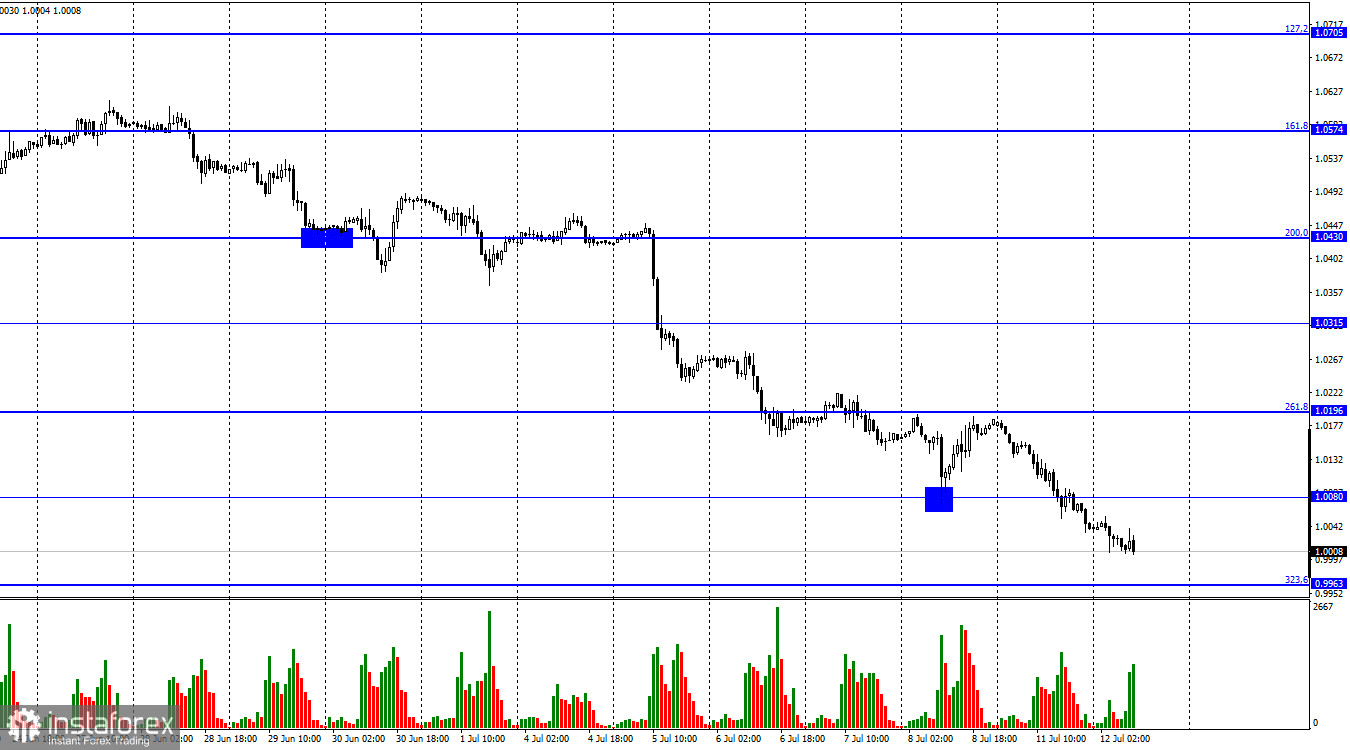

EUR/USD keeps on sliding after consolidating below 1.0080 towards the correctional level of 323.6% at 0.9963. During the first two days of the new week, bear traders continue to actively get rid of the European currency. Euro has already fallen to the important 1.0000 level. For the past decades, 1.0000 has been the level that represented the true strength of the European currency and of the European Union as a whole. For over 20 years, the pair was above 1.0000, sometimes even above 1.5000. However, it is now much more likely that the Euro will be under 1.0000 for the next few years. Neither on Monday nor on Tuesday, there were no major events that could cause the pair to fall by 200 pips. This movement can be described as an uncontrolled fall. At the beginning of the week, I was expecting a US inflation report, which could have caused a rise in the dollar or a rise in the euro. Now, this report makes no sense, as the pair is trading in one direction only.

Even a weak US inflation report will not change anything. So, frankly, it is hard for me to even imagine what could save the European Union currency right now. Remarkably, the EU economy does not seem oppressive. The latest GDP data was weak, but not a failure. Certainly, inflation is rising and the ECB is inactive. However, are these reasons enough for the pair to fall 800 points in one month? Traders may be worried about an energy crisis in Europe. However, the market cannot move constantly on mere fears. All in all, the current situation is discouraging and very unexpected. I had no doubt that the euro would continue its fall. In fact, no one could have predicted that it would be so fast and so strong.

On the 4-hour chart, the pair is holding under the corrective level of 127.2% (1.0173). As a result, the price decline can be extended toward the next corrective level of 161.8% (0.9581). Today, no indicator has detected brewing divergences. The downward trend corridor continues to characterize traders' mood as bearish.

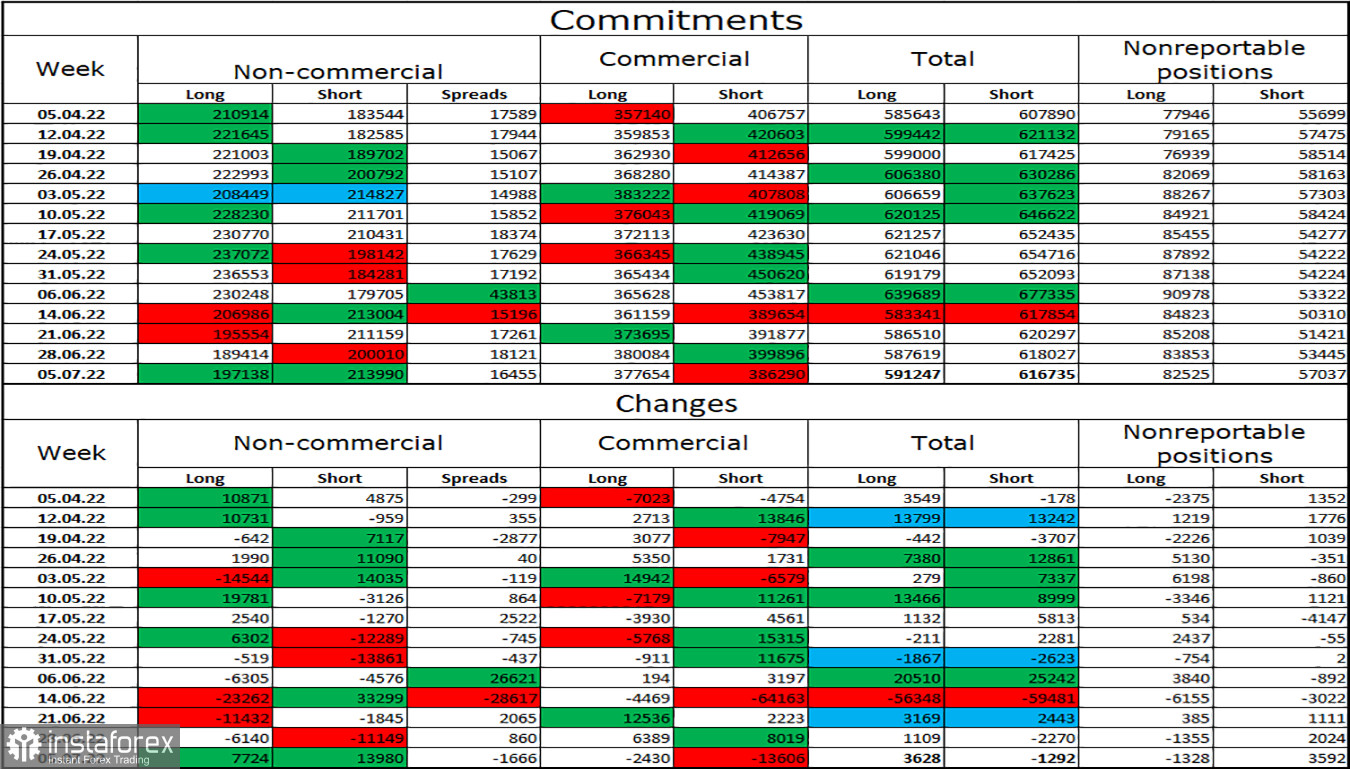

Commitments of Traders (COT) report:

Speculators opened 7,724 long contracts and 13,980 short contracts during the previous reporting week. This means that the major players' "bearish" mood has intensified and will remain "bearish." The total number of long contracts concentrated in the hands of speculators is now 197 thousand, with 214 thousand short contracts. The difference between these figures is minor, but it is not in the bulls' favor. In recent months, the euro has mostly maintained a "bullish" mood among "non-commercial" traders, which has done nothing to help the euro currency. The chances of a euro currency rise have gradually increased in recent weeks, but recent COT reports indicate that new sales of the EU currency may now follow, as speculators' mood has shifted from "bullish" to "bearish." This is the exact progression of events that we are witnessing right now.

News for the United States and the European Union:

On July 11, neither the European Union nor the United States had any interesting economic events scheduled. Today's traders' mood will be unaffected by the information background. However, the European currency has been falling for a day and a half and is not going to stop.

EUR/USD outlook and tips for traders:

I recommended to open short positions at a close under 1.0196 with targets 1.0080 and 0.9963, the first of which has already been reached and the second might be reached within a few hours. I recommend to buy the Euro currency at a consolidation above the corridor on the 4-hour chart with a target of 1.1041.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română