At the end of the last week, the risk sentiment rose slightly, the reason for that was a good report on US retail sales and the University of Michigan report which showed that the 5- and 10-year inflation expectations fell to 2.8% from 3.1%. Despite some positivity, recession risk remains high, with the US economy falling by 1.5% in Q2 according to the Atlanta Fed model.

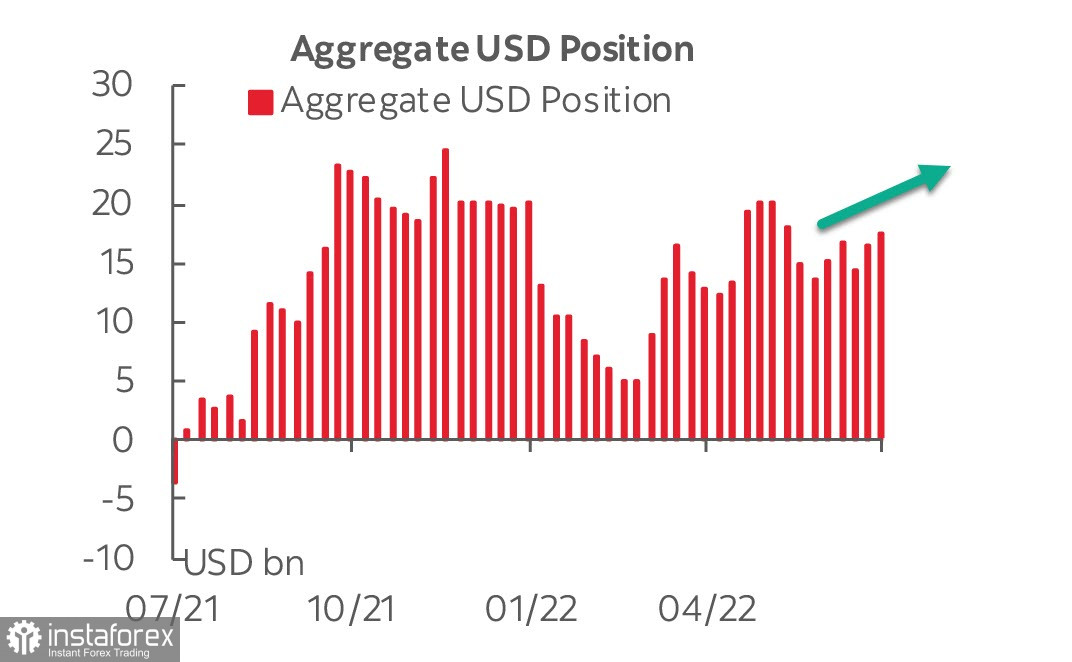

Investors remain bullish on the US dollar, according to the latest CFTC report. The total long position rose by 1.197 billion to 17.6 billion during the week, posting a seven-week high.

At the same time, for most currencies changes over the week are insignificant because there were no global changes in investor sentiment. Gold showed a strong contraction in the long position. It posted a weekly change of -5.318 billion, which may indicate a potential for growth in demand for both the US dollar and protective assets.

EUR/USD

Stagflation risks are growing in the eurozone, with the latest PMI and other activity index reports pointing to a further slowdown in Q2. Inflation in the eurozone reached a new record high of 8.6% in June, and even the slowdown in industrial growth, which is putting some restraining pressure on price growth, will not have much impact on inflation expectations, which are fueled by the threat of a gas supply cuts and the impending food crisis.

The ECB is now struggling to design the right monetary policy. Comments from ECB Governing Council members suggest that inflation control continues to be a priority for the ECB even as the recession approaches. The same conclusion comes from the minutes of the June meeting.

We can expect the ECB to raise all three rates by 0.25% at the July 21 meeting, the probability of a 50 bps rate hike looks unlikely. There is no unanimity within the ECB on this and the approaching recession is already lowering inflation expectations.

The main scenario looks like this - 0.25% in July, 0.50% in September, in total by the end of the year the rate will grow by 141 points (average market expectations) and by 43 more points in 2023. Needless to say, such rates are significantly below the Fed's rate forecasts, and the ECB policy may not have any noticeable effect on the euro.

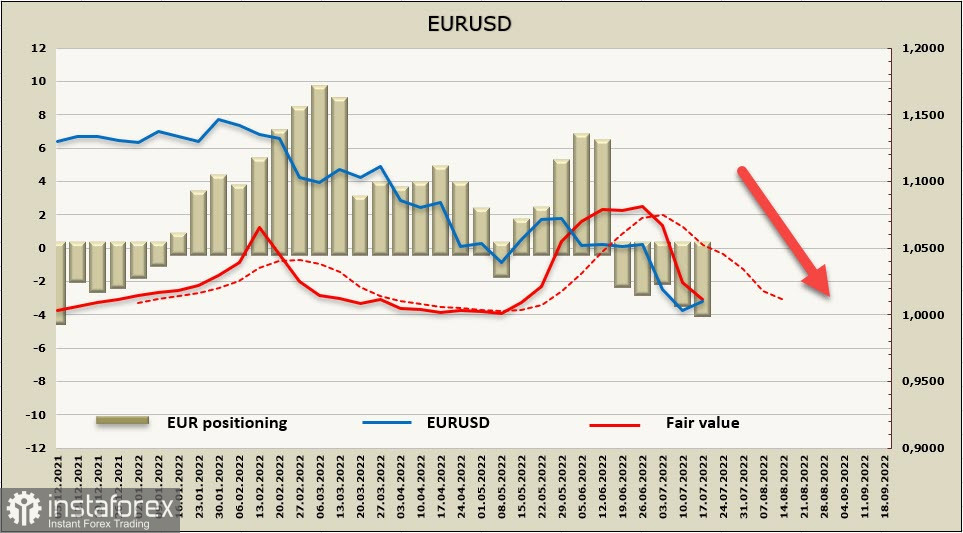

The net short position in EUR increased by 1 billion to -3.17 billion over the week which means that the bearish outperformance is increasing. The estimated price is still moving downwards. Some deceleration in momentum could give grounds for an upward correction, which should be used for selling.

We assume that there are no grounds for the end of the EUR/USD bearish trend yet. Reaching the parity increases the probability of correction, the nearest resistance is 1.0350 and the upper boundary of the channel is located at 1.0410-1.0440. There are no grounds to count on a stronger correction yet.

The pair may fix below 1.0000 and while lacking support levels below, the expected decline can stop at any level.

GBP/USD

The coming week will provide a lot of new information on the state of the UK economy. There will be a labor market report on Tuesday, July 19, a consumer inflation report on Wednesday, and a retail sales report on Friday.

The official unemployment rate is expected to rise to 3.9%, and in May the number of working people increased by 90,000, the general tension in the labor market gave the Bank of England reason to raise the rate, so a strong report will allow the pound to recover a little.

As for inflation, prices are expected to rise to 9.3% from 9.1%.

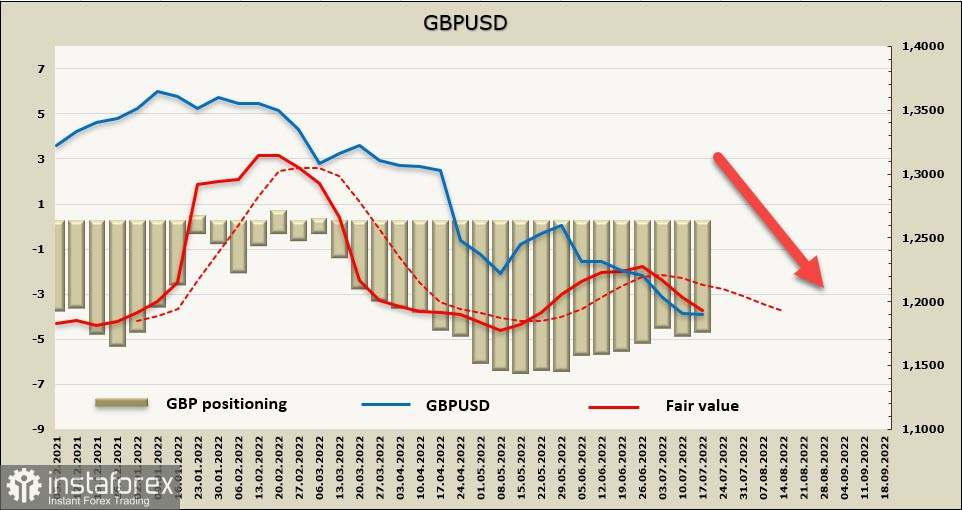

Bearish positioning on the pound remains, the weekly change is -194 million, the accumulated overweight is -4.39 billion, the settlement price is moving downwards, and there is no reason to wait for a trend reversal.

The sharp drop in the pound increases the probability of a correction. However, growth to the strong resistance of 1.2130/60 is possible only in case of good macroeconomic data and strong inflation, which will give reasons for the Bank of England to act faster.

As for the long-term trend, the trend remains bearish and there are no signs of a reversal. Bears are targeting to reach 1.1410, and in the long term, a decline to that level cannot be ruled out if the Fed is determined and the US recession is delayed a bit.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română