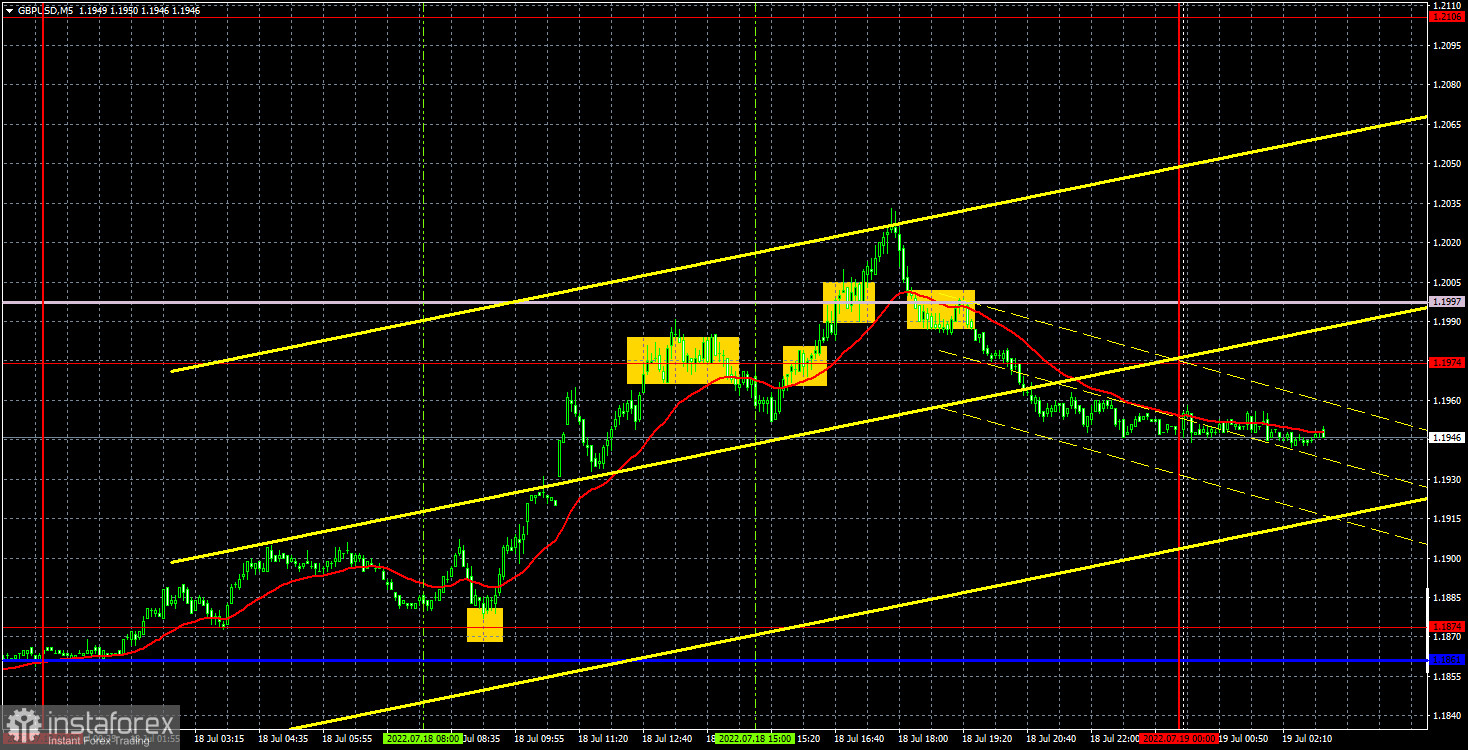

GBP/USD 5M

The GBP/USD currency pair again showed almost the same movements as the EUR/USD pair on Monday. The upward movement intensified and by the end of the day the quotes worked out the Senkou Span B line. Therefore, we can say that the pound recovered even stronger than the euro. In principle, this is not surprising. We have already said in recent articles that the pound falls weaker against the dollar, and recovers stronger. The downward trend line has been overcome, so formally the trend has already changed to an upward one. But we still fear that this is a trap for bulls. Since the Ichimoku cloud on the 4-hour timeframe has not been overcome, the pound can still fall at any moment. There were also no important reports or events in the UK on Monday, so we conclude that here, too, the correction is purely technical.

But with trading signals for the pound, the situation is much more fun. A buy signal formed early in the morning when the price rebounded from the extreme level of 1.1874. In fact, it did not reach it by 3 points, but this shortcoming can be considered an error. After that, the price rose to the level of 1.1974 and initially rebounded from it, thus forming a sell signal. Therefore, traders had to close longs and open shorts. Profit on the deal amounted to about 80 points. The sell signal turned out to be false, as the pair failed to go down even 20 points. Therefore, the short position closed in loss when the price broke the 1.1974 level. Then the pair settled above the Senkou Span B, but for a short time and after a couple of hours it returned to the area below this line, where the long position should have been closed. It managed to earn several points. Thus, the day ended in good profit for traders anyway.

COT report:

The latest Commitment of Traders (COT) report on the British pound again showed insignificant changes. During the week, the non-commercial group closed 5,700 longs and 2,800 shorts. Thus, the net position of non-commercial traders increased by 2,900. But what does it matter if the mood of the big players still remains "pronounced bearish", which is clearly seen in the second indicator in the chart above? And the pound, in spite of everything, still cannot show even a tangible upward correction? The net position fell for three months, then grew for some time, but what's the difference if the British currency still continues to depreciate against the US dollar? We have already said that the COT reports do not take into account the demand for the dollar, which is probably still very high right now. Therefore, even for the strengthening of the British currency, the demand for it must grow faster and stronger than the demand for the dollar. The non-commercial group currently has a total of 93,000 shorts open and only 34,000 longs. The net position will have to show growth for a long time to at least equalize these figures. Neither macroeconomic statistics nor fundamental events support the UK currency. As before, we can only count on corrective growth, but we believe that in the medium term, the pound will continue to fall.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. July 19. Important achievements of the euro and the pound.

Overview of the GBP/USD pair. July 19. The pound is resurrected from the dead. How long?

Forecast and trading signals for EUR/USD on July 19. Detailed analysis of the movement of the pair and trading transactions.

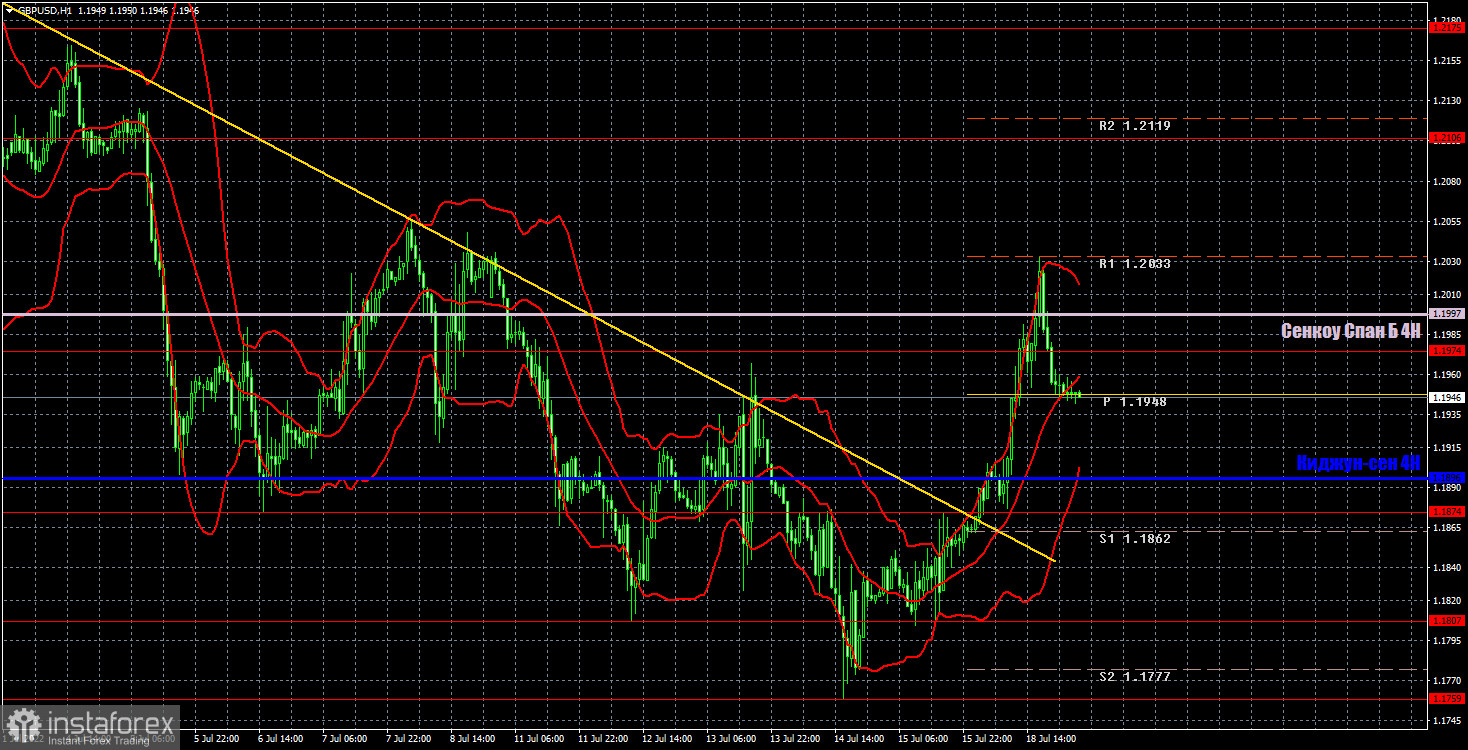

GBP/USD 1H

The pound overcame the descending trend line on the hourly timeframe, but failed to overcome the Senkou Span B line. Thus, without overcoming this line, the pound's succeeding growth is in doubt. Moreover, there were no fundamental and macroeconomic grounds for growth on Monday either. For July 19, we highlight the following important levels: 1.1807, 1.1874, 1.1974, 1.2106, 1.2175. The Senkou Span B (1.1997) and Kijun-sen (1.1896) lines can also be sources of signals. Signals can be "rebounds" and "breakthrough" of these levels and lines. The Stop Loss level is recommended to be set to breakeven when the price passes in the right direction by 20 points. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. The chart also contains support and resistance levels that can be used to take profits on trades. Reports on unemployment and wages will be released in the UK. These data rarely provoke a reaction of traders, although they are quite important. Bank of England Governor Andrew Bailey will deliver a speech in the evening, but we do not expect any important announcements from him. Nothing interesting in the US.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română