The demand for the US dollar is increasing as the Federal Reserve System continues to raise interest rates aggressively. The US Department of Labor reported an increase of nearly 400,000 new jobs in June this year, despite two sharp rate hikes of 0.5% and 0.75% months earlier. The fact that the unemployment rate is approaching a 50-year low is probably reason enough to tighten monetary policy further. And suppose the Federal Reserve System was trembling a few years ago over how to avoid a significant drop in the unemployment rate. In that case, it has to deal with extreme labor market tensions and stimulate the highest inflation in the last 40 years.

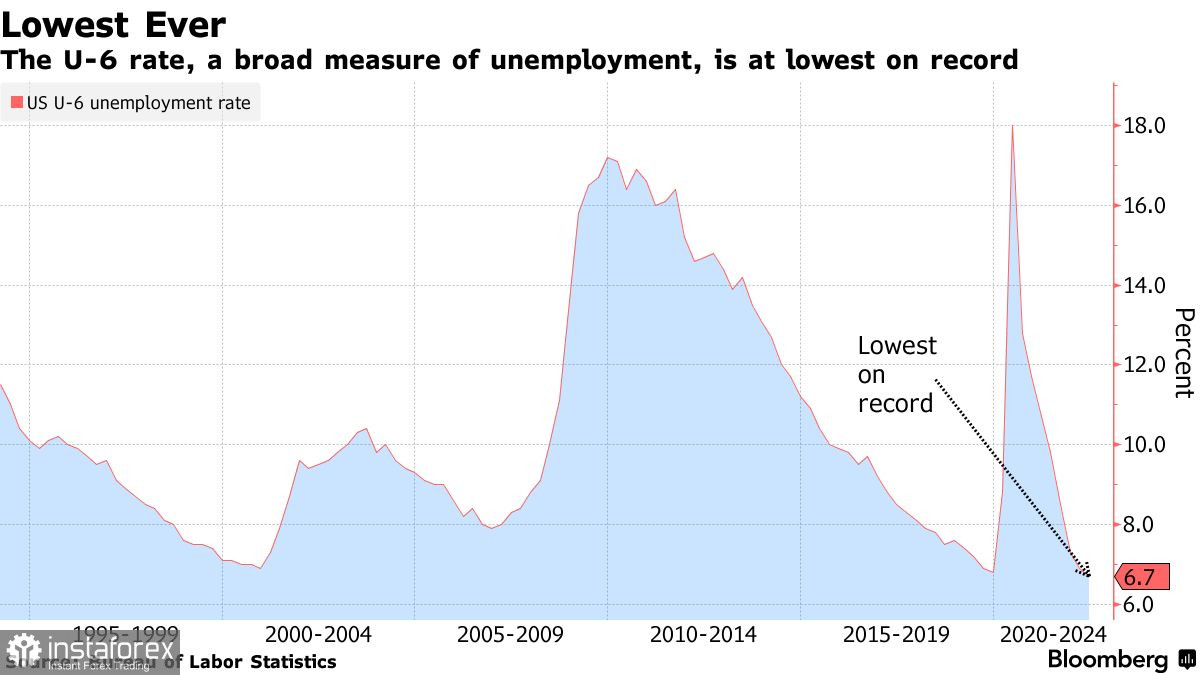

According to the report, the overall unemployment rate hit a record low last month, while wages for non-management workers continued to rise. The number of open positions remains near historical highs. All of this is expected to add to the acceleration of inflation, with consumer prices expected to reach a new high in June, exceeding the 9.0 percent mark.

Economists and traders now expect the central bank to raise interest rates by another 75 basis points later this month to reduce the economy's high demand and stimulate inflation. Several Fed policymakers stated this last week: Governor Christopher Waller and James Bullard, president of the Federal Reserve Bank of St. Louis, emphasized the importance of hawkish policies in dealing with the most severe price pressures in 40 years, even if it means slowing economic growth. Bullard argued against raising interest rates at a separate event last week. He believes the US still has "good chances of a soft landing," though there are always risks. "When I see all these models for predicting a recession, which many economists now publish, I smile a little because we at the Fed know for certain that predicting a recession is not so easy," he told reporters. "At this point, I believe it makes sense to choose a 75-point increase all at once, as it did last month. I have spoken and will continue to speak in favor of achieving an interest rate of 3.5 percent by the end of this year because only then will we be able to see how inflation is progressing."

The broader U-6 unemployment rate, which includes unemployed and underemployed workers, fell to its lowest level since 1994 in June, indicating that layoffs are becoming increasingly rare. Employers have been struggling for months to hire qualified workers and retain existing ones due to a labor shortage.

Because of the low unemployment rate, the number of workers looking for work will remain extremely low, increasing vacancies. According to several experts, this dynamic will only fade at the end of this year when the Fed raises interest rates sufficiently to dampen consumer appetite and, as a result, labor demand.

In any case, an increase in US interest rates will maintain demand for the US dollar.

In terms of the euro's prospects, everything is very bad. It is not necessary to discuss serious purchases or bulls' attempts to correct the situation just yet. Only a return to 1.0190 will assist in dealing with the developing bearish scenario. Only after we see a consolidation at 1.0120 will the prospects for a recovery in the area of 1.0190 and 1.0270 open up. Even so, the bulls will not be able to seize market control. Maximum - we'll hang out in the side channel once more. If the euro falls further, buyers must show something around 1.0050. Otherwise, the pressure on the trading instrument will only increase. After missing 1.0050, you can say goodbye to hopes for the pair's recovery, which would open a direct path to 1.0000. A break of this support level will almost certainly increase the pressure on the trading instrument, allowing for a test of 1.0050.

The pressure on the British pound has returned, and it is difficult to predict who will come out on top. It is no longer necessary to discuss a significant upward correction in the current environment. Only after the bulls gain a foothold above 1.1990 can you expect a breakthrough to the 1.2040 area, where buyers will face much more difficulty. In the event of a larger upward movement in the pound, we can expect a 1.2090 update. If the bears break below 1.1935, the pound will immediately fall to 1.1880. Exiting this range will result in another downward movement to a minimum of 1.1815, paving the way for 1.1750.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română