US index futures fell on Tuesday as the dollar and sovereign bonds rose, highlighting widespread concern about the economic outlook amid high inflation and China's struggles with Covid.

The S&P 500 and Nasdaq 100 futures dropped by about 0.5% each, as traders brace for a Q2 earnings season which may provide clues on how companies are weathering inflation and recession concerns. PepsiCo, one of the first major corporations to report, rose in premarket trading after lifting its revenue forecast. The soft-drinks maker said demand remained robust despite inflation.

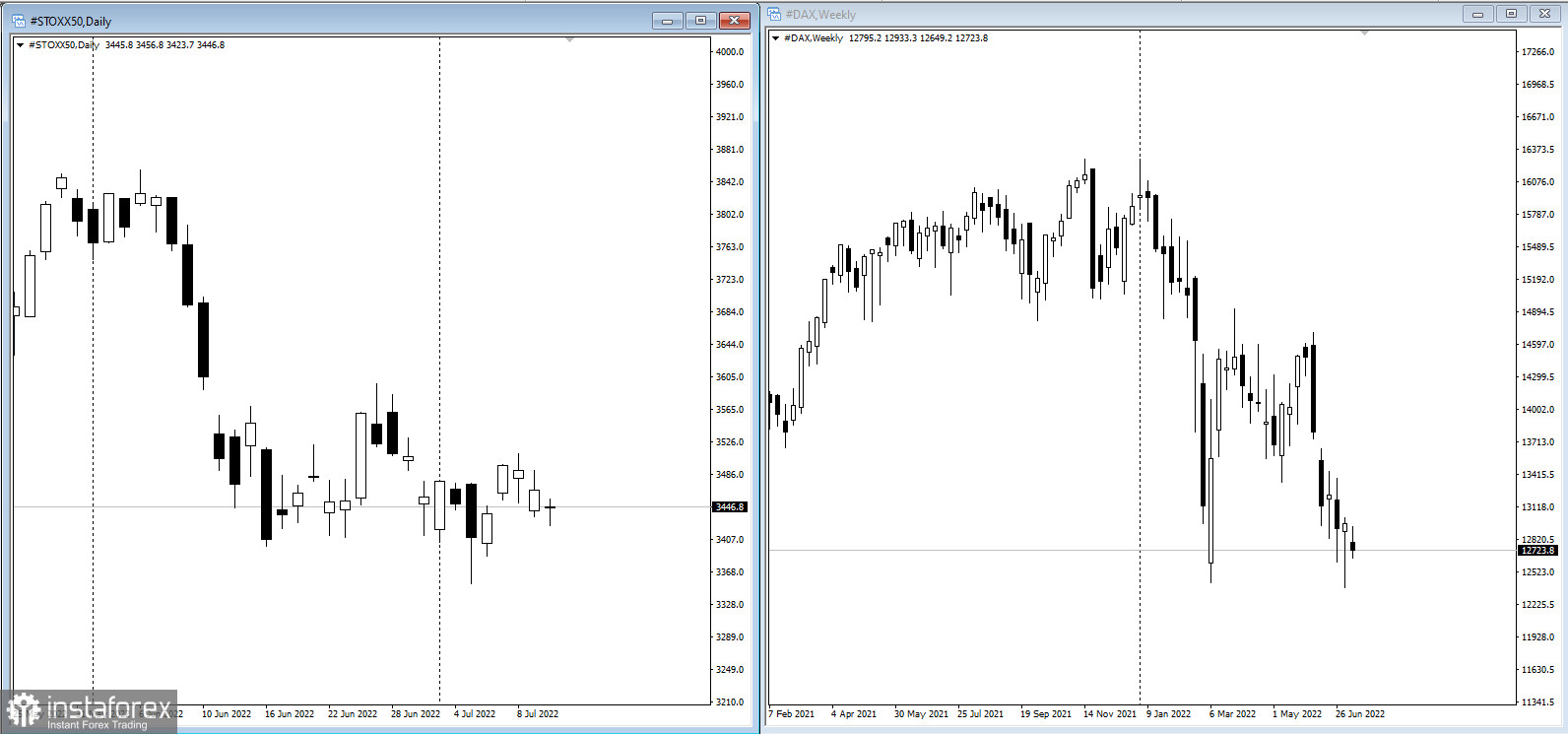

Euro Stoxx 50 dropped for a second straight day, though it pared the decline with utilities outperforming as EDF jumped after a report that the French government will pay a premium to take control of the electricity company.

The Asian stock index posted its biggest two-day decline in a month.

The dollar rose just shy of record highs last seen at the height of the 2020 market panic over Covid. The yen strengthened, underlining investor caution. The euro meanwhile briefly touched parity hammered by the region's energy crisis and acute recession fears. German bonds surged, sending the benchmark 10-year yield to the lowest since May, after data showed investor confidence plunged to a 2011 low.

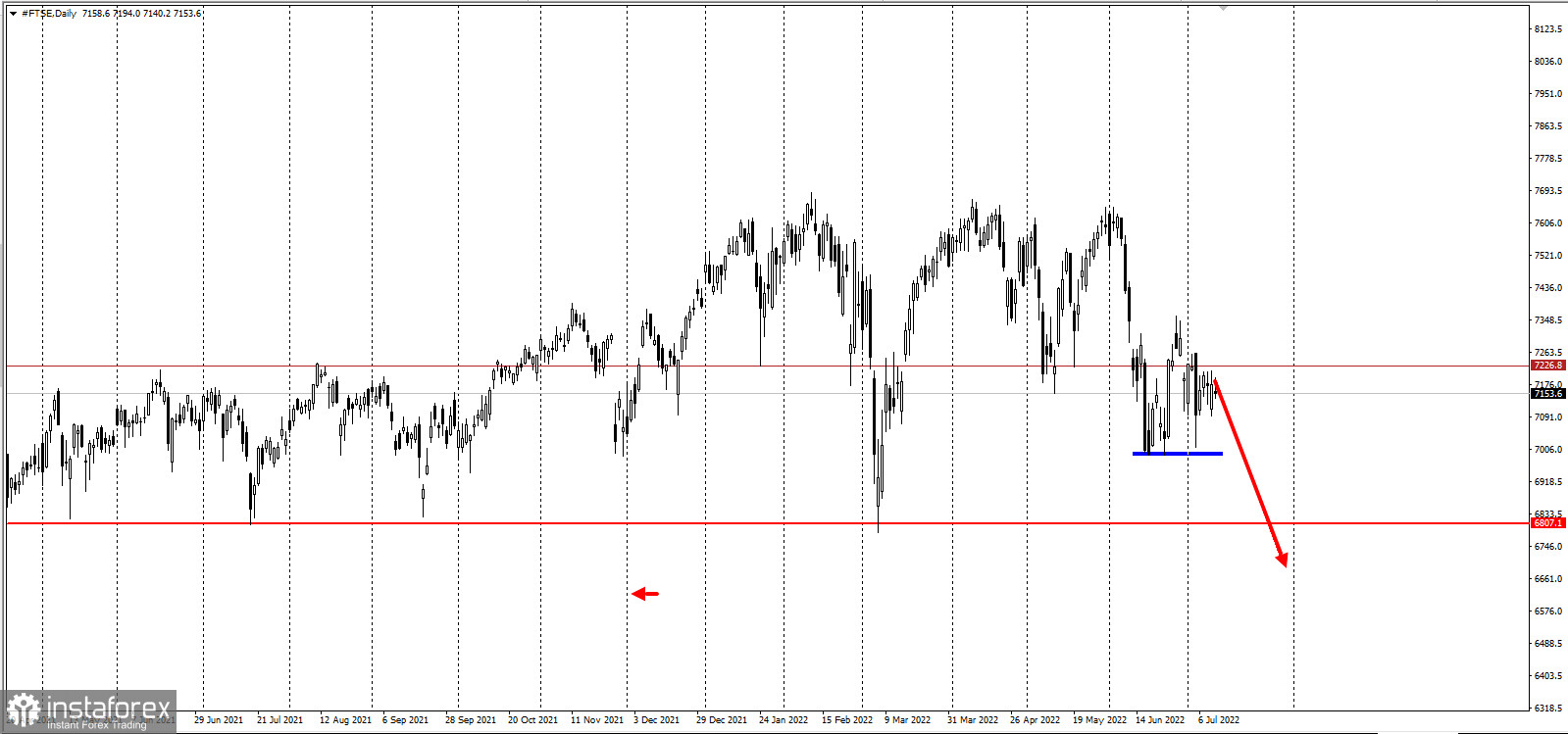

The FTSE 100 is also under pressure as a result of the political crisis in the UK:

Treasuries rose, taking the US 10-year yield near 2.9%. Bonds also rallied in Europe.

In China, investors are concerned that Covid-19 restrictions may be re-impose as Beijing continues its strategy of mass testing and mobility restrictions.

Meanwhile, the Fed's latest comment highlighted both the hawkishness of the central bank and the risks of an aggressive interest rate hike.

Federal Reserve Bank of Atlanta President Raphael Bostic said the US economy can cope with higher interest rates and repeated his support for another jumbo move this month. Federal Bank of Kansas City President Esther George dissented last month against the central bank's jumbo 75 basis-point. However, now she has warned that a hasty policy tightening could have unpleasant consequences.

What to watch this week:

- Earnings due from JPMorgan, Morgan Stanley, Citigroup, Wells Fargo

- BOE Governor Andrew Bailey discusses the economic landscape, Tuesday

- Amazon.com Inc. kicks off its Prime Day event, Tuesday

- South Korea, New Zealand rate decisions, Wednesday

- US CPI data, Wednesday

- Federal Reserve Beige Book, Wednesday

- US PPI, jobless claims, Thursday

- China GDP, Friday

- US business inventories, industrial production, University of Michigan consumer sentiment, Empire manufacturing, retail sales, Friday

- G-20 finance ministers, central bankers meet in Bali, from Friday

- Alanta Fed President Raphael Bostic speaks, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română