When to go long on EUR/USD:

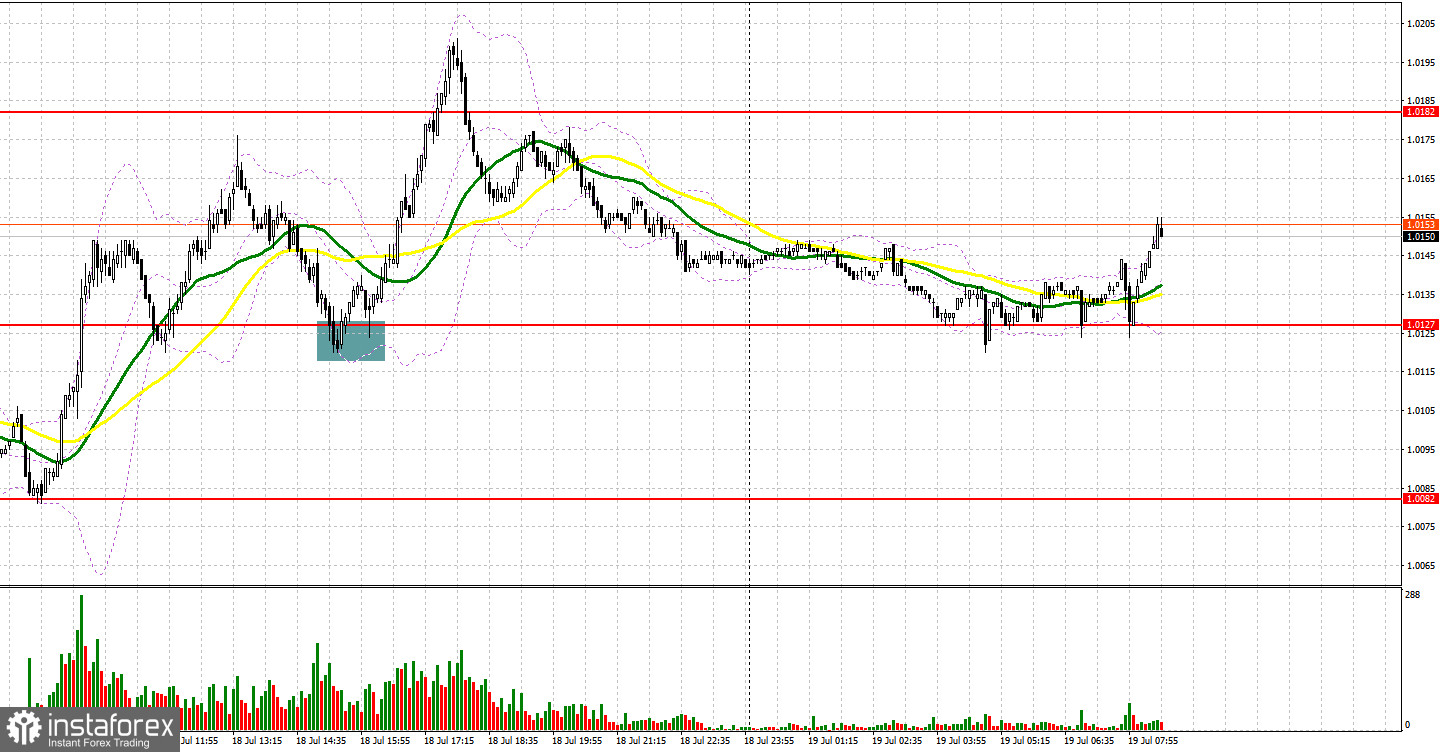

An excellent signal to buy the euro was formed yesterday. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the 1.0116 level in my morning forecast and advised you to make decisions on entering the market. The euro continued to rise in the absence of statistics, but before forming an entry point into the market, there was not enough time. A breakthrough of 1.0116 took place, but there was no reverse test from top to bottom - literally about 5 points were not enough to form a buy signal as the pair continued to rise. From a technical point of view, the picture completely changed in the afternoon. After a slight downward movement at the beginning of the US session, the bulls managed to protect the new level of 1.0127, which created an excellent signal to open long positions from there, which resulted in the euro rising by more than 70 points.

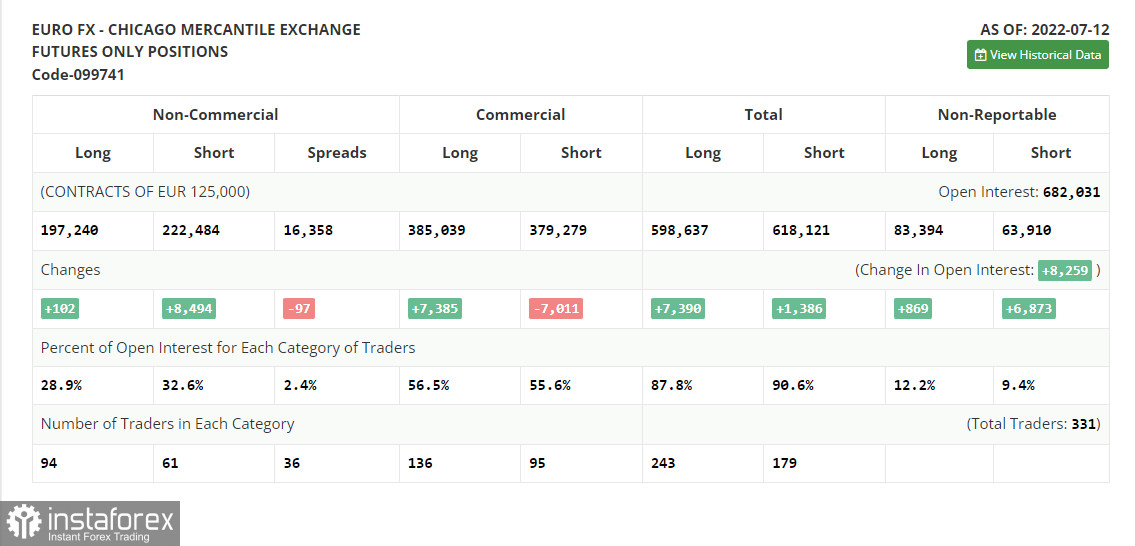

COT report:

Before talking about the further prospects for the EUR/USD movement, let's look at what happened in the futures market and how the Commitment of Traders positions have changed. The Commitment of Traders (COT) report for July 12 logged an increase in both long and short positions, but the latter turned out to be much more, which indicates that the bearish sentiment in the market remains. This also led to a larger negative delta, as there aren't many willing bulls even at non-current lows. It's all to blame for the strong statistics in the US, where rising inflation and growth in retail sales led to the preservation of bullish sentiment towards the US dollar and further weakening of demand for risky assets. As long as the Federal Reserve raises rates, the dollar will rise. In the near future, a rather important report on inflation in the euro area is expected, which may once again point to another jump in price growth. If this happens, do not be surprised by a slight upward correction of the pair, but it is unlikely that it will be able to save from a repeated decline and another test of the euro's parity against the dollar. The COT report found that long non-commercial positions rose only 102 to 197,240, while short non-commercial positions jumped 8,494 to 222,484. In many developed countries - all this continues to push for longs on the dollar. At the end of the week, the total non-commercial net position remained negative and amounted to -25,244 against -16,852. The weekly closing price dropped and amounted to 1.0094 against 1.0316.

The euro corrected quite significantly, and further growth raises more and more questions. Today, the focus will shift to inflation data in the eurozone, which, although not as influencing the direction of the pair as the US data, will still have quite serious consequences for the European Central Bank and its further decisions. If inflation shows a more significant increase, and it is expected to remain at the same level, then the bulls may try to break above 1.0176. If not, most likely the struggle will unfold for a new support level of 1.0127, where the moving averages play on the bulls' side. After forming a false breakout at this level, you can count on a further upward correction. As I noted above, the immediate target will be the resistance at 1.0176, which the bulls missed in yesterday's US session. A breakthrough and test of this range would hit the bears' stops, giving a signal to enter long positions with the possibility of a bigger upward trend towards 1.0224. The bears will be more active there, as going beyond this range will jeopardize the entire July downward trend. A more distant target will be the area of 1.0271, where I recommend taking profits.

In case EUR/USD falls and bulls are not active at 1.0127, which is more likely, the pressure on the euro will seriously increase again. In this case, I advise you not to rush to enter the market: the best option for opening longs would be a false breakout in the area of 1.0082. I advise you to buy EUR/USD immediately on a rebound only from the level of 1.0045, or even lower - in the parity area of 1.0001, counting on an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

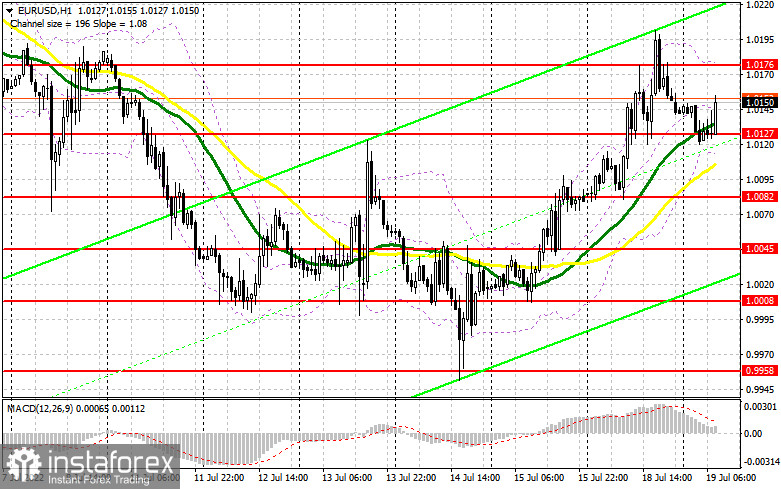

As long as trading is below 1.0176, the bears will have every chance to turn the market in their direction and to complete the upward correction that has been observed recently. In case EUR/USD grows in the first half after a strong inflation report in the eurozone, which may indicate the need for the ECB to raise rates immediately by 0.5%, forming a false breakout near the nearest resistance of 1.0176 creates a signal to open short positions with the prospect decrease in EUR/USD and return to support at 1.0127, on which quite a lot depends today. A breakdown and consolidation below this range, as well as a reverse test from the bottom up, will lead to another sell signal with the removal of bulls' stop orders and a larger downward movement of the pair to the 0.0082 area, where the bulls will already try to slow down the pair's downward movement in order to build a new lower limit of the upward channel. A breakthrough and consolidation below is a direct road to 0.0045, where I recommend completely leaving shorts. A more distant target will be the area of 1.0001.

In case EUR/USD moves up during the European session, as well as the absence of bears at 1.0176, I advise you to postpone short positions until a more attractive resistance at 1.0224 is in reach. Forming a false breakout there may be a new starting point in hopes of a return of the bear market. I advise you to sell EUR/USD immediately on a rebound only from the high of 1.0271, or even higher - in the area of 1.0341, counting on a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading is above 30 and 50 moving averages, which indicates a continuation of the upward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0110 will lead to a fall in the euro. A break of the upper border of the indicator in the area of 1.0176 will lead to an increase in the euro.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română