On Monday, the GBP/USD currency pair also saw a spectacular upward surge, leaving many perplexed. On the one hand, the pound has also been declining for a long period and with great conviction (although less so than the euro), so trend corrections are inevitable. On the other hand, with a blank calendar on Monday, the increase of the British currency by more than 100 points was unexpected. However, we want to remind you that 100 points per pound is minimal. Based on these 100 points of upward movement and the overall 230 points of movement, it is difficult to infer that the declining trend has ended and that we may anticipate a long period of British currency appreciation. This is because the geopolitical and basic contexts have not changed significantly for a very long time. What has changed during the past few weeks? Boris Johnson's resignation? We have grown accustomed to frequent political crises in the United Kingdom, even during the past few years. We have long gotten accustomed to the idea that the political forces in the UK are so polarized that a great number of truly crucial decisions must be taken nearly in court. Almost every month, discussions regarding resignations in the government surface. And ministers and legislators frequently resign their positions for various reasons. Someone cannot resist holding a party during the lockdown, someone reveals their relationships within Parliament, someone disagrees with the current leader of the country, someone does not suit the current leader of the country, etc. Consequently, the new election of the Prime Minister is now merely news that does not merit any additional attention. Brexit? Is protocol relative to Northern Ireland? Scotland's plans to quit the United Kingdom? Everyone is accustomed to this situation.

The premise and geopolitics.

In light of the preceding, we are inclined to assume that the foundation and geopolitics continue to exert the largest influence on market sentiment at present. As previously said, the pound has been weakening against the euro in recent months, leading us to assume that the market "in retrospect" still factors in the Bank of England's rate hike. Let's be sincere, however. Looking at the 24-hour TF for both currencies, it is difficult to conclude that the pound is falling slower or weaker. The main difference is that the euro has updated its 20-year lows, whereas the pound is only two years old. That is the distinction. The geopolitical element remains a significant consideration for dealers. If all is mundane, it is as follows: the American economy is stable, and the dollar is the world's reserve currency. Why should you invest in European bonds if a military battle has already begun in Eastern Europe, which may spread to other territories? Relations between the European Union and the Russian Federation have deteriorated, and it is unclear how the economy will function under the current "gas war" and "oil embargo" conditions.

Moreover, these two big players likely have additional effects on one another. For instance, via NATO. Recall that Finland and Sweden may join NATO within a few months, and Moscow's reaction remains uncertain. Recall that Lithuania has stopped the flow of sanctioned products and goods to the Kaliningrad region and that Moscow has yet to reply. In general, investors feel, with great justification, that investing their cash in a country and currency as far away as possible from the center of a military conflict is preferable.

It is made even simpler by the foundation. The Fed and the Bank of England are both increasing interest rates. However, the Bank of England is located in Europe and the Fed in the United States. Therefore, traders view each Fed rate increase as an opportunity to acquire more US currency. However, they purchase the pound with great reluctance since, in addition to monetary policy, the economy must be attractive to investors for capital to flow into it. And the British economy, post-Brexit and under the conditions of sanctions on the Russian Federation, does not appear to be in the best shape.Consequently, the pound sterling appears to be periodically corrected and decreasing against the euro, but you know what? No global corrections exist when 600 to 800 points are passed in the countertrend direction. Since May 25, 2021, the negative movement on the 24-hour TF has nearly reversed.

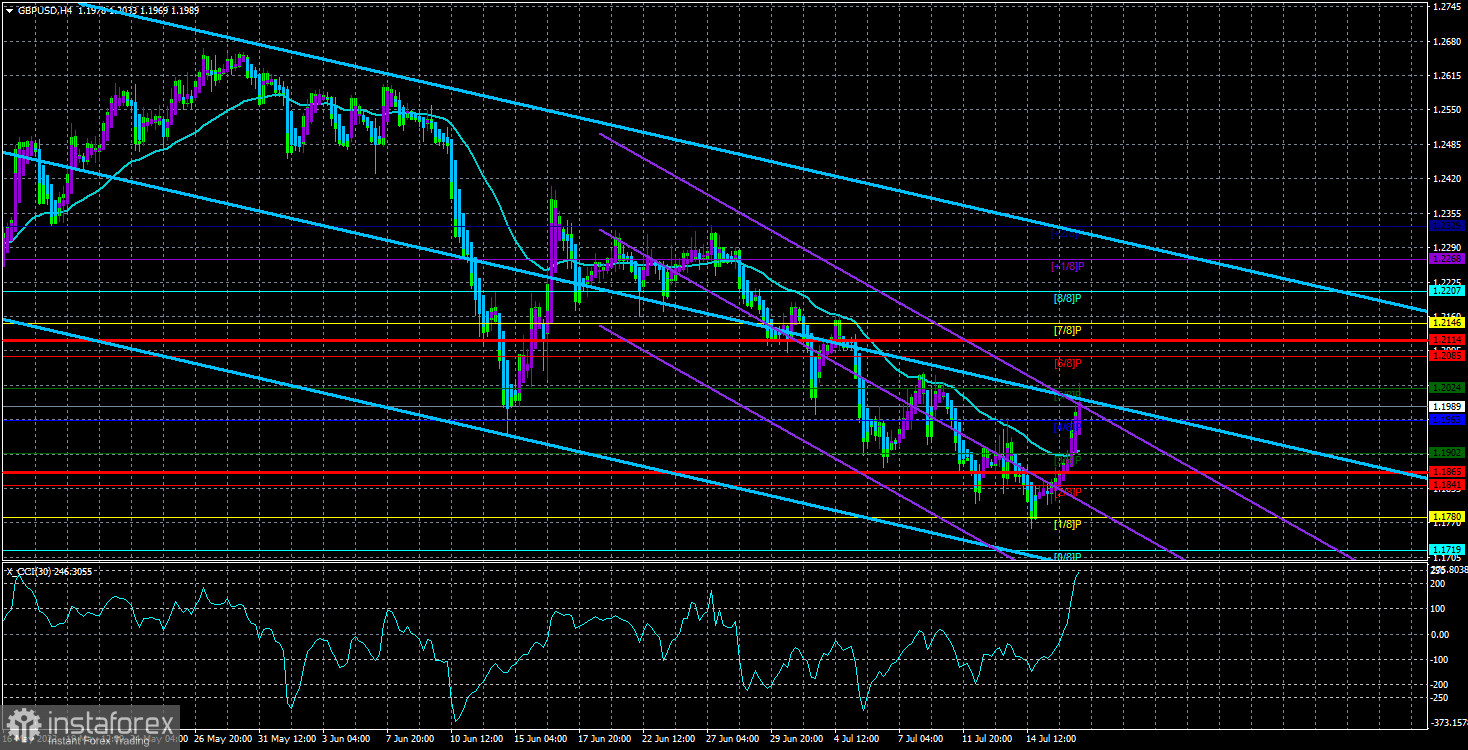

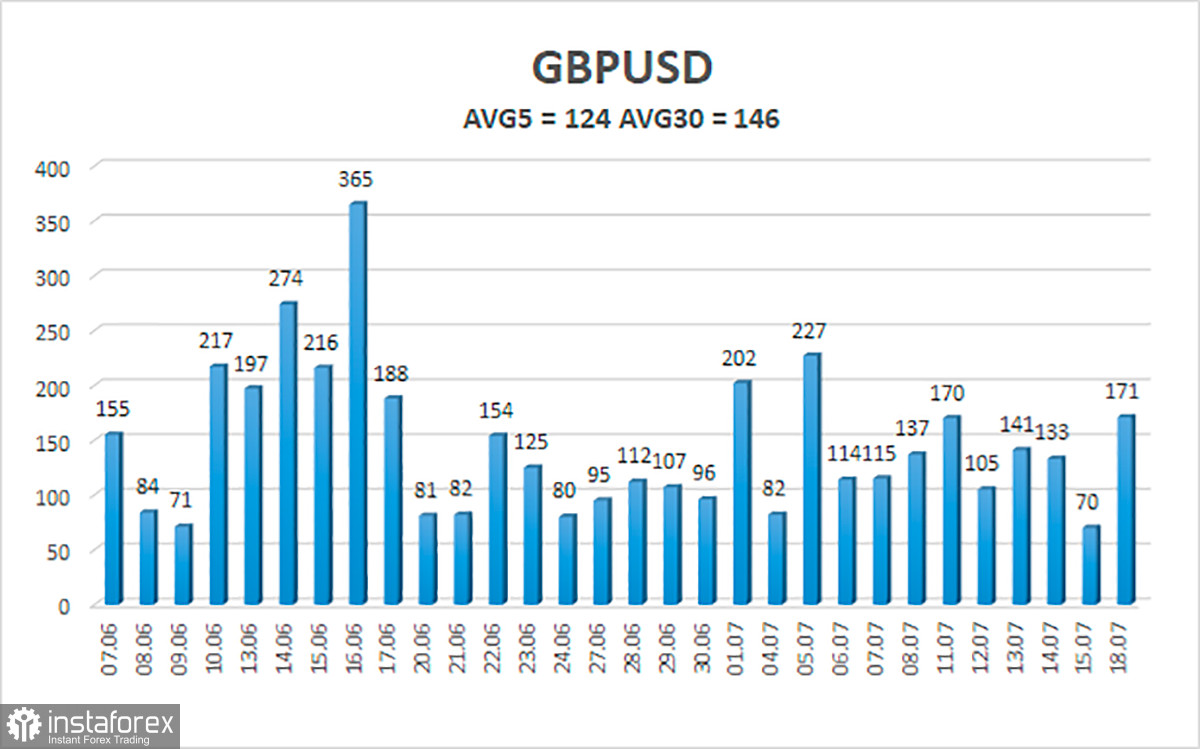

The average five-day volatility of the GBP/USD pair is 124 points. This value for the pound/dollar combination is "high." Therefore, on Tuesday, July 19, we anticipate movement within the channel, bounded by the levels of 1.1865 and 1.2114. The negative reversion of the Heiken Ashi indicator suggests a likely continuation of the decline.

Nearest support levels:

S1 – 1.1963

S2 – 1.1902

S3 – 1.1841

Nearest resistance levels:

R1 – 1.2024

R2 – 1.2085

R3 – 1.2146

The GBP/USD pair has surpassed the moving average in the 4-hour timeframe and is continuing its upward trend. You should thus maintain purchase orders with goals of 1.2085 and 1.2114 until the Heiken-Ashi indicator turns bearish. Open sell orders should be placed with targets of 1.1841 and 1.1771 below the moving average.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română