The disastrous first half of the year for bitcoin turned into a loss of interest in the asset, which previously looked like a means of easy enrichment. According to CryptoCompare, the volume of cryptocurrency trading on the futures and stop markets in June decreased by 15% to $4.2 trillion, the lowest level since January 2021. At the same time, the scale of cash transactions fell to $1.41 trillion. Until BTCUSD comes out of its bear market cycle, which may take months, we can expect trading activity to remain below average levels.

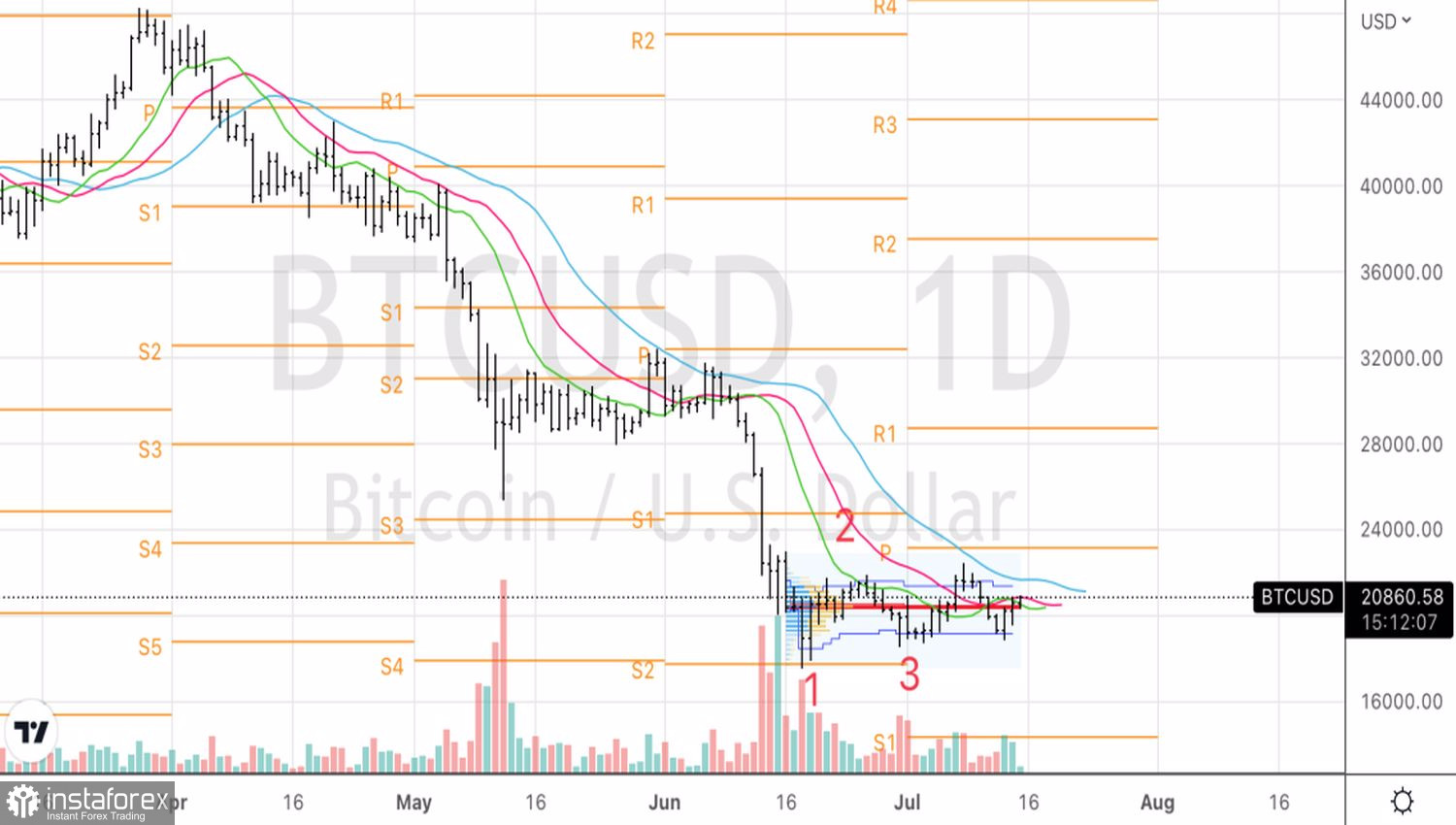

When exactly Bitcoin will stop falling, no one knows. According to a survey of 950 investors conducted by MLIV Pulse, the token will fall to 10,000 faster than rise to 30,000. 60% of respondents came to this opinion. At the same time, Arcane research suggests that a fall in BTCUSD quotes below the 2017 peak at 19,500 is fraught with subsidence to 16,000–17,000. Overcoming this support will increase the risks of a slide to 14,000—2019 high. The resumption of the upward trend will be possible if Bitcoin manages to trade above the 28,000 mark.

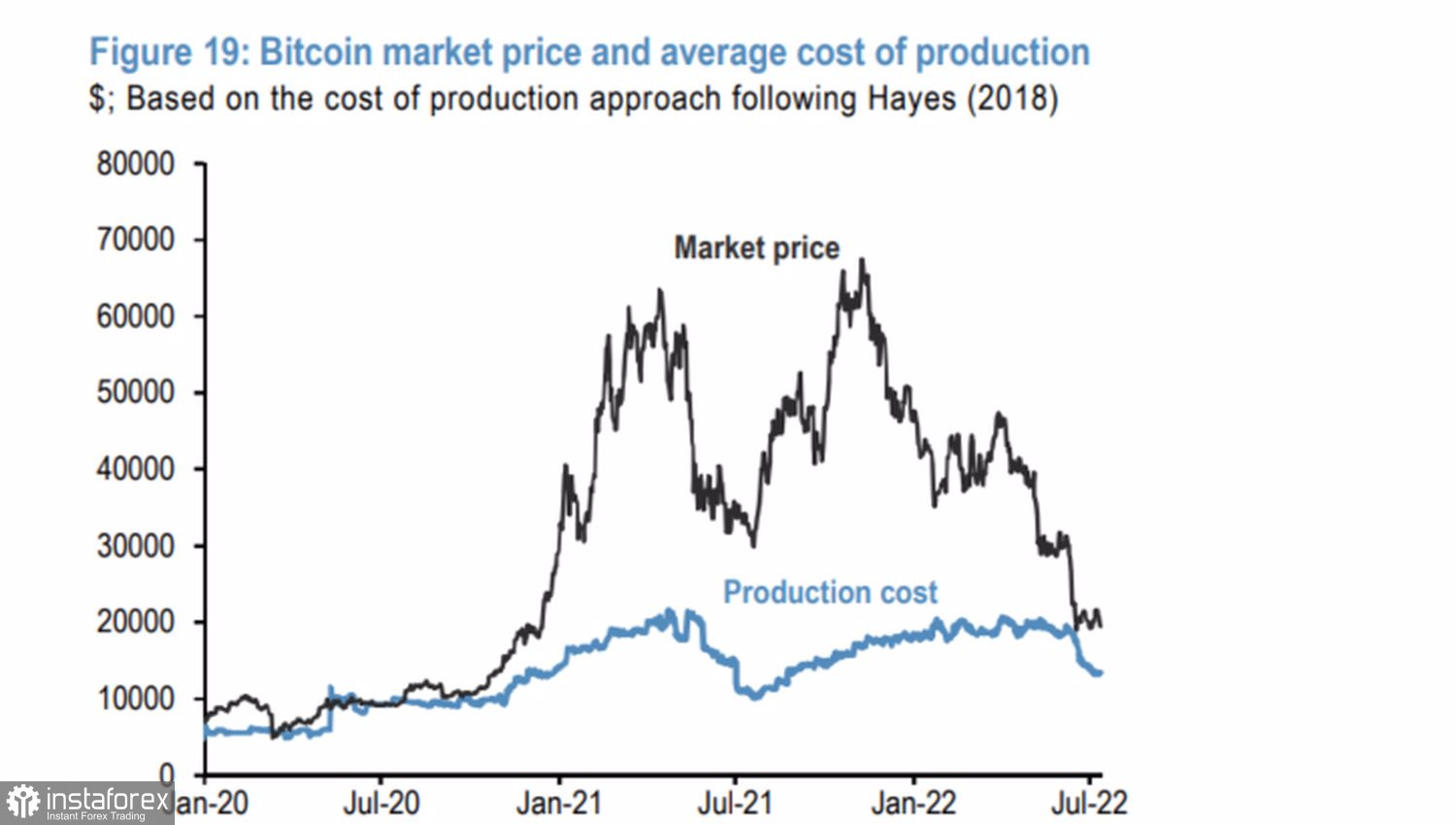

JP Morgan claims that due to the transition of large miners to alternative energy sources and the exit of bankrupt miners from the market, the production cost of bitcoin fell from 21,000 to 13,000. The company views this as a bearish factor for BTCUSD, as market participants often consider the costs on the production of a token as a kind of floor for prices.

Dynamics of bitcoin and its production costs

Meanwhile, BTCUSD continues to consolidate, reacting sensitively to events in the financial markets. The US dollar rapidly strengthens, keeping risky assets under pressure and not allowing US stock indices to raise their heads. The acceleration of consumer prices to 9.1% and producer prices to 11.2% increases the likelihood of an increase in the federal funds rate by 100 bps at once at the July Fed meeting. Only the comments of Christopher Waller and James Bullard that such a move is too big allowed the stock market to recover.

Bitcoin and Nasdaq Composite Correlation Dynamics

Bitcoin's 40-day correlation with the Nasdaq Composite has fallen to its lowest level since the beginning of the year. Does this mean that now the paths of the assets will diverge? They have the same growth drivers, but the specifics of the tools are somewhat different.

According to Morgan Stanley, the Fed is determined and ready to provoke a recession if it is necessary to defeat inflation. Part of this equation is a strong US dollar, the demand for which is growing due to fears of approaching recession in the global economy. At the same time, a strong US currency reduces companies' profits and worsens their forecasts. As a result, the decline in stock indices risks resuming.

Technically, there is a Splash and Shelf pattern on the BTCUSD daily chart. A break of the upper limit of the consolidation range of 19,000–22,000 will allow buying the token. On the contrary, a fall below 19,000 is a reason for its sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română