What is happening with the pound should now be considered exclusively through the single European currency, the behavior of which determines the development of events in the foreign exchange market. And in general, everything happened exactly as predicted - as soon as the euro reached parity, a rebound immediately began. Confused only by the scale of the rebound. Less than a hundred points. And this despite the fact that the dollar is simply unimaginably overbought. So it is quite possible that a second attempt will be made today. Moreover, the single currency is again moving towards parity.

With that in mind, the just-released UK industrial production figures are irrelevant. Although its growth accelerated from 0.7% to 1.4%. Whereas, a decline of 0.3% was called before. But there was no reaction.

Industrial production (UK):

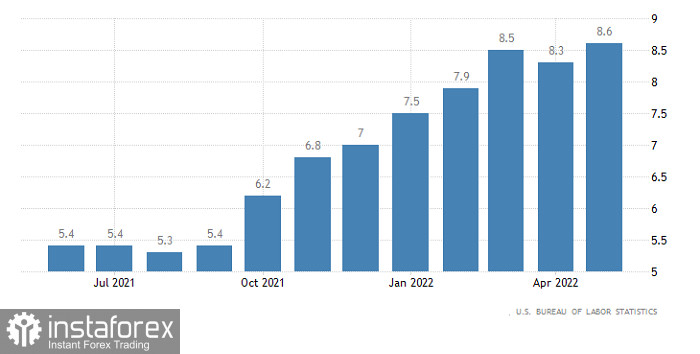

Today's attempt at a rebound will be more successful due to the fact that this time its implementation will be helped by a rather serious reason. The US will release its inflation report, which should accelerate from 8.6% to 8.8%. And if earlier the growth of inflation contributed to the dollar's growth, now the situation is somewhat different. Rising consumer prices forced the Federal Reserve to raise interest rates, the expectation of which just contributed to the dollar's growth. Now everything is clear with the increase in the refinancing rate - the US central bank will raise it until the middle of next year. So the only thing that reflects inflation now is only a further deterioration in the state of affairs in the economy and the approach of a recession.

Inflation (United States):

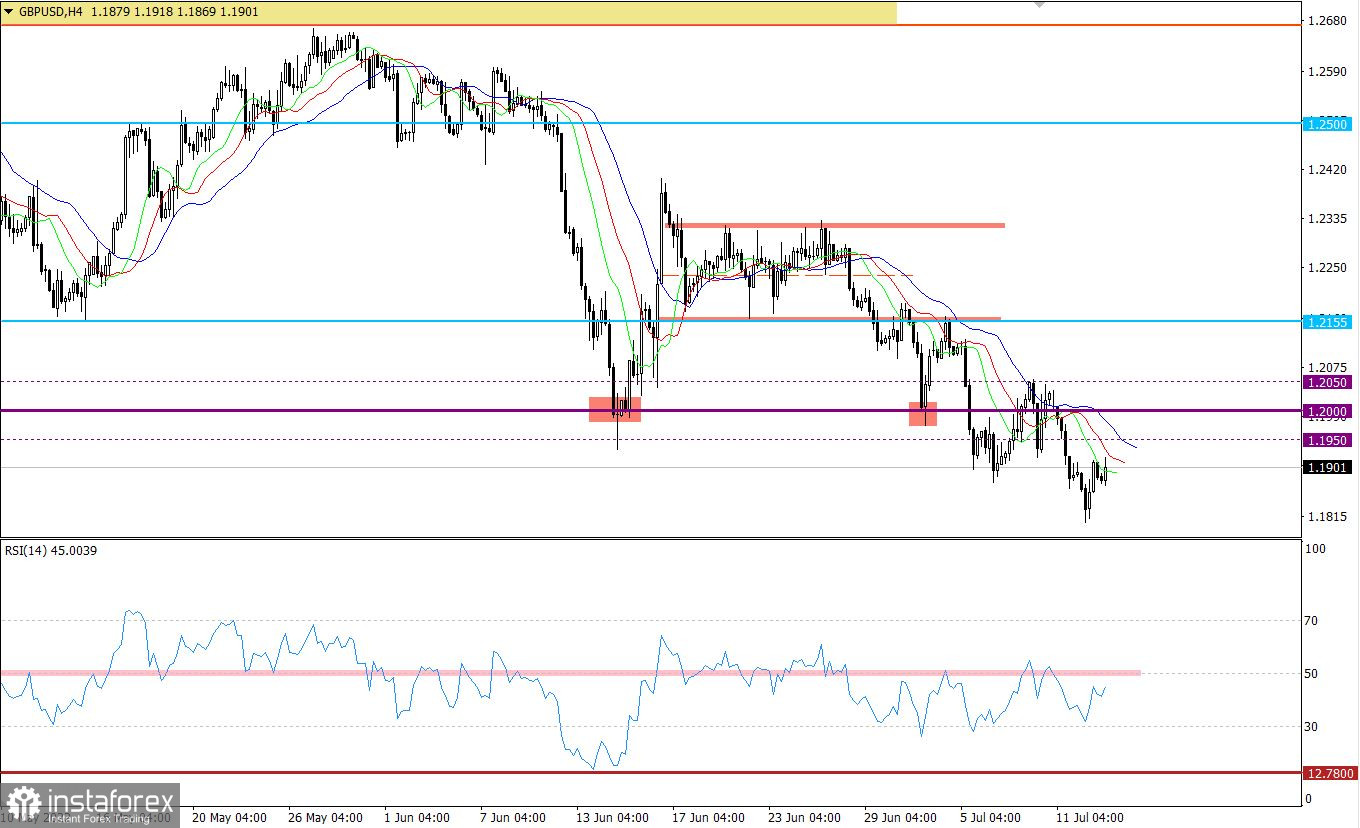

The GBPUSD currency pair, through a positive correlation with EURUSD, has similar price fluctuations. After the next update of the local low of the downward trend, the quote slowed down around the value of 1.1800, where a rollback eventually occurred.

The technical instrument RSI H4 and D1 is moving in the lower area of the 30/50 indicator, which indicates a high interest of traders in the downward move. RSI H1 in the rollback stage locally crossed the middle line 50 upwards.

The moving MA lines on the Alligator H4 and D1 indicators are directed downwards, which corresponds to the direction of the main trend.

Expectations and prospects

In this situation, everything will depend on speculators' behavior on the correlating euro/dollar pair. In the event of a transition to the stage of a full-size correction, the pound will also be able to strengthen its position towards the values of 1.1950-1.2000. Otherwise, we will update the local low of the downward trend again.

Comprehensive indicator analysis signals a buy in the short term due to a pullback. Technical instruments in the intraday and medium-term periods signal sell due to price movements within parity.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română