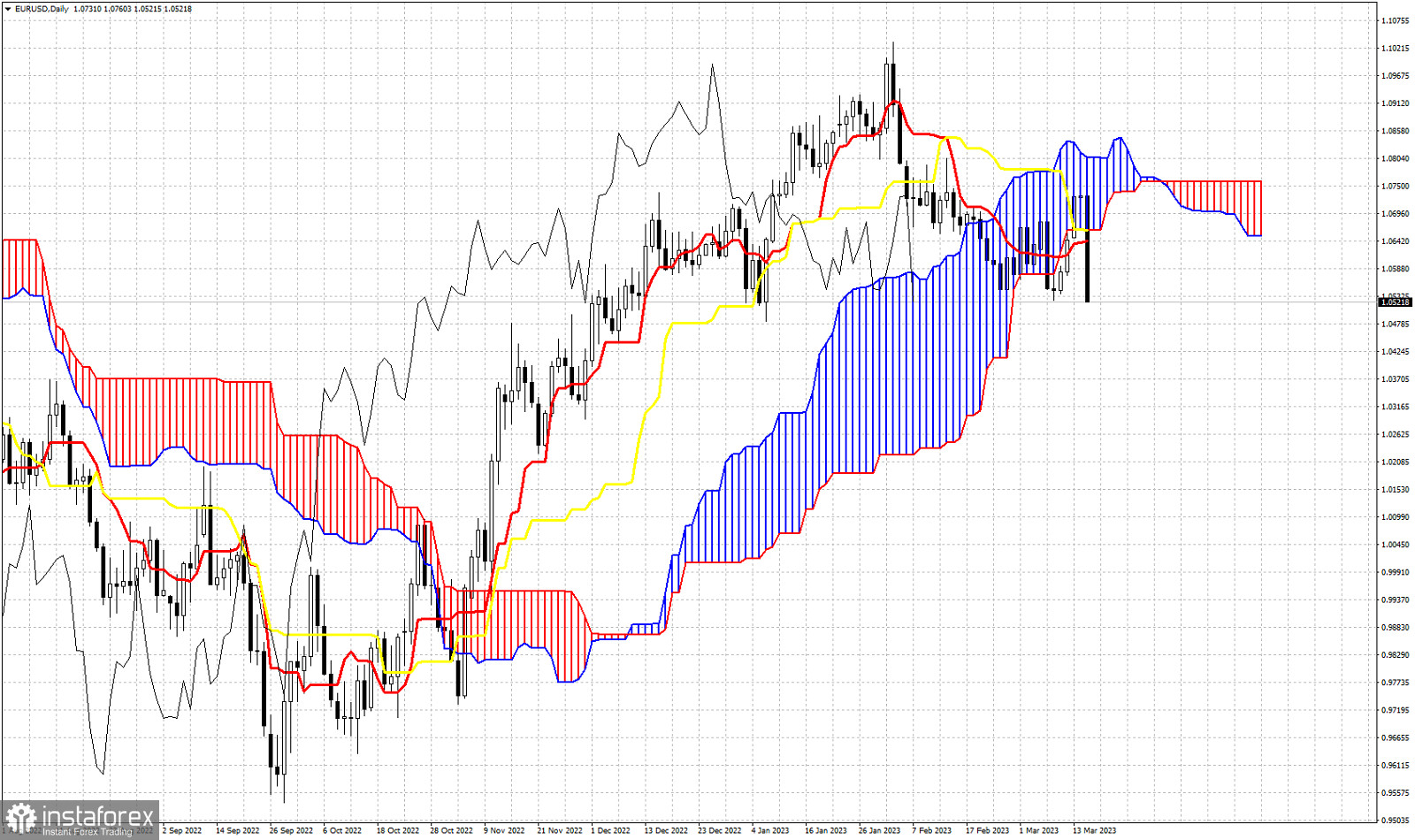

EURUSD is trading below 1.06 close to 1.0535 after getting rejected by the cloud resistance and by the 38% Fibonacci retracement. In our previous analysis we noted that price was trading around the 38% Fibonacci retracement level and that a rejection here would be a bearish sign. Price in the Daily chart has broken below the Kumo (cloud) and is also trading below the kijun-sen (yellow line indicator) and the tenkan-sen (red line indicator). The Chikou span (black line indicator) is below the candlestick pattern and it also got rejected once it touched the candlestick pattern (resistance). In order for trend to change to neutral from bearish, price must re-enter the cloud, in other words price must push above 1.0665.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română