The GBP/USD currency pair began to adjust on Friday but could not reach the moving average. Since the pound has been incapable of regularly adjusting for a very long time, nothing unexpected has occurred again. The reasons for the lack of demand for the pound are comparable to those behind the decline of the European currency. However, we highlight again that the pound has fewer reasons to decline against the dollar than the euro. Possibly because of this, the British pound is depreciating slower. However, this is still insufficient to prevent any collapse. All trend indicators point downwards, but fundamental and geopolitical conditions favor the dollar.

In addition, the United Kingdom is beginning the selection process for a new Conservative Party leader, who will automatically become Prime Minister. We cannot say that this process affects the market's mood, but it is impossible to avoid discussing this issue. The new government (particularly if it becomes Rishi Sunak) can make economic modifications. This is likely why the British economy would benefit from Sunak becoming the minister. And for foreign policy, it seems probable that anyone other than Sunak would be superior. Regardless, the pound is still sliding despite those reasons that could provide support. For example, the Bank of England's tightening of monetary policy.

Will the pound capitalize on the "inflationary opportunity"?

In the upcoming week, there will be some intriguing macroeconomic developments in the United Kingdom. For instance, the unemployment rate and wage data will be released on Tuesday. These are not the most significant facts right now. Thus, we do not anticipate a significant market reaction. On Wednesday, the June inflation data will be released, and it is anticipated that it will continue to increase in the same manner as in the European Union and the United States. According to the prediction, the pace of price rise acceleration may range between 9.2 and 9.5 percent. In other words, British inflation continues to approach the value predicted by the Bank of England, which, as we recall, anticipates a maximum value above 10 percent. Because recent inflation estimates have typically been exceeded, we anticipate an inflation rate approaching 10 percent by June. Inexplicably, this is good news for the British pound, as the Bank of England may hike the key rate by 0.5 percentage points at the beginning of August in response to a new rise in inflation. Theoretically, this could bolster the British pound if the preceding five rate increases had not "passed by" traders. Also scheduled for Friday is the release of a report on retail sales and business activity indexes for the service and manufacturing sectors, neither of which is likely to have a significant impact on the sentiment of traders.

How about the United States? This week, the United States is virtually absolutely tranquil. For macroeconomic events, only secondary or unimportant data will be available - the identical indices of business activity in the production and service sectors and unemployment benefit applications. Thus, we can say that the influence of the US fundamental background will be nearly nonexistent this week. Will the euro and the pound seize this opportunity? Remember that the core background of the United States influences both pairs in most cases. It is feasible. We have previously stated that it is nearly impossible to predict when a market correction will begin, i.e., when traders will either reduce their sales or begin buying. Therefore, you must travel using technical indicators. The initial candidate may be settling above the moving average line. After that, it will be crucial to watch for the emergence of an upward movement; if none develops, the pound will likely not exhibit a significant correction this time. The Fed and Bank of England meetings can significantly impact the balance of forces on the foreign exchange market, but they are unlikely to reverse the long-term downward trend.

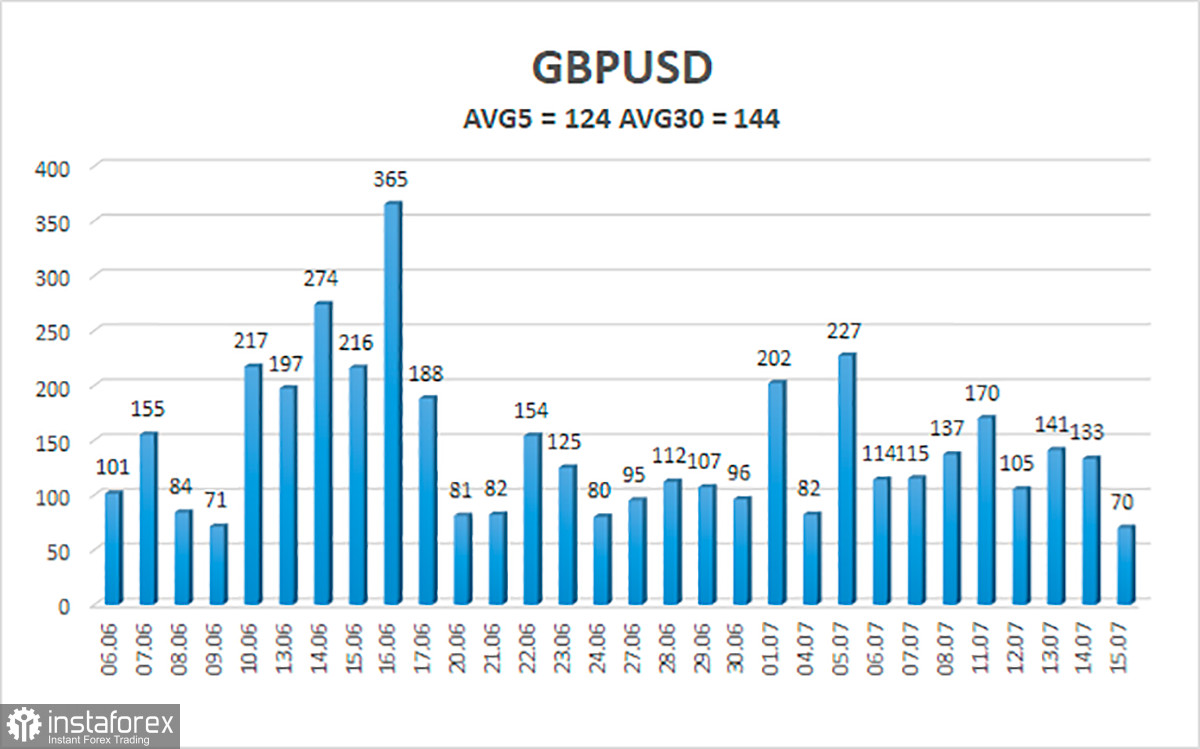

The average five-day volatility of the GBP/USD pair is 124 points. This value for the pound/dollar combination is "high." On Monday, July 18, we anticipate price action within the channel, bounded by the levels of 1.1739 and 1.1986. The negative reversion of the Heiken Ashi indicator suggests a likely continuation of the decline.

Nearest support levels:

S1 – 1.1841

S2 – 1.1780

S3 – 1.1719

Resistance levels closest:

R1 – 1.1902

R2 – 1.1963

R3 – 1.2024

On the four-hour timeframe, the GBP/USD pair attempts to adjust again. Therefore, additional sell orders with targets of 1.1780 and 1.1739 should be considered if the Heiken Ashi indicator reverses to the downside. Open buy orders when the price is above the moving average, with goals between 1.1963 and 1.1986.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the current trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română