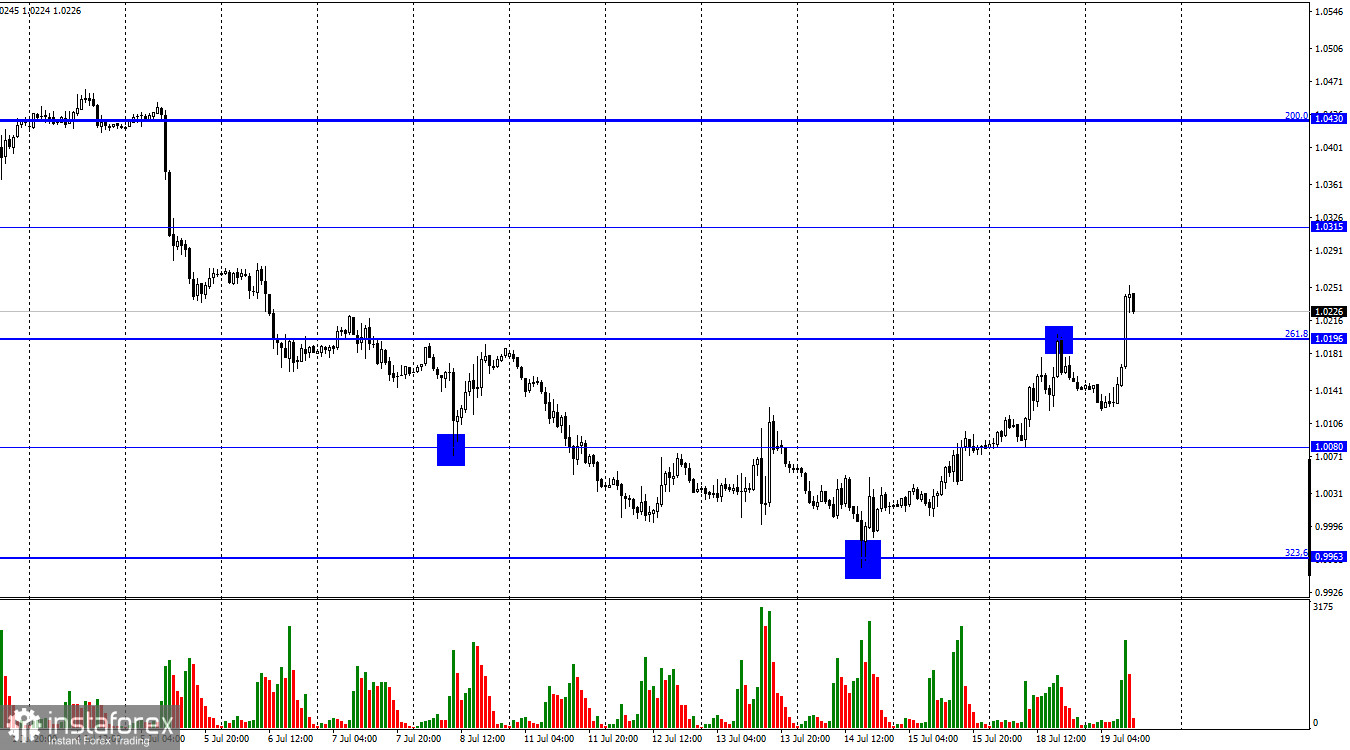

Good afternoon, dear traders! On Monday, the EUR/USD pair made an upward reversal to the correction level of 261.8% - 1.0196. Shortly after, it retreated. Many traders assumed that the euro would not rise higher. However, today, it resumed an upward movement, climbing above the Fibo level of 261.8%. Personally, I was confused by such price fluctuations as the EU inflation report was due to be released in the afternoon. So, it was quite wise to expect speculators to wait for this report and only then begin to actively trade. However, the situation was the opposite. The euro rose significantly and only then the report was unveiled. Traders no longer knew what to do next. The report turned out to be rather controversial. Inflation accelerated to 8.6% in annual terms in June, which was in line with forecasts. It means that there should be no market reaction at all. Yet, there was no reaction as the euro grew before the publication of the report. At the same time inflation jumped to 8.6% from 8.1%. It would also be strange to ignore such an increase.

A new rise in inflation hardly surprised anyone. Investors could be caught off guard by a surge in consumer prices in the United States as the Fed is raising key rates aggressively. The ECB has not hiked the interest rate. However, it is expected to tighten monetary policy for the first time this week. The odds that the ECB will raise the key rate by 0.50% instead of 0.25% are high. Many traders are betting on such a scenario. Therefore, an upward movement of the euro this week is justified. However, there are some "buts". Now, it is better to wait for the ECB's key rate decision. I believe that if the regulator does not hike the rate by more than 0.25%, the euro may resume a downward movement again.

On the 4-hour chart, the pair performed an upward reversal, having consolidated above the correction level of 127.2% - 1.0173. It may keep rising along the upper line of the descending channel. It means that the market sentiment remains bearish. There are also no divergences in any indicator today. The euro is likely to cement its upward movement only after consolidation over the descending channel.

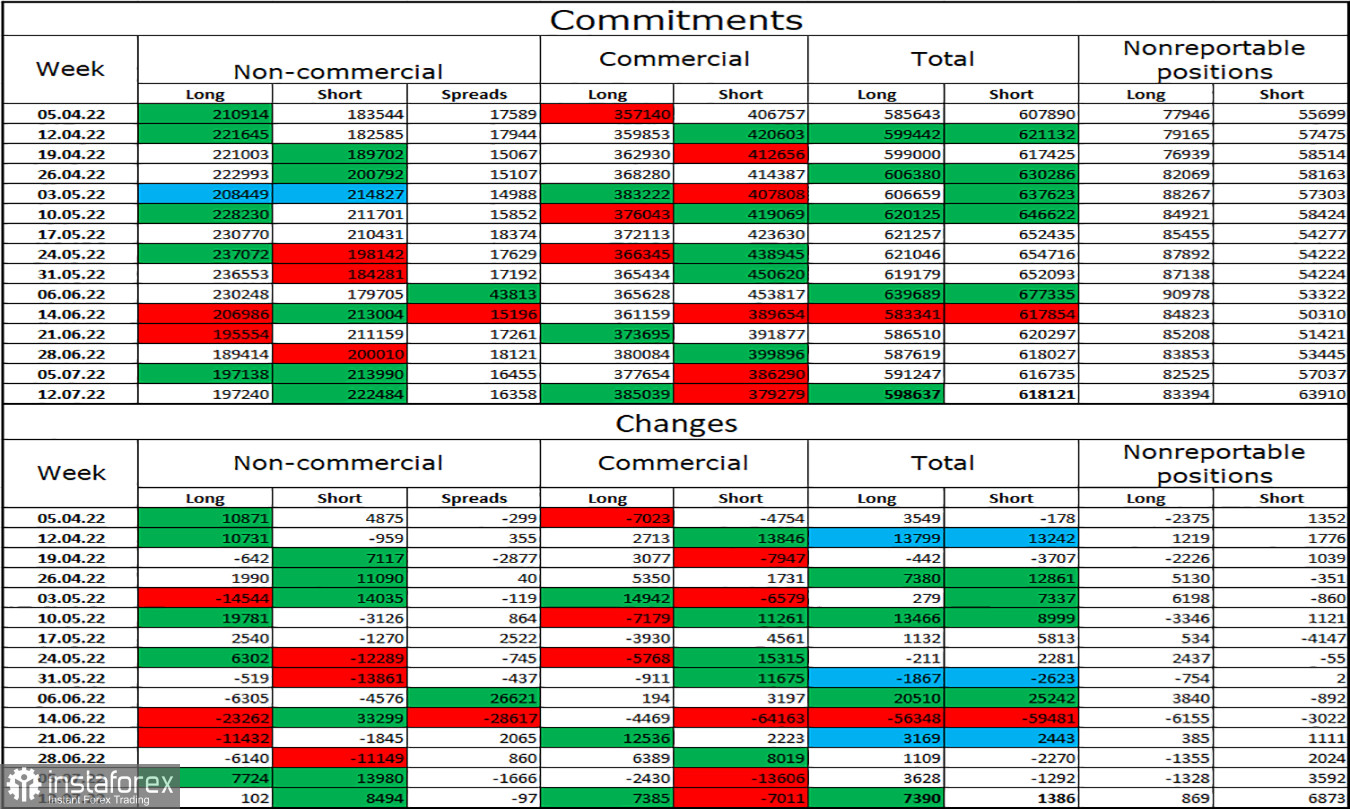

Commitments of Traders (COT):

Last week, speculators opened 102 Long contracts and 8,494 Short ones. It indicates that the bearish sentiment has intensified again. The total number of Long contracts is now 197,000 and the number of Short contracts totals 222,000. The difference between these figures is not too big but it shows that the bulls are not in control. In recent months, "Non-commercial" traders have remained bullish on the euro. Nevertheless, it did not support the euro. In the last few weeks, the euro has been gradually growing. Yet, recent COT reports have shown that a new wave of sell-off may take place as the mood of speculators has changed from bullish to bearish. Investors are now witnessing a trend reversal.

The economic calendar for the US and the EU:

EU- Consumer Price Index (CPI), 09:00 UTC.

US – Building permits, 12:30 UTC.

On July 19, the economic calendar for the European Union and the United States is almost empty. The Us and the EU will unveil one report each. The inflation report has already been revealed. Building permits data will be unveiled soon. I believe that the influence of fundamental factors on the market sentiment will be insignificant in the second half of the day.

Outlook and trading recommendations for EUR/USD:

It is better to open short positions if the pair bounces from the upper line of the descending channel on the 4H chart or from any level on the 1H chart aiming at the next levels. It is recommended to open long positions if the euro consolidates above the upward channel on a 4H chart with the prospect of a rise to the target level of 1.0638.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română