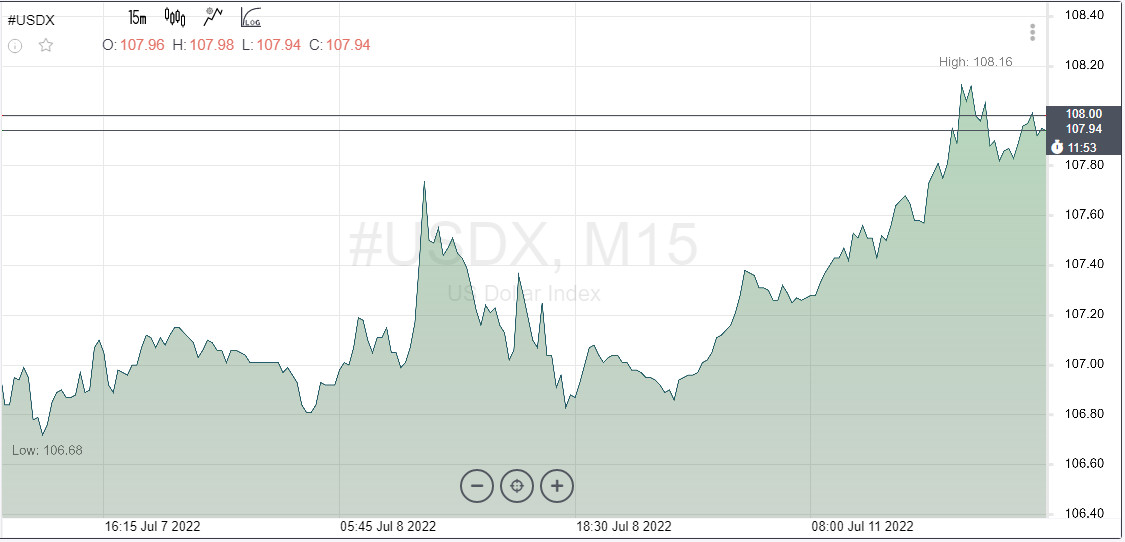

Demand for the dollar increased at the beginning of the new week. The US dollar index jumped to a new multi-year high, breaking through the 108.00 mark at the moment. Support comes from lingering concerns about global economic growth and increasingly restrictive US monetary policy. Analysts cited elevated global inflation, an energy crisis in Europe and Covid-related uncertainty in China as additional factors boosting the influx of dollars.

Strong payrolls reinforced the Federal Reserve's aggressive stance on inflation. The head of the Atlanta Fed, Rafael Bostic, who until recently was among the dovish politicians, said that he fully supports another 75 bp rate hike this month.

In addition, investors are looking forward to the release of US inflation data on Wednesday. Another strong reading is likely to reinforce expectations of continued aggressive tightening by the Fed.

Further growth of the dollar is expected in the short term. Continuation of the upward trend is initially aimed at the 108.00 round level, then the October 2002 high at 108.70 could be taken.

Resistance is now the round level of 108.00.

Most banking analysts, including UBS, adhere to the ascending line for the US currency in the near future. The rally should continue given the current climate of risk aversion. In the more distant future, the dollar is unlikely to be able to maintain strength. The current rally will have certain limits, including temporary ones.

UBS said in a report that the dollar's gains will be held back by peak Fed rate hike expectations as investors begin to assess a significant slowdown in economic growth in 2023. Such prospects may even force the Fed to cut rates.

"We advise investors not to tune in to a continuation of the dollar rally. Our preferred defensive asset is the Swiss franc. We also favor commodity currencies, which we expect to benefit as commodity prices recover from their recent fall.

As for other major currencies, the fate of parity after the euro is now predicted for the pound.

The British currency is approaching its lowest level since March 2020 amid concerns about the UK's economic outlook as the race for the country's next prime minister begins. Ten Tory MPs, including former Chancellor of the Exchequer Rishi Sunak, have announced their intention to become the next prime minister.

Investors doubt that in the current difficult economic and political conditions, the Bank of England will be able to control rising inflation without harming the country. The central bank raised interest rates by 115 percentage points, but inflation shows no signs of peaking. Tensions in households are likely to escalate in the coming months, with markets cutting some of the rate hikes.

Market players are looking forward to monthly GDP data. A new report could show that the economy stalled in May, fueling expectations for an economic downturn in the second quarter.

Nomura believes that the pound is now on its way to testing the 1.1000 level. Analysts predict that this mark will be broken by September. They also do not rule out a fall in the exchange rate to parity with the dollar.

It is worth noting that Nomura has been holding a strategic short position on GBP/USD to 1.1800 since February. Now the pound is approaching the goal very quickly, we can say it is a few steps away from it.

The pound is inferior to its counterparts, and among the reasons for this distress, several additional factors can be noted. This, in particular, the increase in taxes in the UK. The country has done little to lower the cost of living. This leads to a reduction in consumer activity.

According to the updated Nomura forecast, the pound will fall below 1.1800 in the near future. The target for the end of July is 1.1500, and then, as mentioned above, it is worth waiting for a move to 1.1000 by the end of September.

The euro, as everyone has noticed, collapsed to parity against the dollar. Now the question is how long it will last on this fixed day. Prospects in the eurozone, to put it mildly, do not inspire optimism, so the euro will remain under severe pressure.

Investors worry that the energy crisis will send Europe into a deep recession and make it difficult for the European Central Bank to tighten monetary policy. The annual maintenance of the key Nord Stream 1 gas pipeline began on Monday, July 11, with flows expected to stop for ten days, but concerns remain that supplies may not return to current levels after work.

The ECB should raise rates by 25 bp at the July meeting. This will be the first increase in more than 11 years. The Fed, for comparison, will raise rates by 75 bp after a cumulative increase of 150 bp since March. It is clear that the euro has no chance of any meaningful recovery.

The dollar drove the Japanese currency to the new frontiers. The USD/JPY pair was quoted above 137.60 on Monday.

The yen thus reached a new 24-year low. This, among other things, was served by internal events in Japan. The ruling Liberal Democratic Party and its coalition partner Komeito increased their majority in elections for the upper house of parliament on Sunday. The victory signals no change in the current soft policy of the Bank of Japan.

The election took place two days after the assassination of former Prime Minister Shinzo Abe, widely regarded as a powerful figure in the ruling party. The yen is under pressure from the central bank's commitment to keep interest rates low to support the economy, while other major economies are rapidly raising rates to fight rising inflation.

BOJ Governor Haruhiko Kuroda said recently that the central bank would "without hesitation" take additional steps to ease monetary policy as needed.

Market players will continue to closely monitor the dynamics of Treasury yields. Unless the BOJ's yield curve policy is adjusted in the near term, the fate of the USD/JPY is likely to depend on US yields. If the yield increases, then the USD/JPY will continue to grow.

The nearest resistance levels are located at 138.00, 139.00, 140.00. Support at 136.00, 135.8, 135.20, 135.00, 133.70.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română