EUR/USD

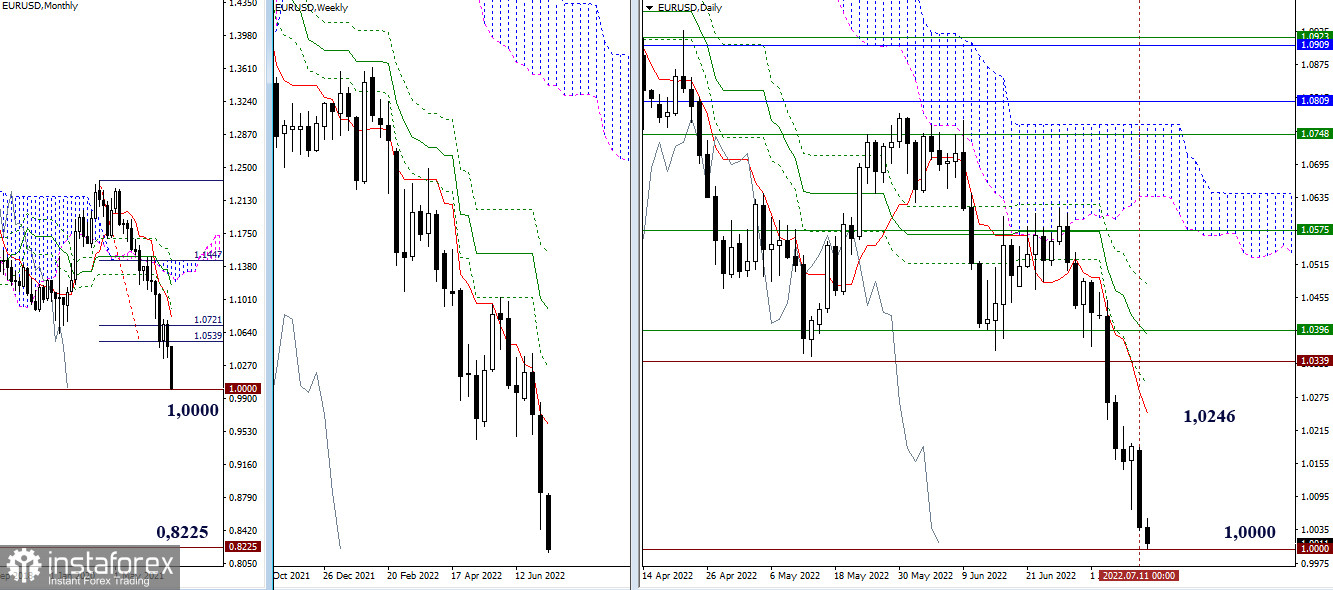

Higher timeframes

Bulls were not able to realize the braking in this area, the prerequisites for which were outlined on Friday last week. The decline continues actively. The significant psychological level of 1.0000 has now been reached. The result of the interaction will determine the upcoming moods. Braking, consolidation, or rebound are options for bulls. The breakdown of support at 1.0000 and continued decline, preferably with the same pace and effectiveness, is a continuation of the bearish scenario. The levels of the daily Ichimoku cross left behind now act as the nearest resistance of the higher timeframes, but due to the distance of location (the first one is 1.0246 Tenkan), they are unlikely to be relevant today.

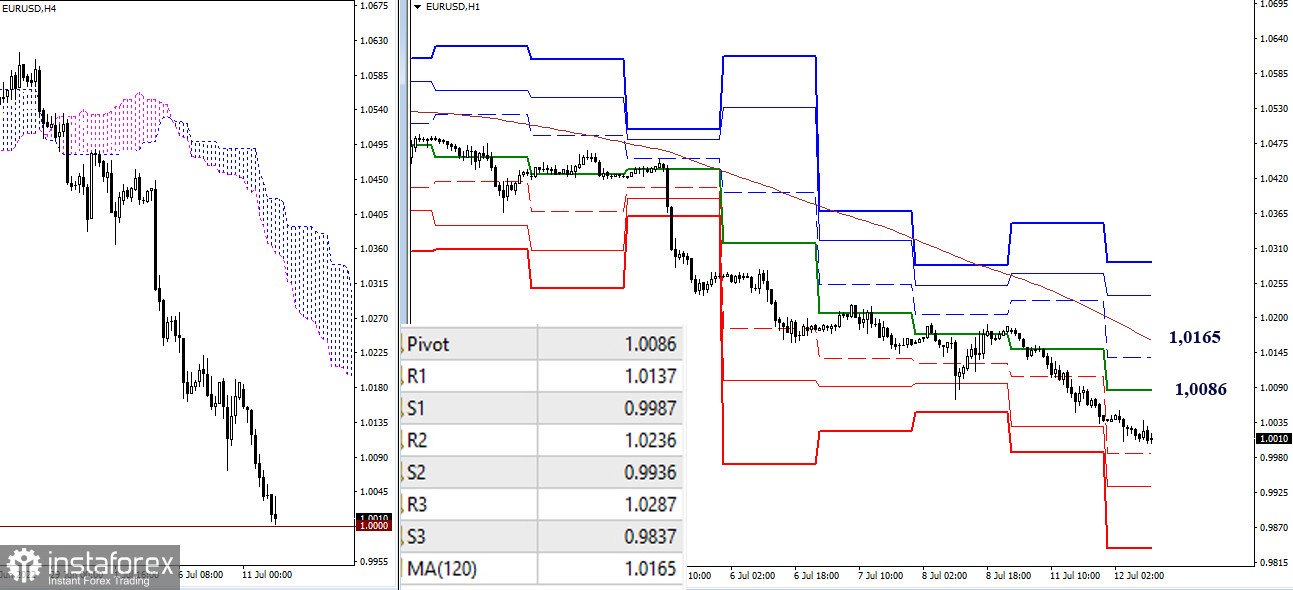

H4 – H1

A downward trend develops in the lower timeframes. The reference points for the intraday decline are now the support of the classic pivot points (0.9987 – 0.9936 – 0.9837). In the event of a corrective upswing, players will be primarily interested in the key resistance levels. They are currently located at 1.0086 (central pivot point) and 1.0165 (weekly long-term trend). Consolidation above can change the current balance of power in the lower timeframes.

***

GBP/USD

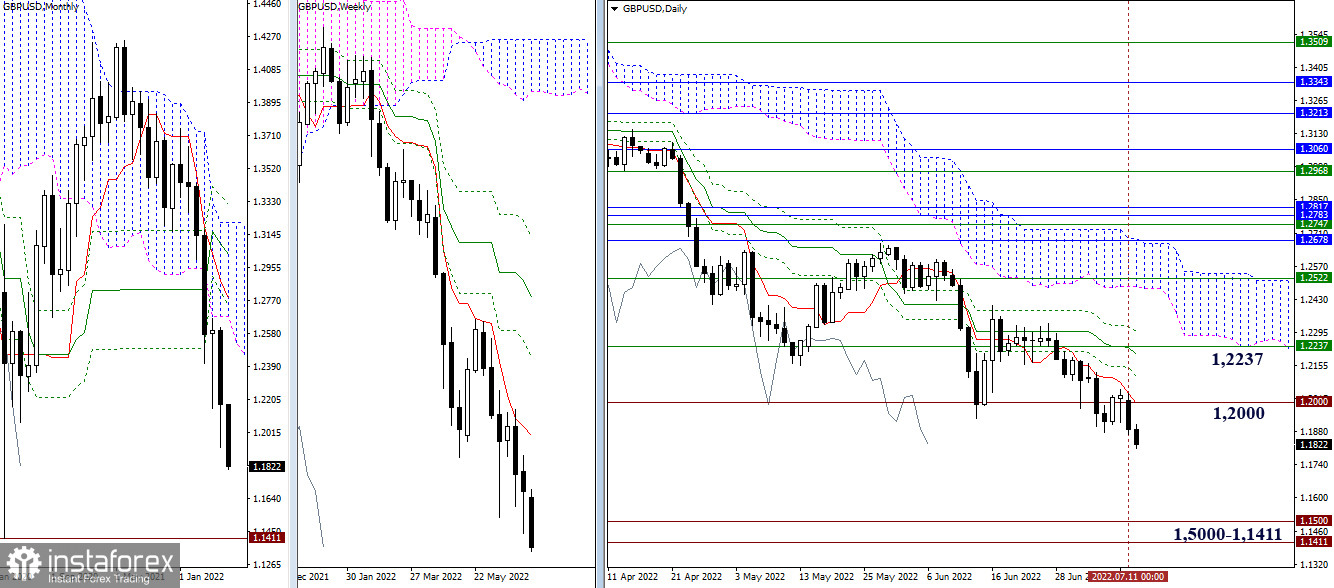

Higher timeframes

The pound also left the correction zone and resumed the downward trend. The most significant reference points for the bears are now the psychological level of 1.5000 and the 2020 local low at 1.1411. For bulls, in case of another recovery of positions, the resistance zone 1.2000 – 1.2237 (daily cross + psychological level + weekly short-term trend) will be of particular interest. Its passage will form new perspectives.

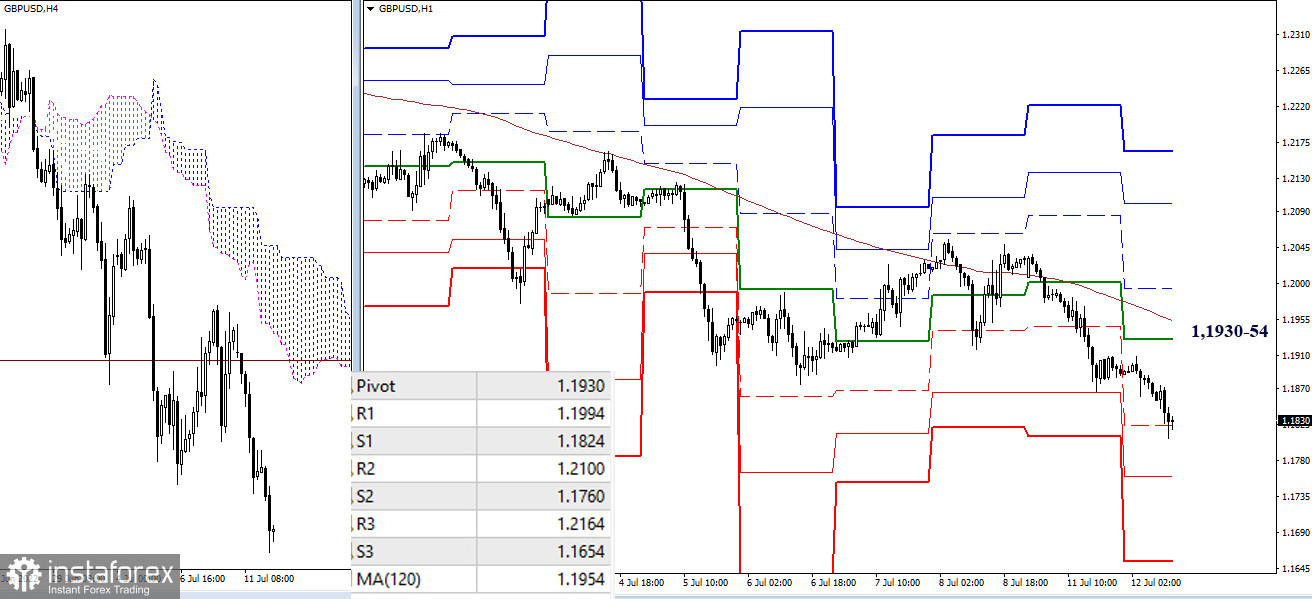

H4 – H1

In the lower timeframes, the advantage belongs to the bears. They are currently testing the first support of the classic pivot points (1.1824), then the second (1.1760) and the third (1.1654) support of the classic pivot points serve as reference points for the intraday decline. If there is a corrective recovery, then the main interest of the bulls will be aimed at conquering the key levels of the lower timeframes that determine the balance of power. Today they are consolidating their efforts around 1.1930–54 (central pivot point of the day + weekly long-term trend).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română