Long-term perspective.

The EUR/USD currency pair has declined by 90 points in the past week. It does not appear excessive, but the fall continues nearly every week. If it continues at this rate, the euro will reach 0.9000 in a couple of months. Before a few months, this alternative appeared amazing, but it is now an objective fact. The euro is still powerless against the US dollar, and the market is delighted to capitalize on this weakness. This week, there were virtually no macroeconomic statistics or "foundations." The most significant event of the week was the release of the American inflation data, whose value did not surprise anyone. The consumer price index rose again and grew stronger than anticipated, so this week it was widely believed that the Fed would raise the key rate by 1% at its next meeting, which has not occurred in the United States in 30 years. However, the new reality necessitates new monetary strategies. We have consistently questioned whether an increase to 3.5 percent will be sufficient to return inflation to the target level. From our perspective, more extreme actions may be required. And any monetary policy tightening is positive for the dollar.

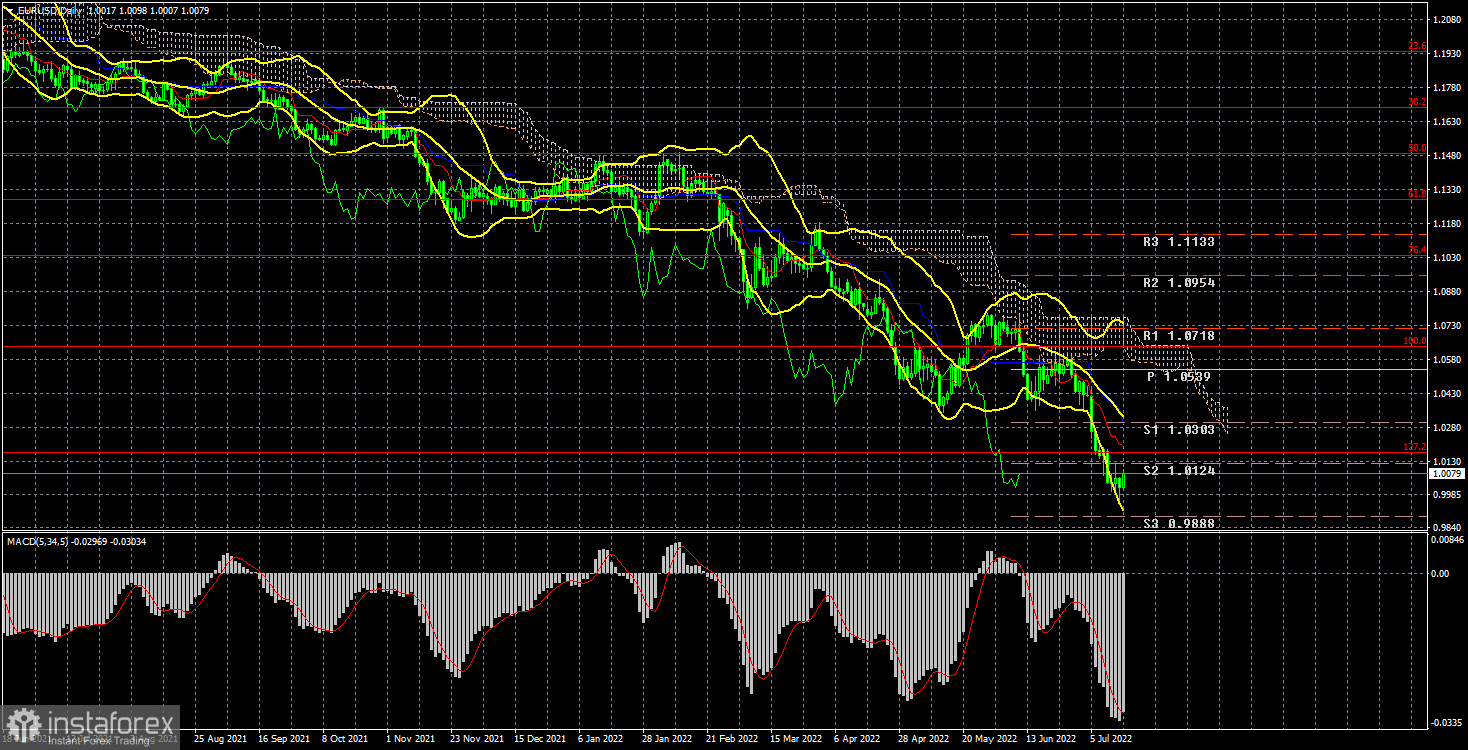

Given that the ECB remains passive, the US dollar enjoys near-complete freedom of action. The technical situation has not changed during the past week on a 24-hour timescale, as one might expect. What must be altered if the pair is only traveling in one direction? There is no indication that even a minor correction is beginning, as all signs continue to point lower. Therefore, it may fall further regardless of how low the euro currency is.

COT evaluation.

In the past six months, COT's reports on the euro currency have raised many issues. The illustration above plainly demonstrates that professional players were in a "bullish" attitude while the European currency sank simultaneously. Currently, the circumstances are not favorable for the euro currency. If previously the sentiment was "bullish" but the euro was falling, it is now "bearish," and the euro is also falling. Therefore, we currently see no reason for the euro to grow, given the vast majority of variables continue to work against it. The number of buy-contracts climbed by 0.1 thousand during the reporting week, while the number of shorts in the "Non-commercial" group increased by 8.5 thousand.Consequently, the net position declined again by about 8,500 contracts. In recent weeks, the "bearish" sentiment of the market's major participants has increased slightly. From our perspective, this demonstrates very vividly that even expert traders do not now believe in the euro currency. The quantity of buy contracts for non-commercial traders is 25,000 less than the number of sell contracts. Consequently, we can state that the demand for the US dollar is not only fairly high, but so is the desire for the euro. It may result in a fresh, larger decline in the euro's value. In theory, the euro currency has not been able to demonstrate even a tangible correction during the past six months, let alone anything more. The greatest upward rise was almost 400 points.

Evaluation of fundamental occurrences.

The most important report of the week was the inflation report. However, so much has been said about it already. From our perspective, the Fed's activities are currently of no consequence, as they are so well predicted that there are no more uncertain situations. In essence, it makes no difference whether the rate is increased by 0.75 percent on July 26-27 or by 1.00 percent immediately. The local market's response may vary, but both approaches will generally benefit the US dollar. The ECB, with its first rate hike of 0.25 percent, should also occur by the end of this month. We have no idea if the market will even pretend to purchase euros on this issue.

Consequently, we believe the decline of the European currency will continue. It cannot continue falling forever, and a correction will come sooner or later. However, it is futile to attempt to relate the commencement of the correction to a specific element or event. It is advisable to track it throughout a four-hour period.

Trading strategy for the week of July 18-22:

1) On a 24-hour timescale, the pair updates nearly daily at its 20-year lows. Nearly all elements continue to support the dollar's long-term growth. Traders could not overcome the Ichimoku cloud. Thus the euro's upward momentum and purchases remain irrelevant. It is crucial to at least wait for consolidation above the Senkou Span B line before considering long bets.

2) The euro/dollar pair's sales remain more relevant now. The price has above the 127.2 percent Fibonacci retracement level of 1.0172. Thus it is likely to continue falling to the next objective of 0.9583. (161.8 percent Fibonacci). In addition, approaching the level of 1.0172, the pair did not even attempt to fake a bounce.

Explanations of the figures:

Price levels of support and resistance (resistance /support), Fibonacci levels – levels used as entry points for buying and sales. Take Profit levels may be positioned nearby.Ichimoku indicators (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

The first indicator on the COT charts is the net position size of each trading category.

On the COT charts, indicator 2 represents the net position size for the "Non-commercial" group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română