The GBP/USD currency pair resumed its downward trend on Thursday, failing to demonstrate a substantial reversal. The previous wave of adjustment concluded close to the moving average line, at which point a recovery ensued. Yesterday, the pair's 2-year lows were revised, and the pound is currently racing towards its absolute lows, below the 14th level. Despite the lack of macroeconomic statistics this week, the pound has been sliding for nearly the whole week. On Wednesday, an important report on inflation in the United States and statistics from the United Kingdom were presented, but neither affected the trading activity. The US inflation report was expected to prompt a further rise in the dollar, and it did so, albeit with some delay. Recall that the US dollar fell on Wednesday evening, which is completely nonsensical considering the recent acceleration of price inflation in the US. And the more rapidly prices increase, the more seriously we must address the Fed's inflation problem.

In contrast to the ECB, the Bank of England is active, but buyers have mostly ignored the five prior rate increases. At the next BA meeting, they will most likely disregard the sixth one, which may occur in early August. The British regulator might potentially begin raising the interest rate at a faster rate, which could end the "bearish" trend. Regarding the degree of influence on market sentiment, however, geopolitics appears to be prevailing over the "foundation" thus far. The ECB has never hiked rates, whereas the BA has done so five times. Despite this, the pound sterling is declining nearly as much as the euro. In recent years, the United Kingdom, without difficulties and controversies, is not the United Kingdom. Yesterday, we discussed the date of the Scottish independence vote, and today we will discuss the race's commencement for the leader of the Conservative Party.

Most votes have been cast for Rishi Sunak thus far, but this could change in the next rounds.

The first round of the Conservatives' leadership election has taken place. Remember that initially, there were eleven applicants for this position, but yesterday there were just six. In the initial balloting, Rishi Sunak received 88 votes. Penny Mordaunt and Liz Truss, his nearest competitors, received 67 and 50 votes, respectively. There must be a brief explanation of the voting procedure. Only current Conservative Party members in Parliament can vote. In each round, everyone will vote. However, if a suitable contender has already dropped out, a vote can be cast for any remaining candidate. The votes received in the first round by the five eliminated candidates will be distributed among the six surviving candidates in the second round. In subsequent rounds, a candidate will be removed. And so on, until only two of them remain. All of these processes will take place rapidly, it should be stated. They will vote nearly every day, and by July 21, there will be two contenders for the position of prime minister, following which the entire Parliament will take a holiday.

Also intriguing is the possibility that the present voting results will alter drastically in the last round. After all, Sunak received 88 votes, but since all the votes that went to other candidates in the first round might conceivably be awarded to Liz Truss instead. Consequently, we would not declare Sunak's win just yet. Additionally, it should be highlighted that Sunak is an economist, whereas the country's leader should be a powerful and charismatic politician and leader. Sunak's conduct did not indicate that he was an effective leader. We feel Foreign Minister Liz Truss has an excellent chance of victory. Her strong pre-election pronouncements may affect the final vote, as the economy is, of course, a significant factor at this time, but developments in Europe have shifted the focus to foreign policy. And in this regard, a stern stance from the British government is vital.

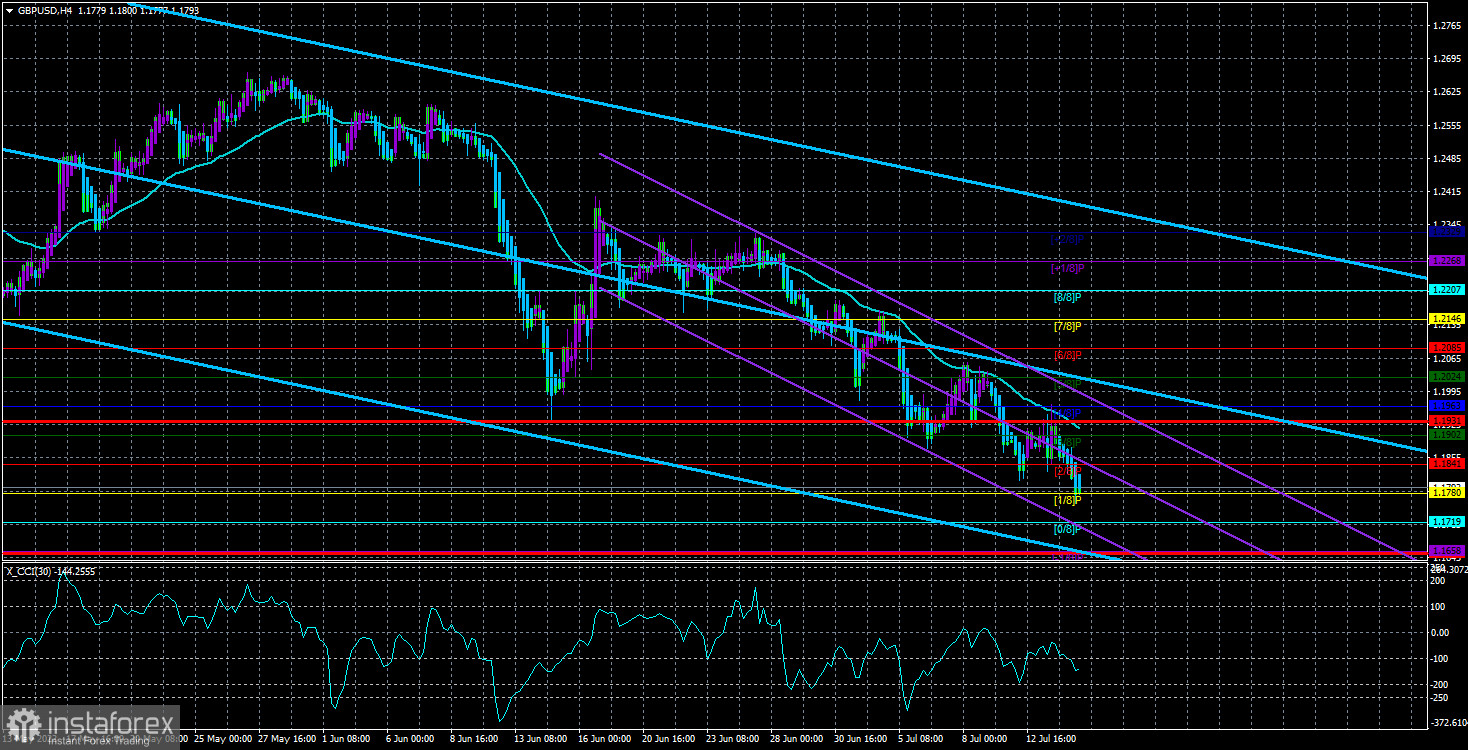

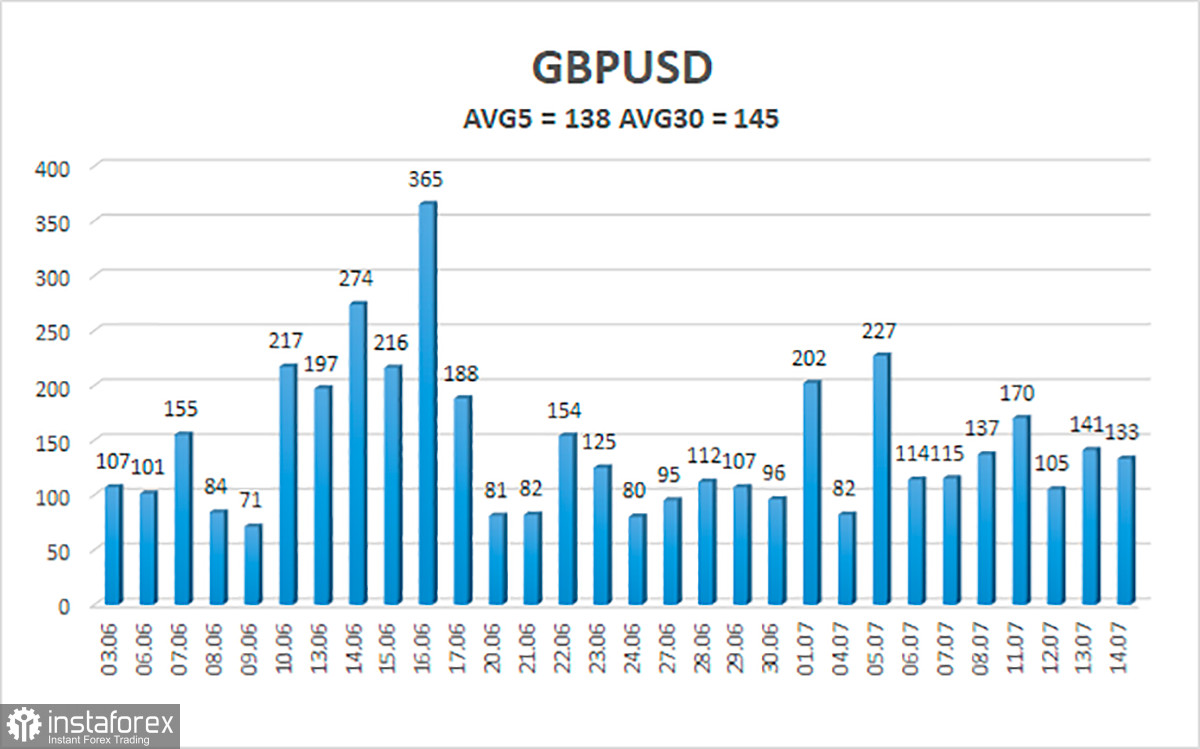

138 points are the average volatility of the GBP/USD pair over the last five trading days. This value for the pound/dollar combination is "high." On Friday, July 15, we, therefore, anticipate price action within the channel, bounded by the levels of 1.1655 and 1.1931. The negative reversion of the Heiken Ashi indicator suggests a likely continuation of the decline.

Nearest support levels:

S1 – 1.1780

S2 – 1.1719

S3 – 1.1658

Nearest resistance levels:

R1 – 1.1841

R2 – 1.1902

R3 – 1.1963

The GBP/USD pair resumed its negative trajectory in the 4-hour period, prompting the issuance of bearish trading recommendations. Therefore, until the Heiken Ashi indicator turns up, you should maintain sell orders with goals of 1.1719 and 1.1658. When the price is above the moving average, buy orders should be placed with goals of 1.2024 and 1.2052.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

The moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română