Details of the economic calendar from July 12

Tuesday was not much different from Monday in terms of the macroeconomic calendar. Important statistics in Europe, the UK, and the United States were not published. Thus, traders tracked the information and news flow and worked based on the technical picture.

Analysis of trading charts from July 12

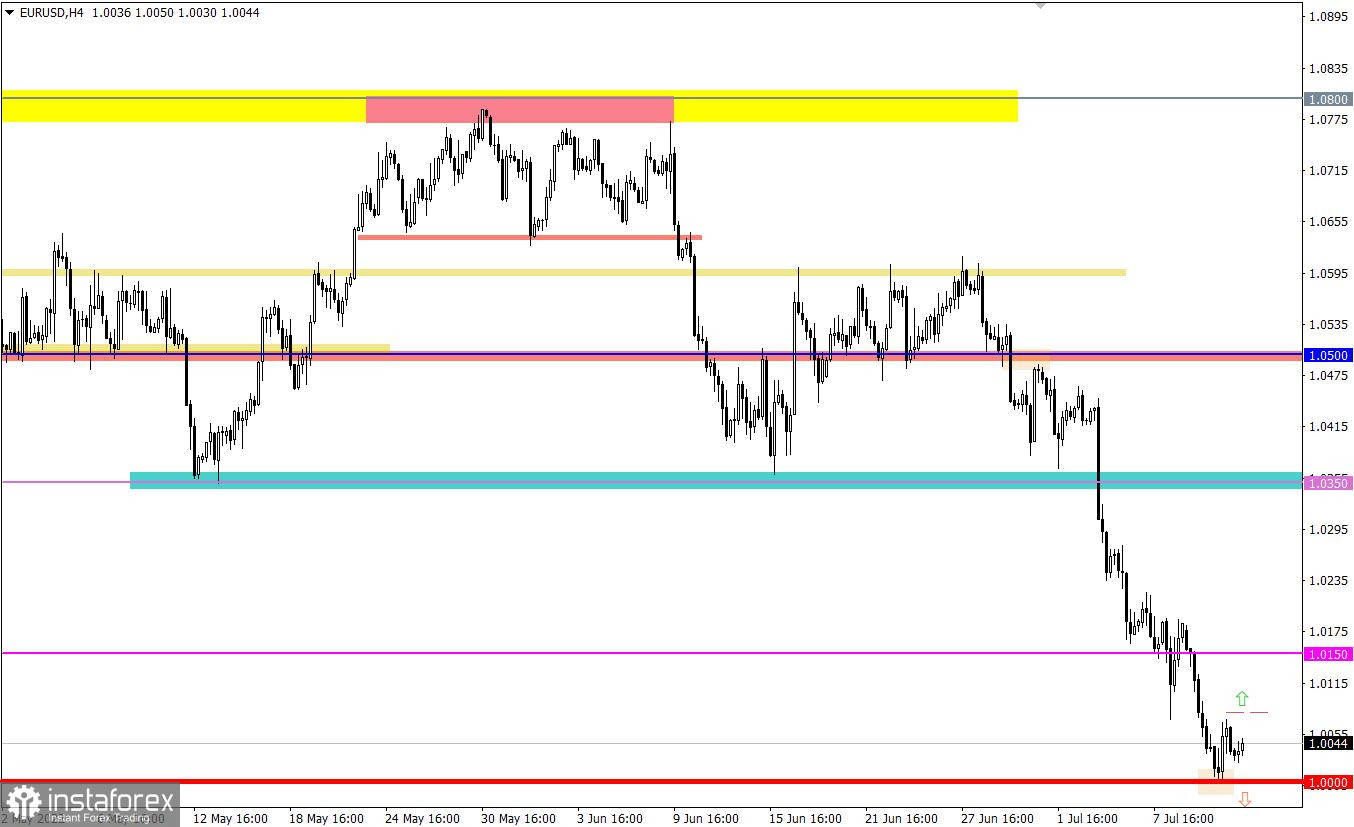

For the first time in 20 years, the euro has equaled the dollar in price. This historical event increased the volume of long positions after the price touched the parity level. As a result, there was a pullback, while there is a downward interest among market participants.

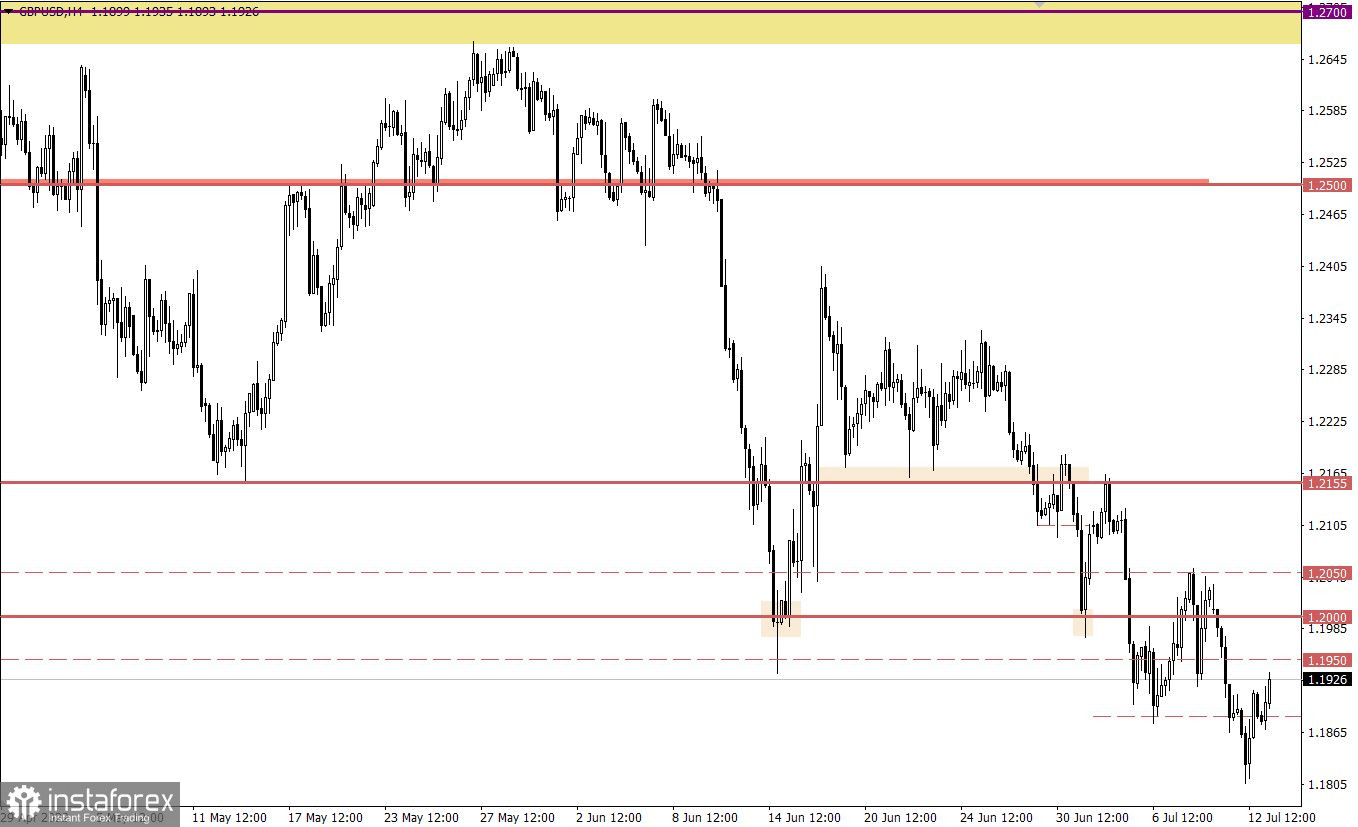

The GBPUSD currency pair has similar price fluctuations through a positive correlation with EURUSD. After the next update of the local low of the downward trend, the quote slowed down around the value of 1.1800, where a pullback eventually occurred. If we compare the time of the pullback, we can see that it occurred at the time of the price rebound from the level of parity in the euro.

Economic calendar for July 13

Today we have an active trading day in terms of the macroeconomic calendar. Data on industrial production in the UK were released at the start of the European session, showing an acceleration in the growth rate in annual terms from 0.7 percent to 1.4 percent. Despite the fact that a decline of 0.3% was predicted, there was no market reaction to the divergence of expectations at the time of the release of statistical data.

The same data is also expected for the European Union, where a slowdown is anticipated and might have a negative impact on the value of the euro. The fact that traders disregarded the data on Britain suggests that the figures from the EU may also be ignored.

The main event of the day will be the publication of inflation data in the United States, where growth is expected from 8.6% to 8.8%. High inflation is considered one of the key problems in the United States, which adversely affects the economy. Thus, this news may lead to an increase in market volatility during the period of its publication.

Time targeting

European Industrial Production – 09:00 UTC

US Inflation – 12:30 UTC

Trading plan for EUR/USD on July 13

In this situation, traders will focus on the parity level since holding below will lead to a subsequent increase in the volume of short positions. In this case, the euro may fall towards 0.9800–0.9700.

Traders will consider a full-fledged correction scenario if the price holds above 1.0080 in a four-hour period. In this case, a gradual increase in the euro exchange rate (1.0150–1.0250) may occur.

Trading plan for GBP/USD on July 13

In this situation, everything will depend on the behavior of speculators on the correlating eurodollar pair. In the case of a full-fledged correction, the pound sterling will also be able to strengthen its position towards the values of 1.1950–1.2000. Otherwise, we will update the local low of the downward trend again.

What is reflected in the trading charts?

What is reflected in the trading charts?A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română