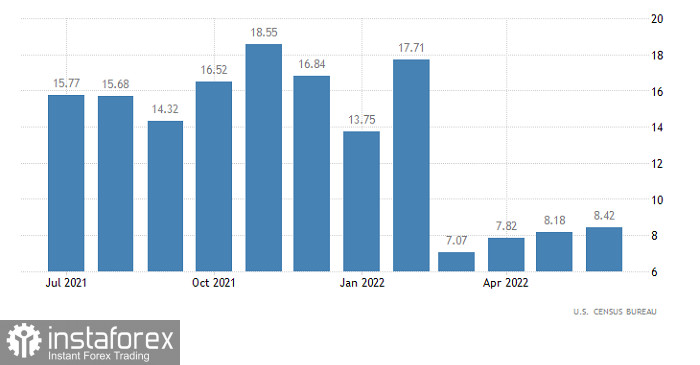

Markets ignored the recent retail sales data from the US even though it was much better than the forecasts. Initially, the growth rate was expected to slow down from 8.1% to 6.5%, but the actual figure was a revised 8.2% to 8.4%. Dollar surprisingly lost positions instead of rallying, which is a sign that it is heavily overbought.

Retail Sales (United States):

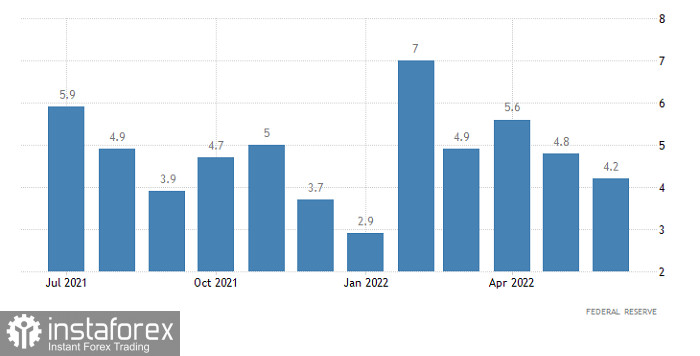

The latest industrial output report was also ignored despite the data showing a much worse slowdown from 4.8% to 4.2%, instead of the projected 5.2% to 4.8%. This is because the retail sales data carries much more weight considering that it reflects the health of the entire service industry, which accounts for approximately 80% of the US GDP.

Industrial production (United States):

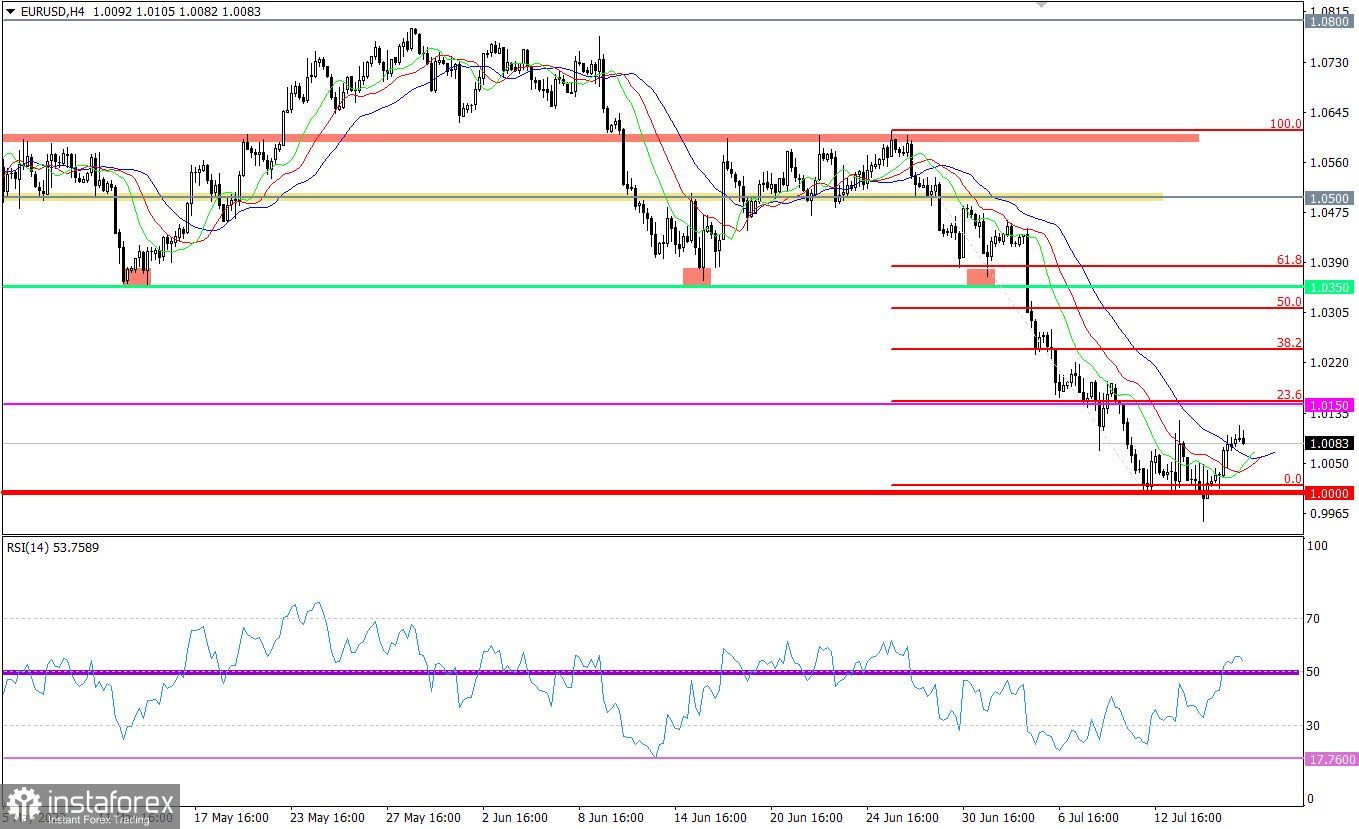

Incredible imbalances caused by the heavily overbought dollar also led to the strange behavior of the market. To change this, a full-fledged correction is needed. However, its implementation is quite difficult as recent US data looks much better than Europe's. A certain scenario is also looming, where euro will hang in a channel, then move towards its lower boundary. Most likely, this momentum will continue until Thursday, when the ECB embarks on its board meeting.

EUR/USD has risen marginally in the market, trading at 1.0100 at the moment. But the RSI indicator managed to overcome the middle line 50 from the bottom up, signaling a potential change in trading interests in the short term. The same is seen in the medium term as the market, as before, retained a strong downward interest.

The MA lines in the H4 chart also intersected with each other, which raises up the chance that a rebound will occur in the D1 chart. Obviously, bearish interest persists despite the clear signal that euro is oversold. The signal to buy will appear only when the price holds above 1.0150 in the H4 chart.

But some analysis points to buying in the short-term and a rebound in the D1 chart. They say that indicators in the medium term signal a sell-off due to movements towards parity price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română