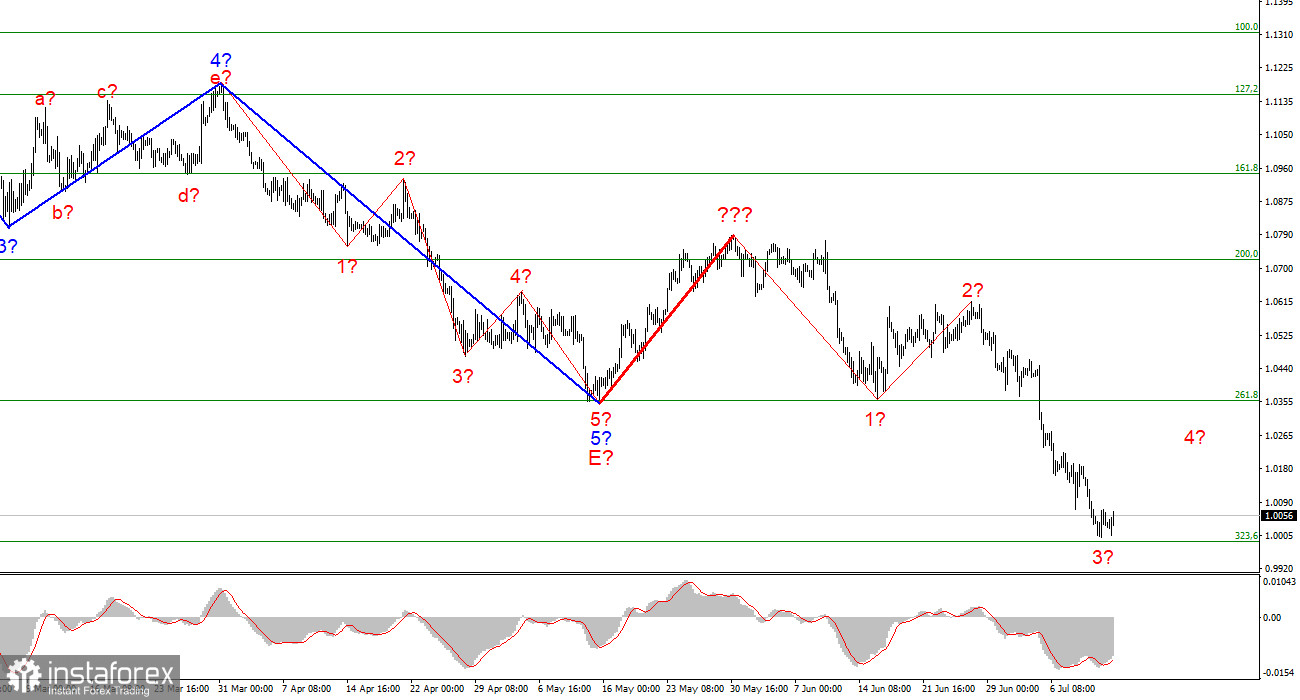

The wave marking on the 4-hour chart for the euro/dollar instrument became more complicated following last week's decline of nearly 300 basis points. Thus, the Fibonacci level of 261.8%, which was also the low of waves E and b, was successfully breached. It is now evident that these waves are not E and b, but market sentiment is of greater significance. A week ago, we had an excellent, promising wave structure consisting of a standard five-wave descent. Instead of constructing at least three upward correction waves, the market preferred to resume selling the instrument, indicating that wave analysis is currently of secondary importance. Now that we have one red-lined correction wave, the instrument can construct a new five-wave descending series. I recommend paying close attention to the lowest wave order now, as wave marking appears to be very challenging on a larger scale. If the current wave identification is accurate, then the decline in quotes will resume after the completion of wave 4 construction. Or wave 3 will assume a form that is even more extensive.

Near the price parity of the euro and the dollar, the market froze up.

On Wednesday, the euro/dollar pair increased by 20 basis points. Yesterday and today, however, the movement's amplitude is minimal. This leads me to the conclusion that the market is waiting, and it is abundantly clear for what. In one hour, the United States will release a report on inflation, upon which a great deal depends. Even though the instrument has already fallen below the 1.0000 level, the construction of the downward trend section is not yet complete. Permit me to remind you that the current wave marking requires the creation of at least one additional descending wave. And if today's inflation report impresses the market, we can anticipate another euro currency decline. I am more likely to believe that the construction of wave 4 will commence today. It is difficult to determine what the inflation rate should be for the dollar's demand to decrease slightly. Not always does the market react appropriately to reports and news. Therefore, I recommend not speculating on what will occur in a few hours but rather waiting for the report.

In addition to being significant in the present, American inflation will also be significant in the future. Inflation will ultimately determine the Fed's decision at the end of the month when the next meeting is scheduled to occur. If inflation continues to rise, as the majority of analysts currently anticipate, the regulator will be able to raise the rate by 75 basis points at once. In the event of a further increase in inflation, this option will become practically the only viable alternative. The new monetary policy tightening will allow the market to continue to increase demand for the US dollar.

General conclusions

Based on the analysis, I conclude that construction of the downward trend section has resumed and is ongoing. If this is the case, then it is now possible to sell the instrument with targets near the estimated 0.9988 level, which corresponds to 323.6 percent Fibonacci, for each "down" MACD signal, based on the formation of waves 3 or 5. A successful attempt to break through the 323.6 percent level will signal to maintain open sales positions with targets near 0.9395, which corresponds to a Fibonacci extension of 423.6 percent.

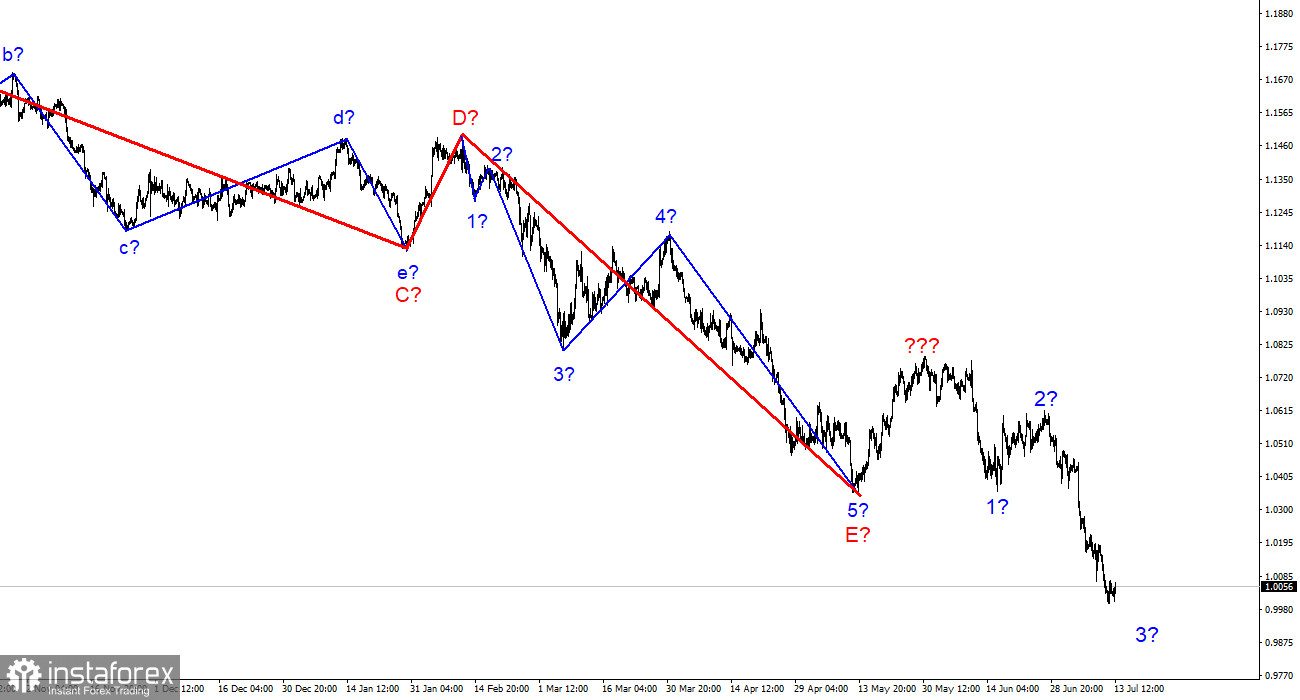

At the larger wave scale, the wave marking of the descending trend segment becomes noticeably more complex and extends in length. It can assume almost any length, so I believe it is best to isolate and focus on three- and five-wave standard wave structures at this time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română