Risk appetite fell on Wednesday morning. Brent, for instance, went below $ 100 per barrel amid fears of a slowdown in the global economy. But Wednesday's key event is the release of June CPI report in the US, which will influence policy decisions by the Fed. Aside from that, the Bank of Canada and the RBNZ will hold their meetings today, both of which are expected to end with further rate hikes to curb inflation.

But the strongest problems are now concentrated in Europe, which has difficulties solving internal divisions and developing a realistic foreign policy. Euro is also under pressure amid decreasing gas supply, fall of ZEW index to its lowest level since November 2011 (-53.8 vs. expected -40.5), and the likelihood of a recession in Germany.

Signals are also appearing from the Fed, indicating growing fears about the approach of a recession. Richmond Fed chief Tom Barkin said he sees signs of easing from low-income households. The Fed's published research paper also discussed the risk of a recession more openly, saying there is a 35% to 60% chance of a recession in 2023 depending on how the Fed's policy changes.

Volatility is expected to surge today, but risk appetite will remain low, while dollar demand will rise.

USD/CAD

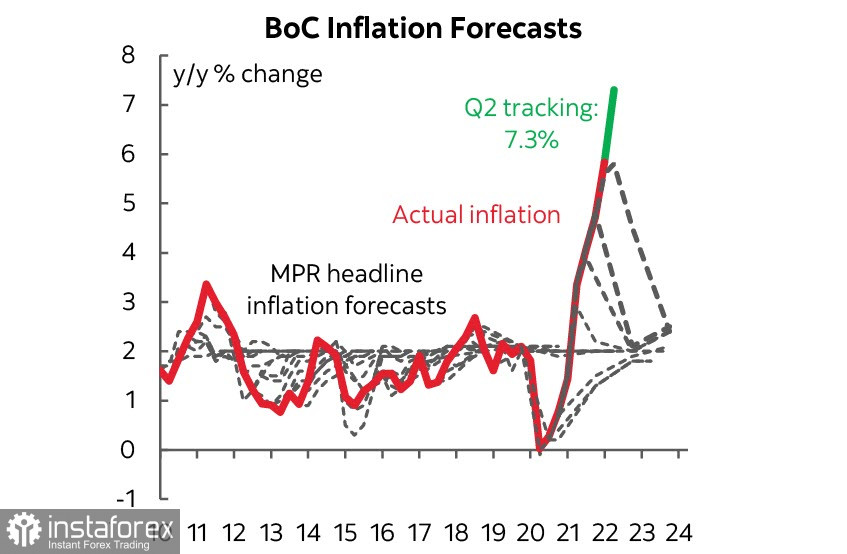

The Bank of Canada will announce its interest rate decision today, along with the release of updated forecasts and estimates on its monetary policy. Chief Tiff Macklem will hold a press conference, following the publication of the consumer price index in the US.

Many expect to see a 0.75% rate increase from the current 1.5%. Some even predict a hike of 100p since inflation is 4 times higher than the target level. Nevertheless, the Bank of Canada will continue to chase inflation, especially since CPI is now at its highest since 1983 and average core inflation is at record high.

Although inflationary expectations continue to grow, GDP in Canada is significantly higher than in the US. This means that it has moved away from the threat of recession.

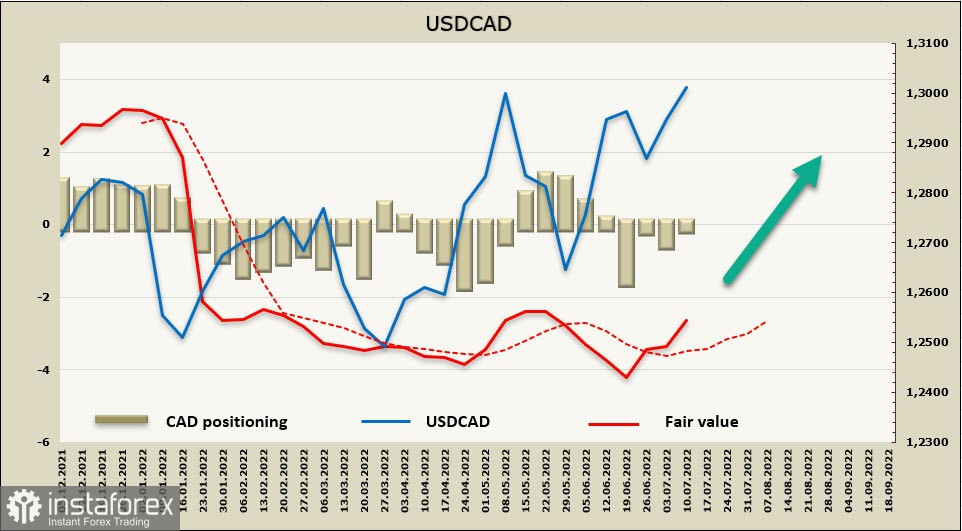

As such, if today's meeting goes according to forecasts, the market may react in favor of USD/CAD decline. But if the rate increases by 100, the pair will rise to 1.2610/50.

Talking about the latest COT report, the positioning of the Canadian dollar is close to neutral, having the weekly change at -377 million. The settlement price is directed upwards, which means that USD/CAD will continue to grow.

CAD is one of the few currencies that remains stable against dollar. Because of this, USD/CAD is in correction for two months, not being able to overcome the resistance area of 1.3060/70. Several attempt will still occur, so CAD will most likely rise a bit and head towards 1.3320/40.

USD/JPY

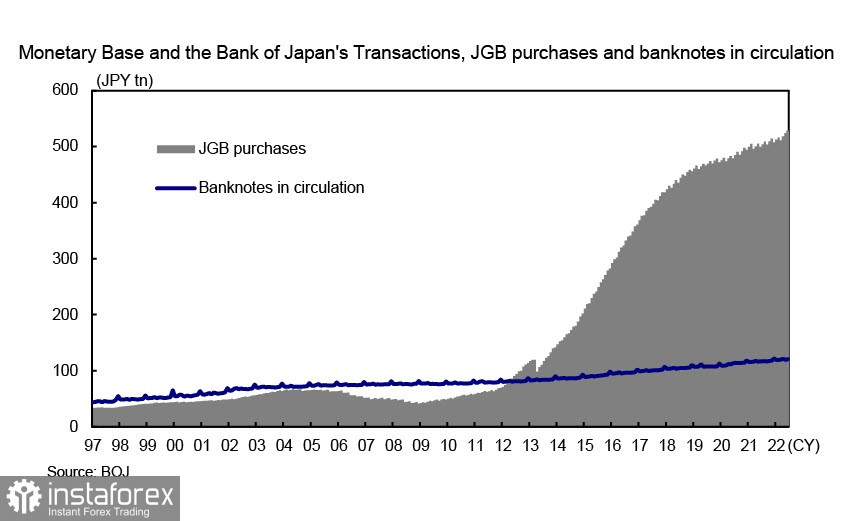

The Bank of Japan continues to defend its yield target. In June, it purchased a record amount of £ 16 trillion. It does not limit its operations in any way and even increases the intensity of purchases in response to changing market conditions.

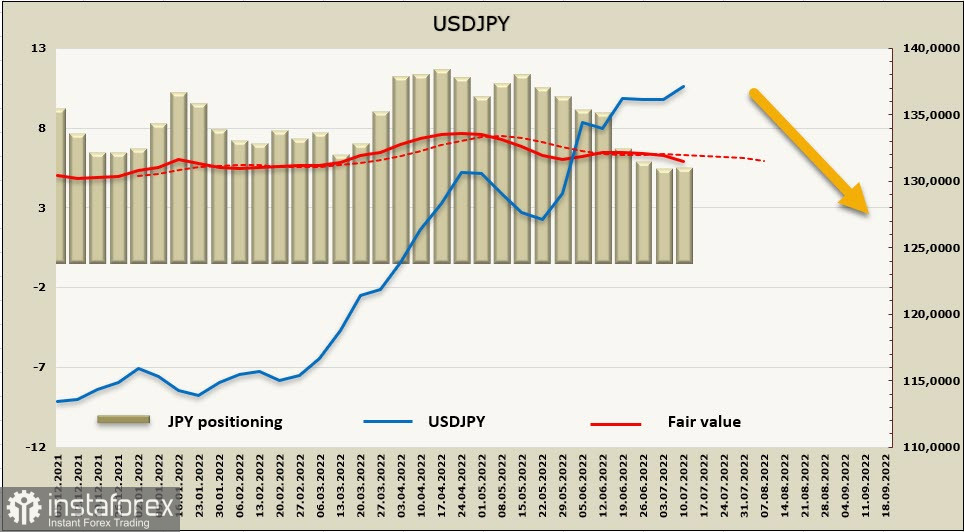

Attempts of speculators to force the Bank of Japan to abandon its goal are failing so far. US Treasury Secretary Yellen previously said she does not want foreign exchange intervention to support the weak yen, stressing that G7 countries should have market-driven exchange rates and "only in rare cases is intervention justified." If so, then the growth of USD/JPY will continue.

Talking about the latest COT report, a weekly gain was recorded in JPY, but the settlement price is still lower than the spot price and lower than the long-term average. This indicates that there will be a corrective decline in the yen.

So, USD/JPY will continue to grow, especially since protecting the yield target leads to more liquidity in the market. The pair will head to 147.68, unless the Bank of Japan stops purchasing huge amount of bonds. If that happens, the pair will fall to 130/135, or even lower.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română