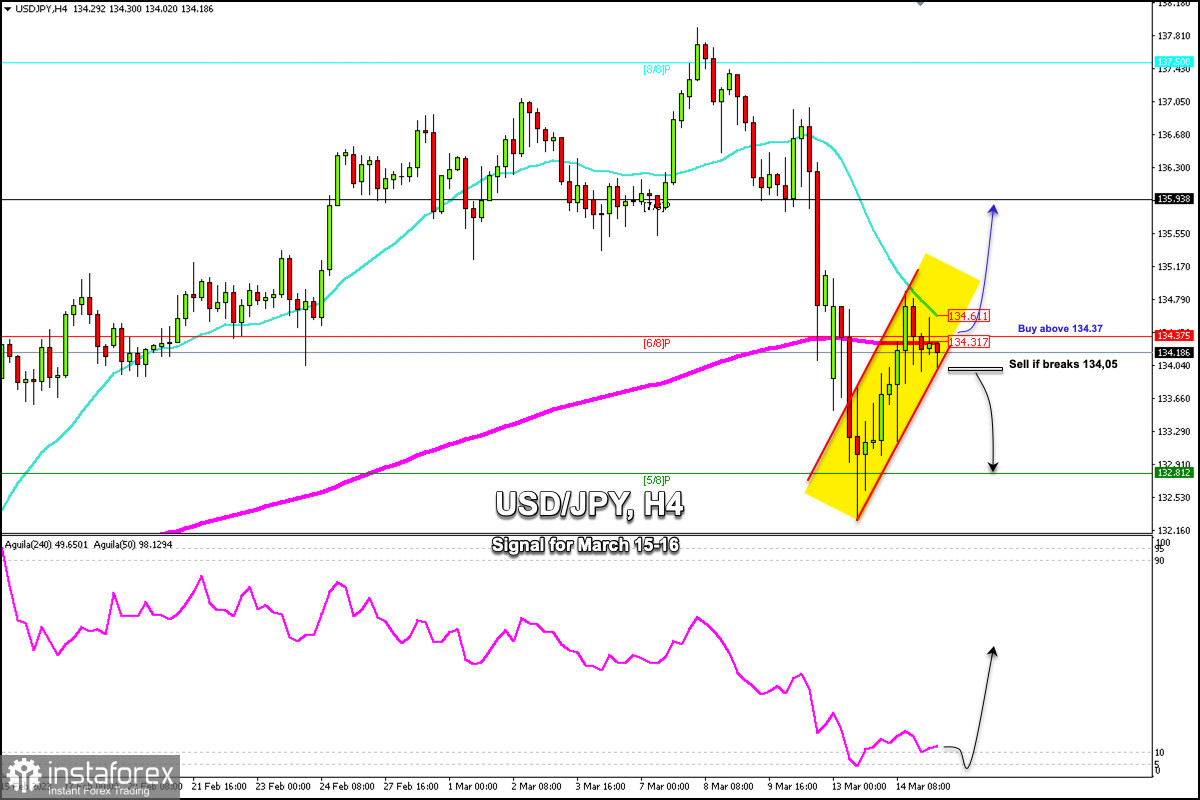

The 4-hour chart shows that USD/JPY has found a strong resistance that is located between the 21 SMA and the 200 EMA.

Currently, the instrument is trading below the 6/8 Murray (134.37). If it fails to consolidate above 134.61 (21 SMA), we could expect a continuation of the downtrend and the price could reach 133.66 and down to 5/8 Murray 132.81.

On the other hand, in case USD/JPY trades above 134.50 and if it exceeds the 21 SMA, we could expect a continuation of the upward movement and the instrument could reach 7/8 Murray at 135.93.

The outlook is bullish as the pair is showing oversold signs, although the overall picture offers mixed signals. If the bullish move extends above 134.62, it could gain further momentum and the instrument could reach 137.50 (8/8 Murray). Conversely, a drop below 134.00 could push the price to the weekly low of 132.27.

If the USD/JPY consolidates above 134.50 in the next few hours, it could continue with an upward move and could reach 135.93. The eagle indicator is in the oversold zone. So, while the pair is trading above 134.00, any correction will be seen as an opportunity to buy.

In case the yen falls below 134.05, it could break the uptrend channel formed since the beginning of the week and it could reach 133.30 and even 132.81 (5/8 Murray).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română