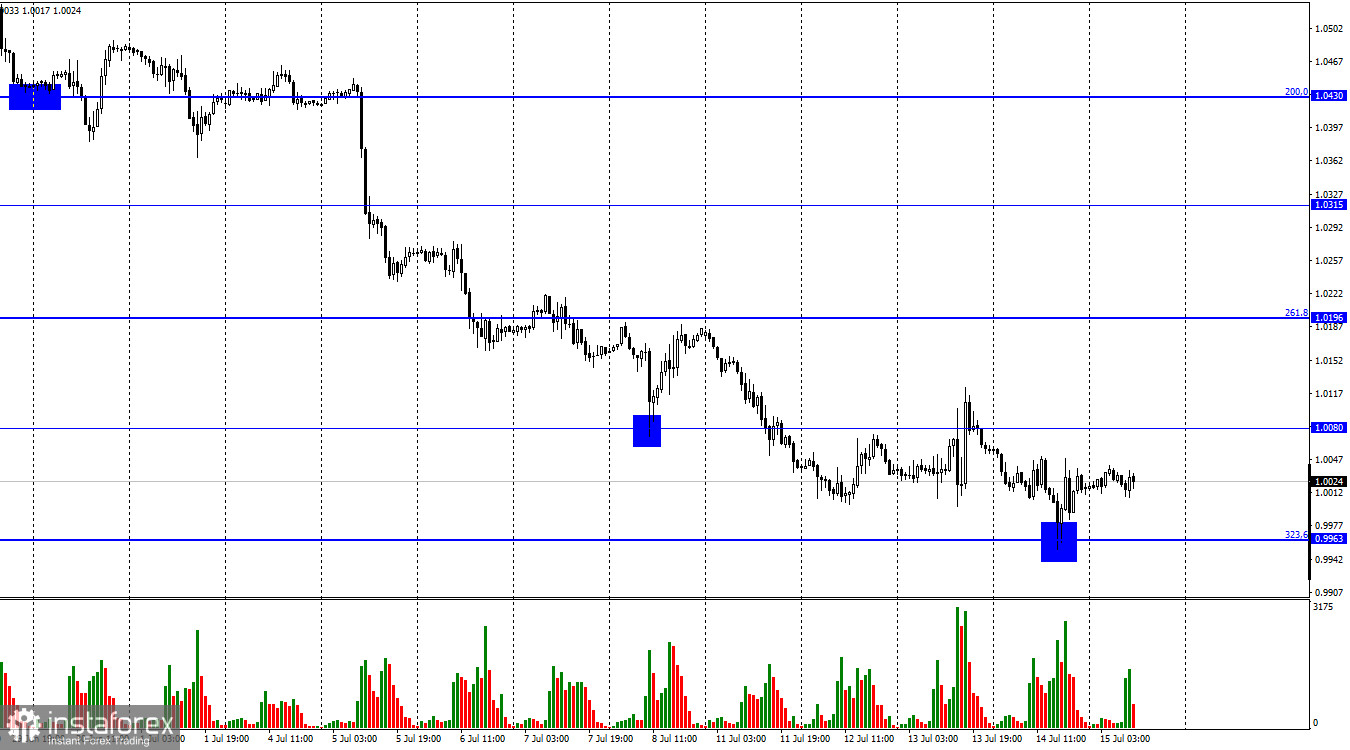

Hello, dear traders! Yesterday, the EUR/USD fell to the 323.6% correction level at 0.9963. The rebound from this level contributed to the euro's growth towards 1.0080. However, at the moment of writing, the euro managed to rise only by 80 pips. Therefore, it is too early to indicate the start of the euro's growth. Notably, a key US inflation report was released this week. Traders predicted that inflation would rise. However, it surged more than expected. Many analysts and mass media reported that the Fed's interest rate could increase by 1.00% at the end of the month. I think this option is realistic, though the US regulator hasn't implemented such measures for more than 30 years. However, it is probably the only way to reduce inflation.

Therefore, the FOMC will have two options. The most likely option is to raise interest rates by 0.75%. As for the second option, the rate can be increased by 1.00%. Though, it is unlikely. Moreover, the point is that inflation and recession are interrelated. The faster the rate rises, the more likely the US economy will face recession. Besides, a sharp rate hike may shock financial markets, and Jerome Powell has repeatedly mentioned that the regulator planned to avoid such consequences. Even if the Fed raises the rate by 1.00% on July 27, it won't bring inflation down to the target level. Therefore, the Fed would discuss new possible hikes at its next meetings in 2022. It was necessary to act rapidly at the start of 2022, when most FOMC members were sceptical about a dramatic rise in inflation.

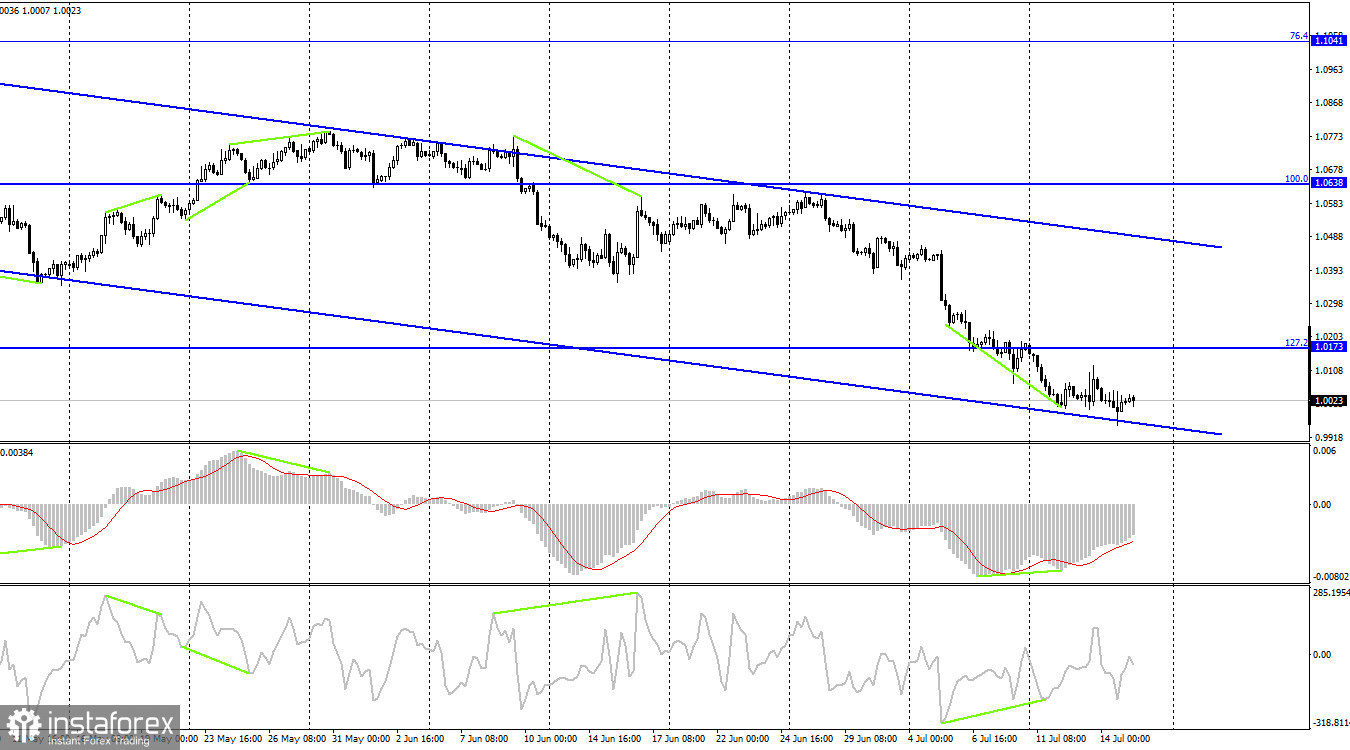

On the 4H chart, the pair has consolidated below the 127.2% correction level at 1.0173. Therefore, the pair may continue falling towards the next correction level of 161.8% at 0.9581. According to the bearish trend channel, traders' sentiment remains bearish. Both indicators have formed a bullish divergence, though they had no impact on traders' sentiment.

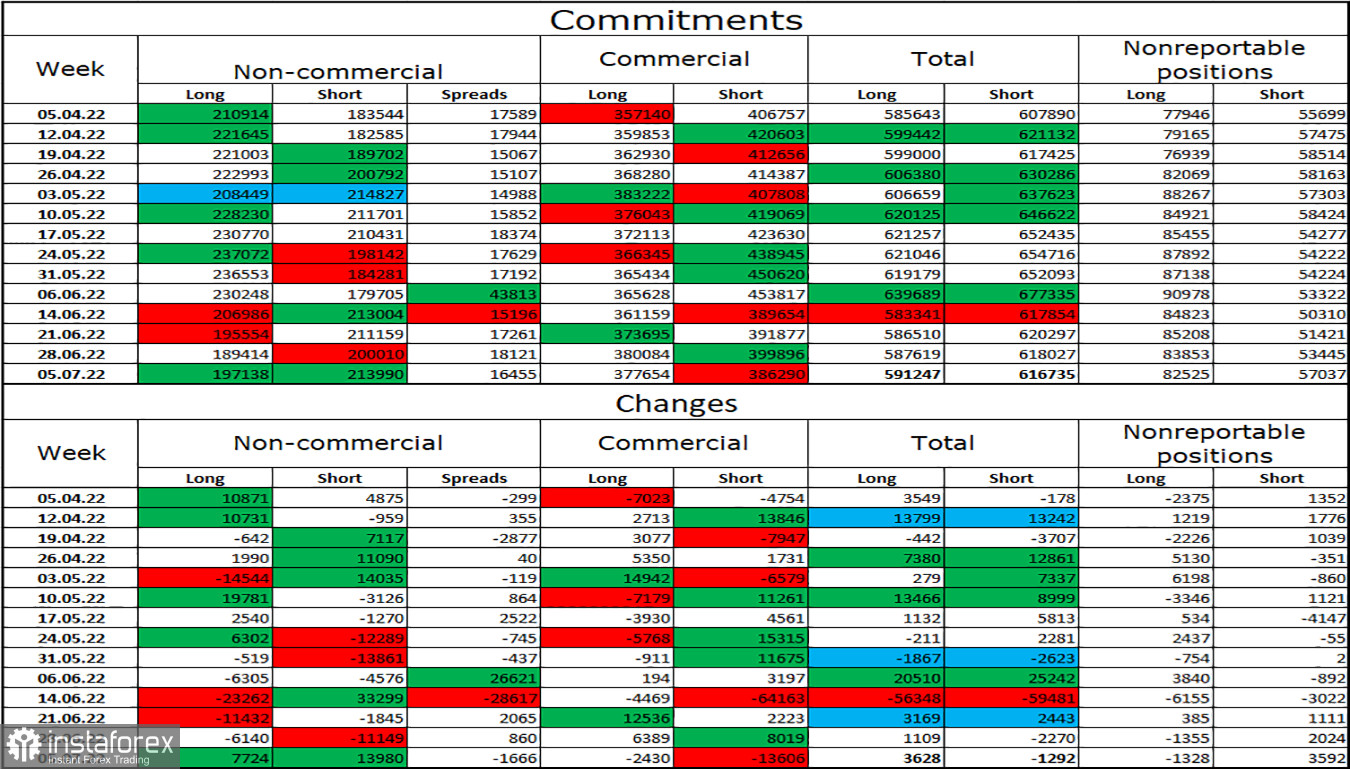

COT report:

Speculators opened 7,724 long and 13,980 short contracts last reporting week. This means the bearish sentiment of major players has increased again and remains bearish. The total number of long contracts held by speculators is now 197,000, while the number of short contracts totals 214,000. The difference between these figures is not significant. However, bulls do not have an advantage. As for the euro, sentiment of non-commercial traders has been mostly bullish during recent months. This fact did not favor the euro at all. The prospects for the euro's growth have been gradually rising over the last few weeks. However, the latest COT reports show that the euro's new sell-off is likely as speculators' sentiment has changed from bullish to bearish.

US and EU economic news calendar:

US - Retail Sales (12-30 UTC).

US - Industrial Production (13-15 UTC).

US - University of Michigan Consumer Sentiment Index (14-00 UTC).

On July 15, the EU economic calendar did not contain any entries. However, three major reports were released in the US. Overall, the news background slightly affected traders' sentiment yesterday.

EUR/USD outlook and recommendations for traders:

I recommended selling the pair at the close below 1.0196 with the targets of 1.0080 and 0.9963. Both of these levels have been reached. New sales are possible at closing below 0.9963 or after the rebound from 1.0080. I recommend buying the euro at consolidation above the channel on the 4H chart, with the target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română