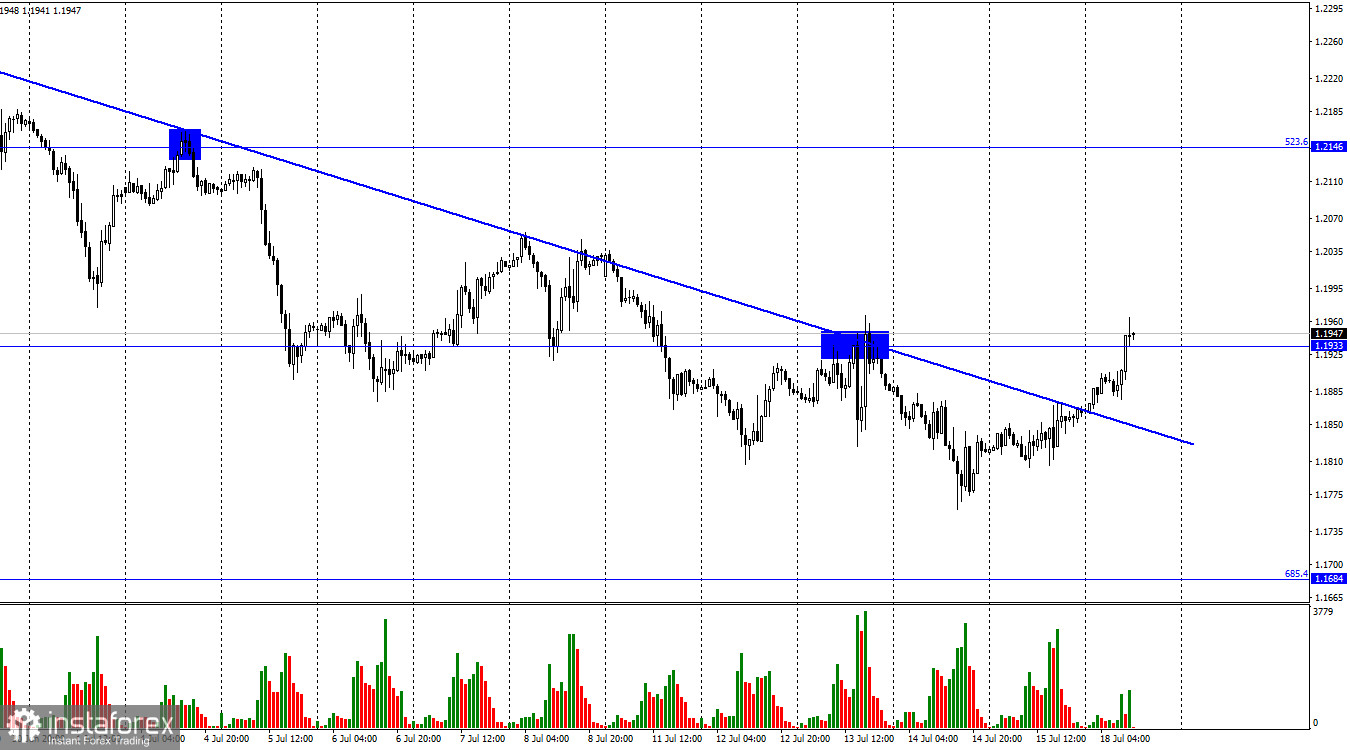

Hi, dear traders! According to the H1 chart, GBP/USD has continued its rally, which began on Thursday. The pair closed above the descending trend line, as well as 1.1933. The ongoing upward movement could be only a correction, but it is the most significant upsurge for GBP/USD in a while. The Bank of England is set to meet in early August – the pair's upsurge is not caused by expectations of an interest rate hike. While traders can go long on GBP/USD right now, the regulator's policy meeting is two weeks away. This week, UK inflation data for June will be released. Market players expect inflation to increase, which would motivate the BoE to hike the rate further.

The Bank of England and the ECB's policy moves have been outmatched by the Federal Reserve's monetary tightening. However, the British central bank does not sit idly. At this point, the Conservative Party's leadership vote is in the public spotlight. Three more rounds of voting will be held this week until two candidates remain. Then, about 160,000 party members will decide who will be the new Prime Minister. At this point, the results of the leadership contest cannot be predicted for certain.

According to the H4 chart, GBP/USD reversed upwards after forming another bullish MACD divergence and moved towards 1.1980. If the pair bounces off this level downwards, it could fall towards the Fibo level of 161.8% (1.1709). If GBP/USD settles above 1.1980, it could then continue to climb towards the next Fibo level of 127.2% (1.2250).

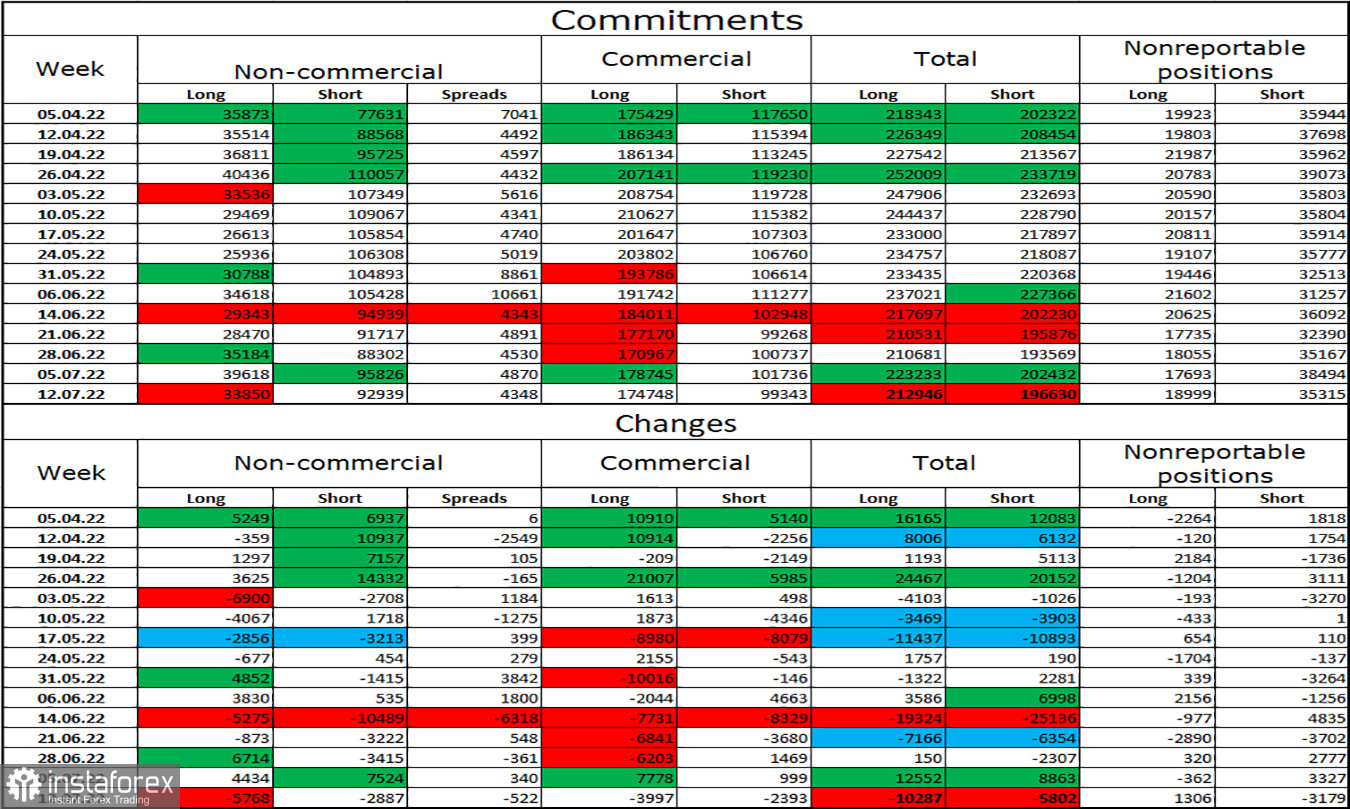

Commitments of Traders (COT) report:

The sentiment of Non-commercial traders became slightly more bearish last week. Traders closed 5,768 Long and 2,887 Short positions. Market players remain bearish on GBP/USD, and Long positions continue to outnumber Short ones greatly. Major players continue to decrease their exposure to GBP, and their sentiment has remained unchanged recently. GBP/USD could continue to fall in the next several weeks and months, despite the gap between Long and Short positions, signalling a potential trend reversal. While the pair could move upwards, it could still be only a 2-3 day correction followed by a renewed decline.

US and UK economic calendar:

There are no economic events in the UK and the US today.

Outlook for GBP/USD:

New short positions can be opened if GBP/USD bounces off 1.1980 on the H4 chart, targeting 1.1709. Earlier, traders were recommended to open long positions if the pair settled above the trend line on the H1 chart, with 1.1933 being the target. The pair has reached that target. New long positions can be opened if GBP/USD settles above 1.1980.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română